Interest rates continue to dominate our recent research. And rightfully so. Big swings in interest rates have ramifications for the domestic and global economy.

Whether it is falling bond yields / interest rates in China (as we highlighted last week) or rising bond yields / interest rates in the U.S. (as we highlighted this week), it is important for investors to follow the bond market.

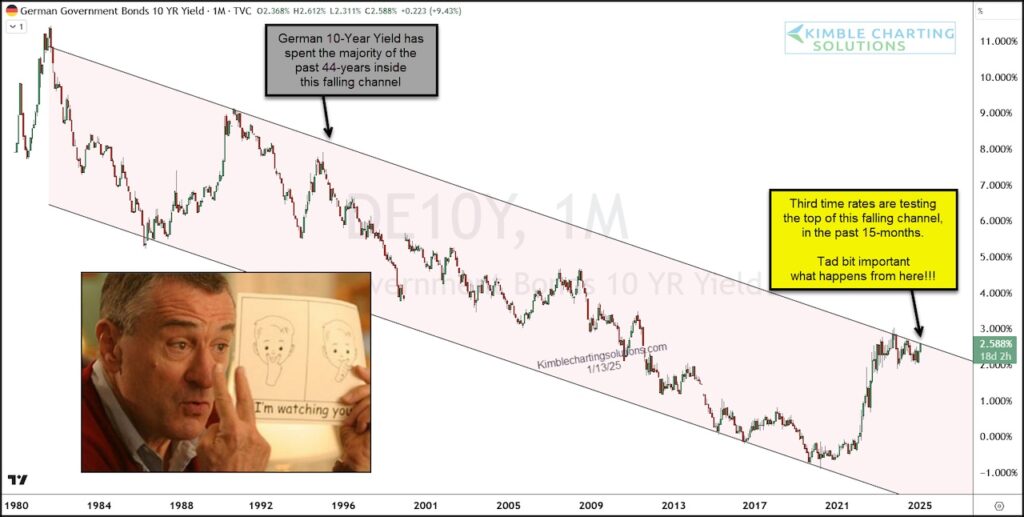

Today we look at elevated German government bond yields (on a long-term “monthly” basis).

As you can see, German interest rates are trading at the top of a 44-year falling channel.

If this is a bull flag pattern, we may see a breakout above and out of this falling channel. A breakout would confirm a trend change and effect the economy and government bonds/debt.

In my humble opinion, it might be important what happens here. Stay tuned!

10-Year German Government Bond Yield “monthly” Chart

Twitter: @KimbleCharting

The author may have a position in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.