The price of copper is already elevated and one of may inflationary indicators investors are watching. Well, it appears to be headed higher again.

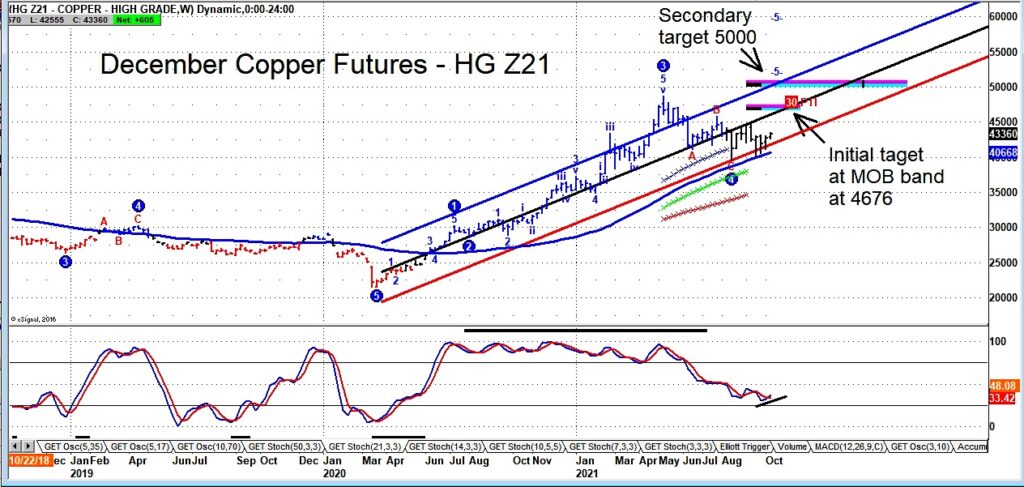

On a weekly basis, copper futures reversed off the 40-week moving average and the lower end of its regression trend channel.

This reversal lead to a move above last week’s high, and this triggered a trading buy signal with an initial target at the MOB band.

I think it’s wise to watch the 40-week moving average at 4066 and use that as an area that would negate this buy signal. A weekly close above the MOB (4676) would be considered a breakout and then target 5000, which is the secondary MOB and the upper end of the price channel.

Our Money Flow Unit (MFU) analysis measures capital flow into an asset, and here too, we get an initial target at the nearby 4623 area – see daily charts.

Copper Futures “weekly” Chart

Copper Futures “daily” Charts

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.