Make no mistake about it, this isn’t the time to be complacent with your trades or trading plans. To be honest, there is never a time to be complacent…

With the stock market making new highs daily, investor sentiment indicators are getting greedy. Traders don’t want to be fearful nor greedy; as traders we should simply follow the price action and respect our exit plans.

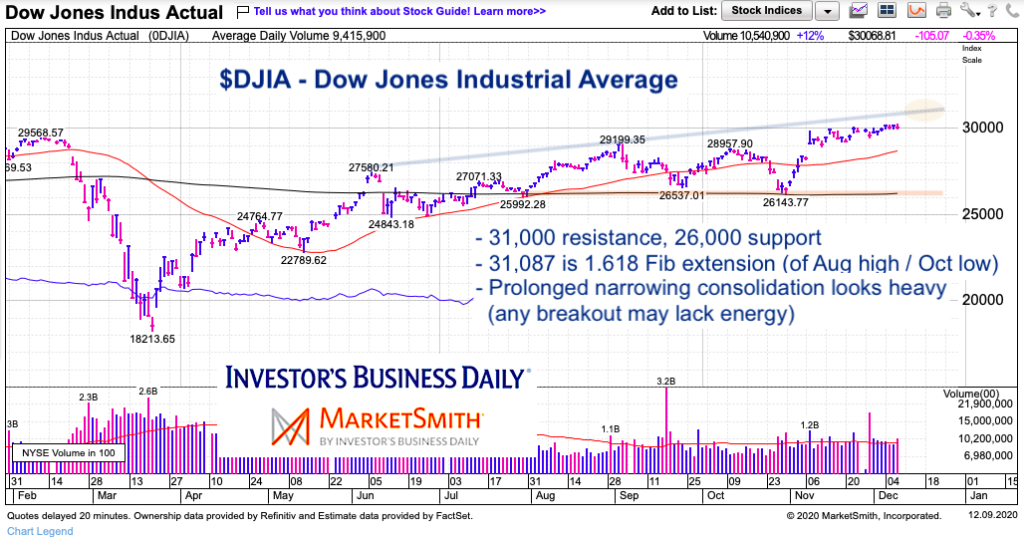

With this in mind, I shared a chart on twitter on November 16 highlighting an overhead trend line resistance that could cap any rally on the Dow Jones Industrial Average. That line now comes in at just over 31,000. The Dow Industrials have traded as high as 30,317 and currently trade around 30,150. With only 3 percent upside, it’s probably better to play the short-term with index/sector leading stocks (as opposed to the index), reducing risk as index targets near.

The 31,000 resistance level is fortified by a 1.618 Fibonacci extension level that projects to 31,087. So that is resistance on a short to intermediate term trading basis. On the downside, we have strong support at the 26,000 level. That represents lateral support and the 200 day moving average. See chart below. We also have last weeks lows at 29,463 and the open gap just below that.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

Dow Jones Industrial Average “daily” Chart

The sideways to higher (yet narrowing) range means that something should give soon. It’s a “heavy” look, so realize that any breakout may be quick and struggle to hold (i.e. could hit resistance and reverse lower). On the other side, any immediate selloff will need to hold 29,463 or risk a drop toward the open gap area (and 50-day MA).

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.