How Patience Turned Apple (NASDAQ:AAPL) Into An Options Winner

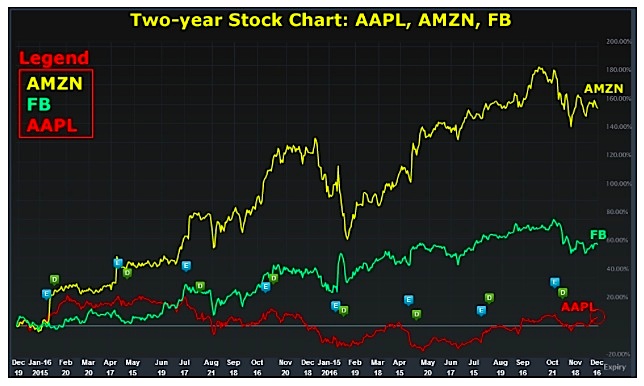

Apple has under-performed its mega cap tech rivals like Google (NASDAQ:GOOGL), Facebook (NASDAQ:FB) and Amazon (NASDAQ:AMZN). Here’s a quick comparsion chart:

Apple’s stock has been tied to the success of the iPhone, and the product has gone through its cycle of ups and now downs.

But, there is an option strategy that has worked very well for Apple over the last two years irrespective of the cyclicality of its crown jewel product. The key here is not to guess stock price direction movement.

It’s about finding calm, low stress stocks, and finding the strategies that created a high percentage of winning trades, gaining profitability slowly, while avoiding unnecessary risks.

Apple Stock Options Case Study (AAPL)

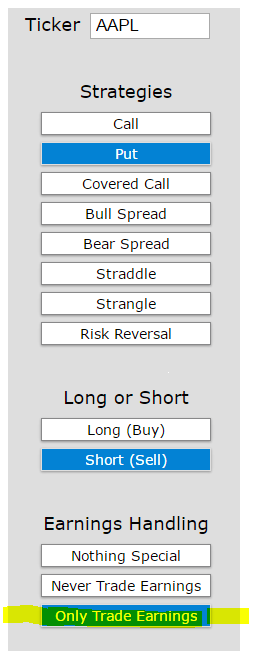

Selling puts is one of many option trading strategies that can be employed to take advantage of a bull market. But, for Apple, it has been a risky endeavor if employed during earnings releases.

And by risky, we mean a loser. Here’s how we can see it explicitly with the CMLviz option back-tester Trade Machine.

After the set up, we get these results. Again, we’re just looking at trading the dates surrounding earnings releases.

Just to slow down for a second, what we can see is that selling a put into earnings for Apple has been a loser across the board. We can see the actual results in the ’% Return’ numbers highlighted above, all in red (losses).

For completeness we detail the back-test: The image above summarizes this back-test:

- Sell Puts in Apple

- Only during earnings

- Trade monthly options

- Test the strategy for two-years

As we stated, selling puts has been a losing strategy across the board when held during earnings. But the real analysis we want to examine is how well this strategy would have done if we eliminated the risk of earnings completely.

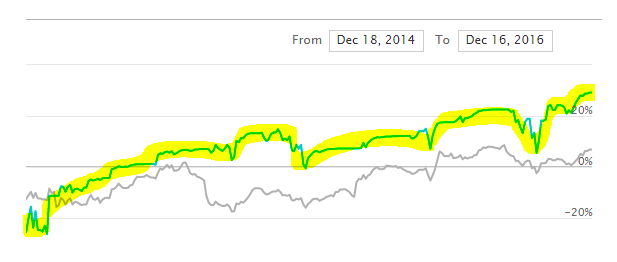

That is to say, if we sold puts every 30-days, but every time earnings approached, we closed the strategy (held no position), then started the strategy again after the volatility of earnings had ended. Here are the results:

All of a sudden, the short put options strategy in Apple turned out quite well if we skipped over each earnings release and far outperformed the stock too.

Look at the number of winning trades to losing trades as well — the ratio goes from 19:7 to as high as 23:3. That is, 23 winning trades and 3 losing trades over a two-year period.

Here is the tail-end of the chart of the option strategy in blue versus the stock in gray, over those two-years. We can see how the two lines move in unison — that is, they are correlated, but the options strategy outperforms Apple stock by a rather large amount.

Specifically, selling Apple puts but avoiding earnings returned anywhere from 16% to 29%, versus the stock price rise of just 7%. For those that don’t like selling naked options, being slightly more conservative did just fine too.

Here are the same test results, but this time selling a put spread, rather than a naked put:

Short AAPL Bear Spreads TABLE

Yet again, we see winners across the board and a substantial outperformance to owning the stock by itself.

Note that trading stocks, stock options, and futures involves risk – consult a professional before trading. Thanks for reading.

Twitter: @OphirGottlieb

The author has a position in AAPL at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.