Apple (NASDAQ: AAPL) traded 5% higher on Wednesday morning, after posting earnings that beat Wall Street expectations and providing higher guidance for the future.

The company reported earnings per share of $2.34 and total revenue of $53.3 billion, above analyst estimates of $2.16 and $52.3 billion.

For the next quarter, Apple’s management provided revenue guidance of $60-62 billion, compared to the average estimate of $59.6 billion.

As well, Apple (AAPL) took another step in its share repurchase program. “We returned almost $25 billion to investors through our capital return program, including $20 billion in share repurchases,” explained CFO Luca Maestri.

Multiple analysts raised their price targets, including a confident RBC analyst who exclaimed, “Hit snooze for 90 days – path to a trillion intact.” This refers to the fact that Apple is approaching the one trillion dollar level for its total market capitalization.

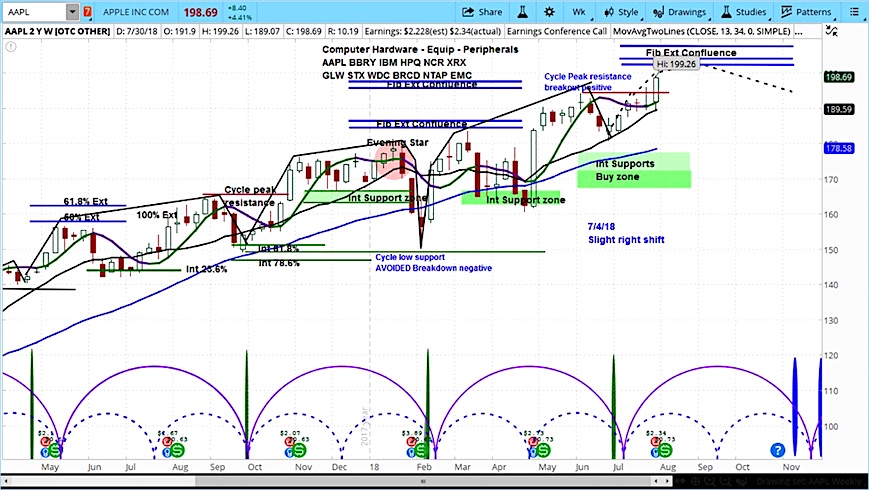

Our analysis of AAPL’s market cycles shows that the stock is in the rising phase of its current cycle.

The cycle patterns have remained positive for over 2 years. However, we are approaching a Fibonacci confluence just over the $200 level. Our upside target for AAPL is $205.

Apple (AAPL) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.