Interest rates remain elevated and this has taken its toll of the stock market… and particularly growth stocks.

While several growth stocks remain in the technology sector, the damage has been wide spread.

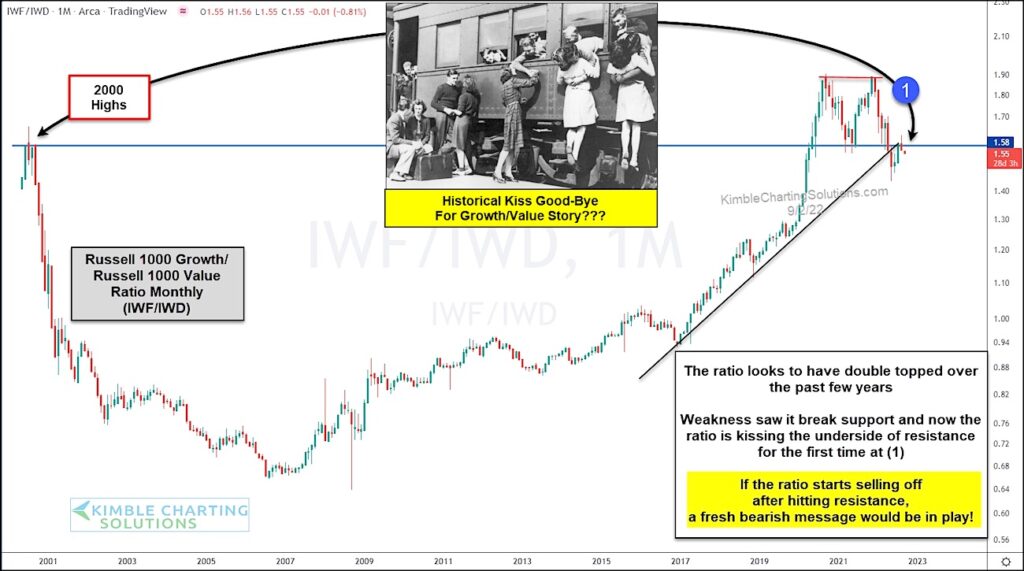

In todays chart, we take a look at the performance ratio of two major Russell 1000 Growth and Value ETFs ($IWF to $IWD).

As you an see in the chart below, this ratio seems to have double topped and price is now trading below neckline support at (1). Yikes!

Moreover, if growth stocks continue to underperform value stocks, it would send yet another sell signal to the broader market. Do bulls have what it takes to help growth stocks recover quickly? If not, it could get ugly. Stay tuned!

$IWF / $IWD Growth to Value ETF Performance Ratio Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.