This week’s earnings corporate reports revealed a continued focus on profitability across various sectors.

While specific details differed, many companies like Shopify, Airbnb, and Uber expressed confidence in the consumer’s health.

On the inflation front, while headline numbers were higher than expected, it is important to note that underlying inflation trends continue to show signs of normalization. Below is some data around that…

Data point #1

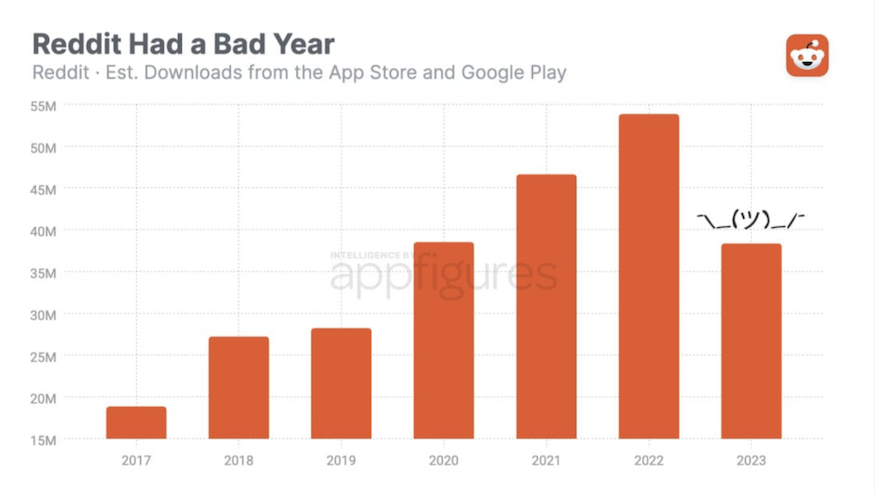

Reddit Download Data Suggests Peak Reddit Heading into IPO?

Reddit is gearing up for an IPO, remaining a well-regarded asset as a top 25 app and the #1 news app. However, one data point stands out: App downloads in 2023 ended up around 38 million, nearly 30% lower than its peak downloads in 2022. While information is limited, this decline could potentially reflect a strategic shift towards acquiring higher-value users rather than maximizing downloads. Reddit might be investing in targeted marketing to cultivate a more engaged and profitable user base. We will find out soon, but having data like this is helpful.

Data Point #2

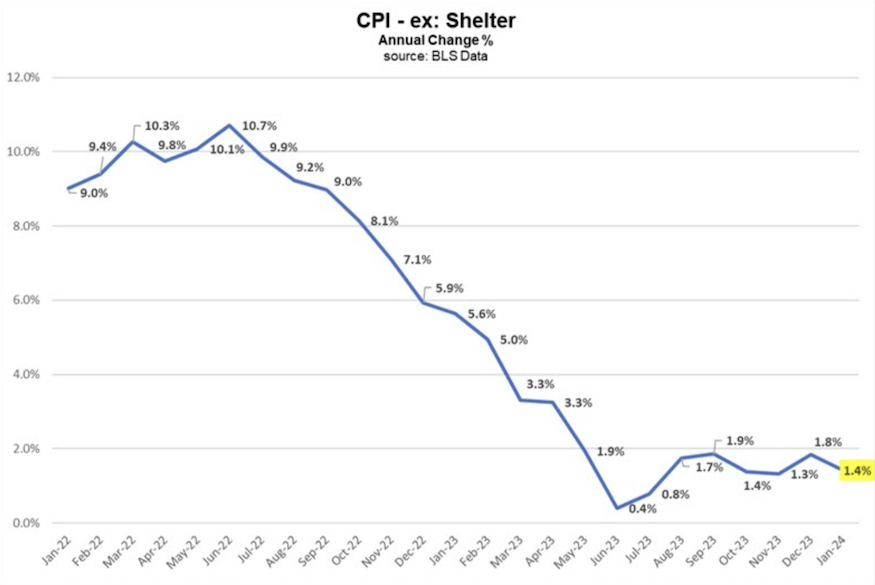

CPI ex Shelter is Sub 2%

Inflation continues to be a major topic in financial media due to its impact on interest rates.We believe inflation is currently under control. Prices have stabilized, the economy is strong, and the CPI data is lagging behind real-time trends.However, high housing prices remain a significant contributor to inflation.

As you may know from our previous work, the CPI calculation for housing prices tends to lag behind actual rental and home sale prices nationwide. This is why the chart above excludes housing costs from the overall CPI calculation.When excluding housing, the CPI hasn’t exceeded 2% since May 2023. This doesn’t negate the importance of housing costs, but it highlights that their current lag may be distorting the overall CPI picture

Data Point #3

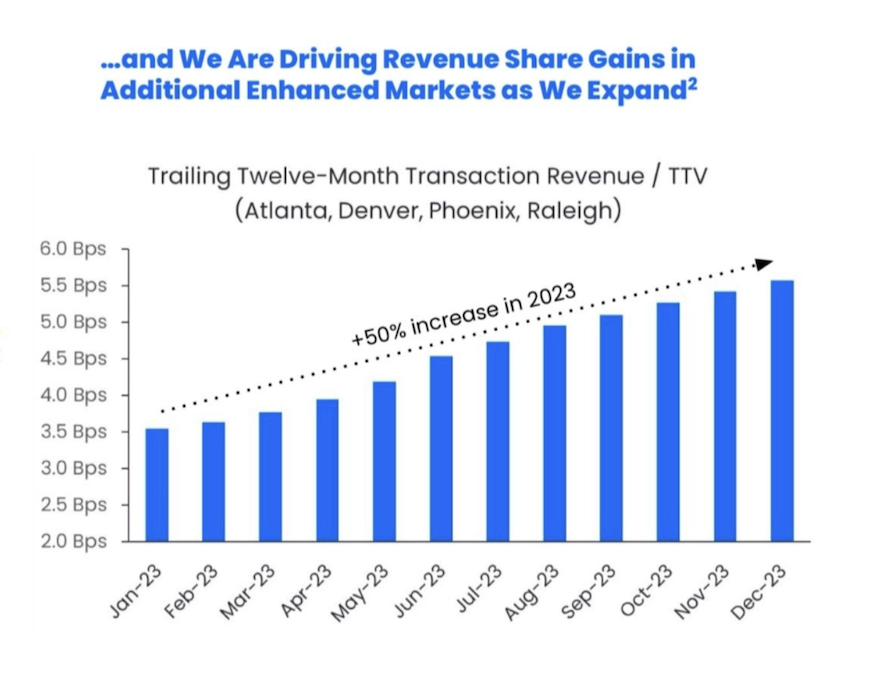

Zillow Enhanced Markets Showing Meaningful Revenue Progress

Why does this data matter?

Zillow reported strong results this week, and we’ll provide a more detailed analysis in our upcoming quarterly earnings summary. One key takeaway is the success of their “enhanced markets” initiative. These markets focus on virtual tours, top Premier Agents, and Zillow Home Loans financing. Data shows these markets are generating an increasing share of Zillow’s total revenue compared to overall home sales in those areas.

For investors, information like this helps confirm an investment thesis and assess the company’s progress toward its stated goals, especially during periods of market volatility.

Twitter: @_SeanDavid

The author and/or his firm may have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.