The major stock market averages continue to remain firmly in up-trends. In particular, I really like the action in the Airlines sector and select airline stocks (more on that below).

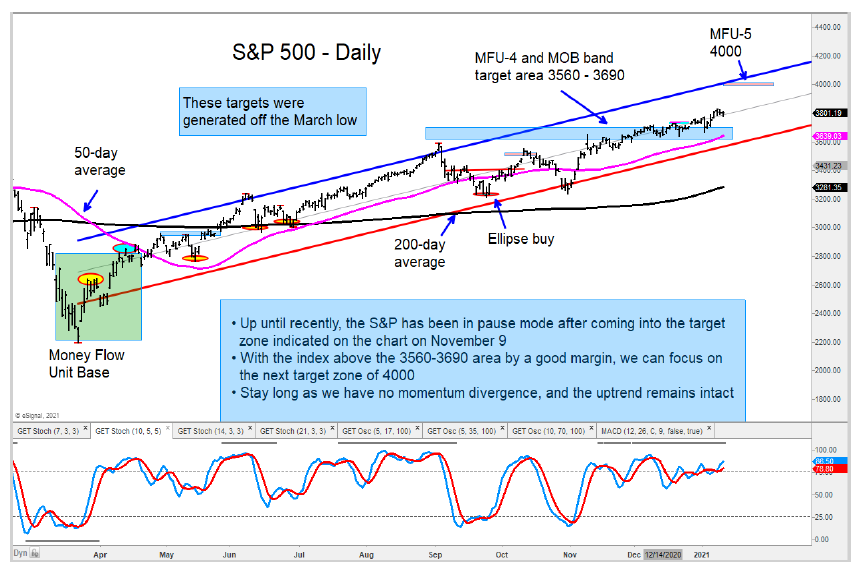

I have the S&P 500 Index firmly above its price target zone (after going sideways since hitting that target in November).

