One week ago, I wrote about the Bank Index (BKX) and the prospects for a breakout.

Here’s an excerpt on why the banks are so important to the broader market:

“One of the most important sectors of the stock market is the banking industry and bank stocks.

When the banks are healthy, the economy is likely doing well. And when bank stocks are participating in a market rally, then it bodes well for the broader stock market.“

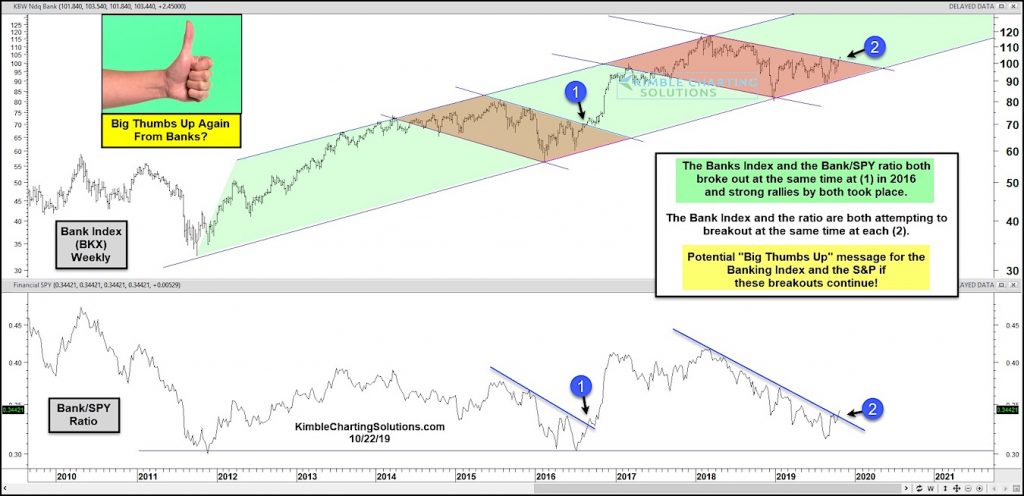

Fast forward to today, and it appears that the Bank Index is trying to get through that downtrend line – see chart below.

As you can see, when the bank index breaks out (see point 1), it leads to big gains for the index and relative outperformance (see Bank/SPY ratio). So the bulls want to see some follow through buying here to confirm the breakout.

This has the potential to be a big thumbs up for the stock market if the Bank index and ratio continue to the upside! Stay tuned!

Bank Index “weekly” Price Chart w/ Relative Strength Ratio

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.