Gold and silver prices were ripe for a move higher. And given current indicators, I wouldn’t be surprised to see gold and silver prices continue to squeeze higher over the next few weeks, and possibly for as long as the next several weeks.

Gold and silver prices were ripe for a move higher. And given current indicators, I wouldn’t be surprised to see gold and silver prices continue to squeeze higher over the next few weeks, and possibly for as long as the next several weeks.

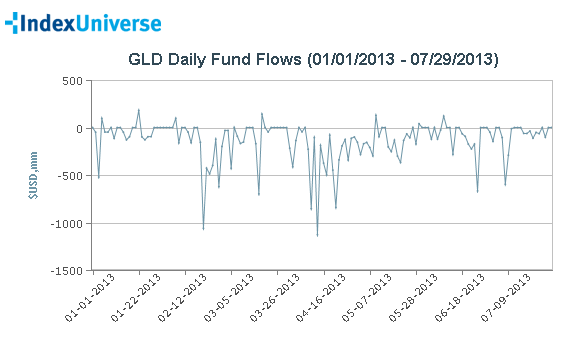

Looking at the SPDR Gold Trust (GLD) one can see the flows of money in and out of the security year-to-date. When the line chart is below the 0 line, this is showing net distribution, while when the line chart is above 0, traders are accumulating shares of GLD. What is this chart telling us? It seems to me that the worst may be over since the major down after seeing major spikes lower in February, April, and late June. And, further, it’s possible that the last major seller was on 6/28, where GLD had a major reversal off the lows. Since then, GLD has been trending higher and currently over its 50 day moving average.

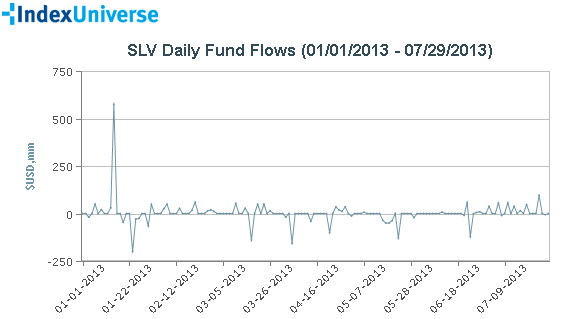

Looking at the iShares Silver Trust ETF (SLV) fund flows, this shows a steady but small accumulation since the low in June.

When also looking at a ratio of GLD to the SPDR S&P 500 (SPY), it looks to be in a clear downtrend and it may just continue lower if this is just another dead cat bounce like we have seen since the top in 2011. If we take a peek at the MACD, there is a positive divergence playing out and with the current seasonality factors, along with some important news headlines, it may be gold’s time to shine once again.

Gold (GLD) to SPDR S&P 500 (SPY) Ratio Chart

Same goes with the daily charts for SLV & GLD. Both ETFs just broke out of a wedge and look poised to continue higher with a positive MACD divergence.

Silver (SLV) MACD Divergence

Gold (GLD) MACD Divergence Breakout

I would not be surprised to see gold head towards 1440-1470. Keep in mind, shorts have been piling in on gold and silver and it may trigger a significant short squeeze beyond my targets.

Be safe. ~ Korey

Disclaimer: The material provided is for informational and educational purposes only and should not be construed as investment advice. All opinions expressed by the author on this site are subject to change without notice and do not constitute legal, tax or investment advice. At Castle Financial, securities are offered through Cadaret, Grant & Co., Inc. and TD Ameritrade, Inc. Members FINRA/SIPC.

Chart sources: TDAmeritrade, Worden, and Index Universe

Twitter: @stockpickexpert and @seeitmarket

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.