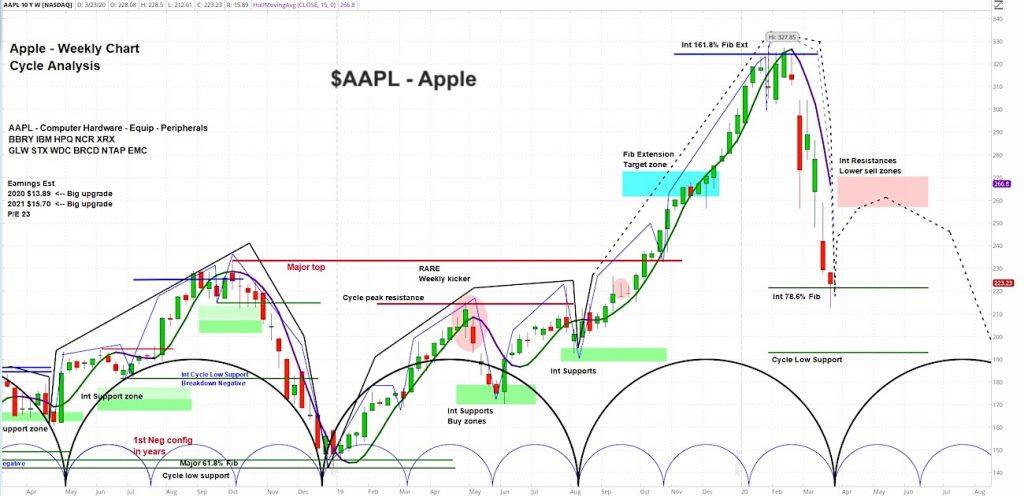

Apple (AAPL) Weekly Chart NASDAQ: AAPL

This morning Nomura lowered their price target on Apple stock (AAPL) from $295 to $225 and maintained a neutral rating on the stock. Let’s see what the charts tell us.

askSlim Technical Briefing

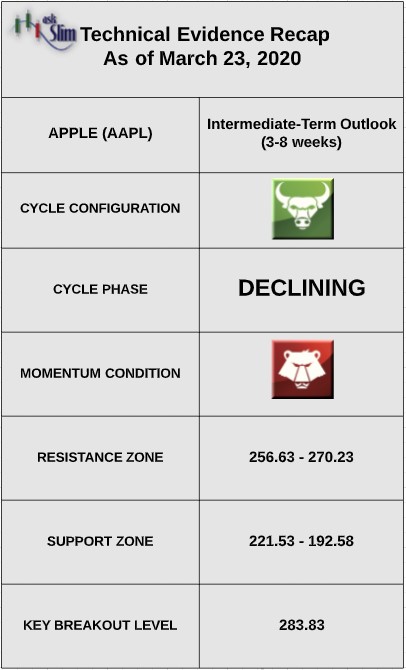

The weekly cycle analysis suggests that Apple’s stock AAPL is in the late stages of a declining phase and is due to form an intermediate-term low.

The next projected intermediate-term low is due in the end of March. Weekly momentum remains negative.

On the upside, there is an intermediate-term Fibonacci resistance zone from 256.63 – 270.23. On the downside, there a lower Fibonacci support at 221.53 followed by cycle low support at 192.58. Our analysis suggests that for Apple stock bulls to regain control of the intermediate-term, we would likely need to see a weekly close above 283.83.

askSlim Sum of the Evidence

AAPL is due to form an intermediate-term bottom and has negative weekly momentum. Given these conditions, we would expect any sell offs in the near-term to be limited to the weekly support zone beginning at 221.53. There is a likelihood that the stock tests 256 by mid-April.

Interested in askSlim?

At askSlim we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.