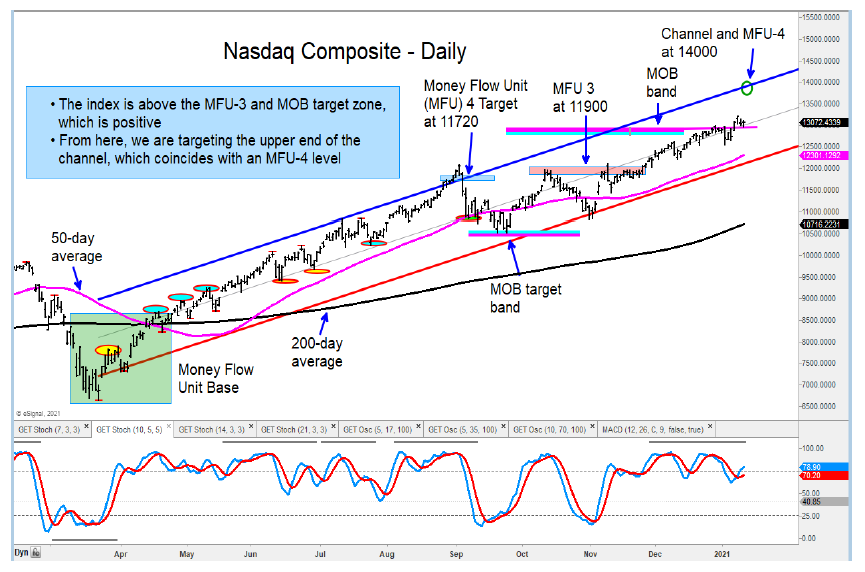

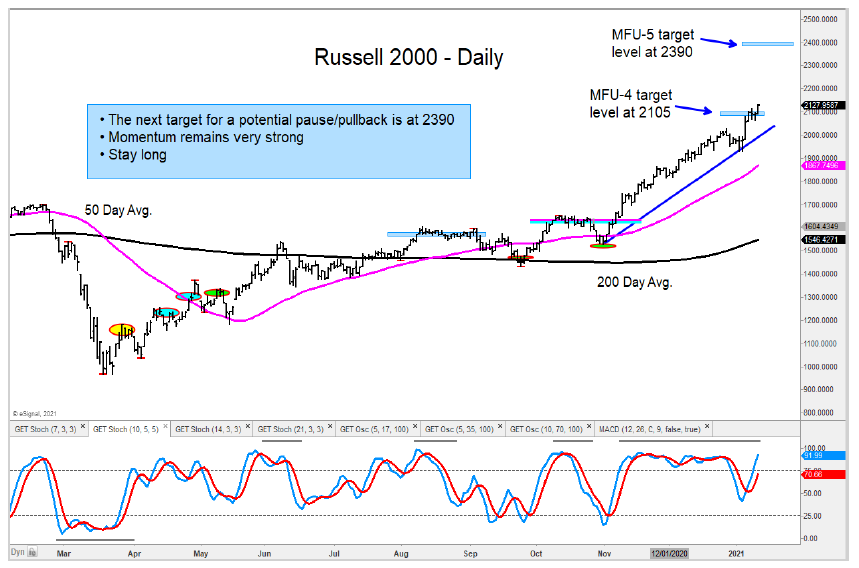

Upside momentum in both the S&P 500 and Nasdaq Composite has been subdued compared to the Russell 2000 and Mid-Cap (MDY). I continue to favor the small and mid-cap stocks over large cap stocks.

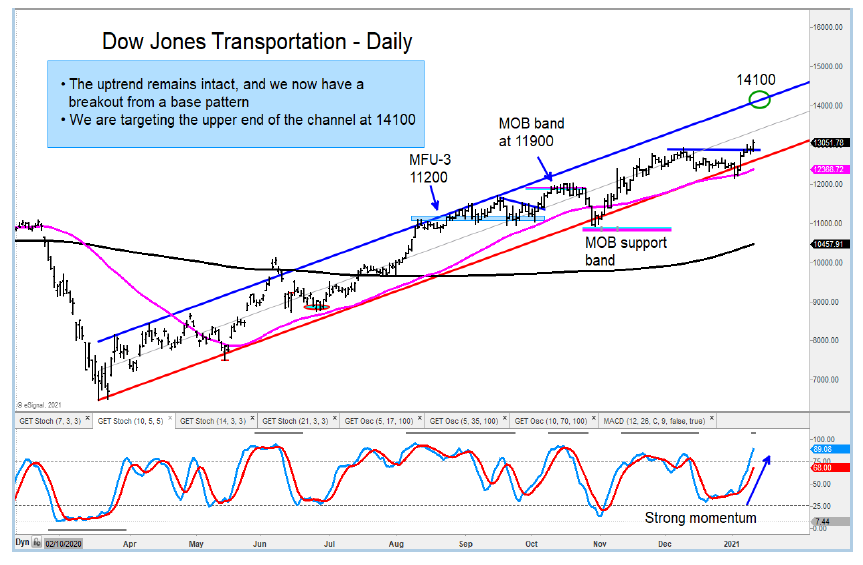

The Dow Jones Transportation Average is breaking out of a multi-month base pattern, and I have the airlines group as a “buy”.

Today we sent out a note to clients that listed two airline stocks as “buys”, along with the sector: Skywest (SKYW), Delta Air Lines (DAL), and the Airline Index (XAL). I believe that the Airline Index is setting up for a significant move higher.

I have been bullish biotechs for close to a year now, and we have the IBB finally coming into its MFU-4 target zone. It’s not a sell, but I will look for signs of a possible reversal in the coming days. If that were to happen, I believe it will be a profit-taking event more so than a reversal. Not sure yet.

In commodities, we remain bullish gold as the metal rallied nicely off an ellipse buy signal.

I have been short the TLT and will reverse the trade here for a short-term long trade. I still have a lower target and will short once again in the coming days.

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.