Piece by piece information has leaked out from Apple insiders and industry watchers about what could well be the turning point in automotive history: the release of the Apple Car. Through collecting these fragments, we’ve assembled a collage of the Apple Car and Apple’s Project Titan.

The picture that’s formed is one of revolutionary potential for the world’s strongest brand to dominate the world’s largest and, by many measures, most competitive industry.

But the collage has many layers within it, and a second image forms of the mounting aggressions between two technology leaders staking their futures’ on becoming the dominant force in the electric vehicle market: Tesla (TSLA) and Apple (AAPL).

It’s clear now that neither will win without a fight, and the battle – who’s opening salvos have already rung out – will be one that the global markets keep a close eye on.

Here is Musk, responding to German newspaper Handelsblatt, about concerns that Apple was hiring away “important engineers”:

“Important engineers? They have hired people we’ve fired. We always jokingly call Apple the ‘Tesla Graveyard.’ If you don’t make it at Tesla, you go work at Apple. I’m not kidding.”

The Battlefield Is Set: Here Are The Combatants

On the left: The richest, most powerful, most beloved company in the world, Apple, shifting its collosal might in this new direction, hiring top talent from across the automotive and battery industries, and staking a huge part of its future on this bold new direction and the Apple Car.

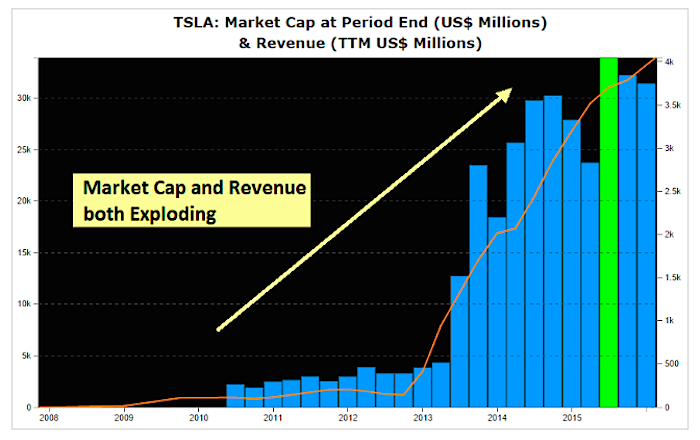

On the right: The small rebel force led by visionary Elon Musk, thwarting skeptics and defying unthinkable odds across the spectrum of his endeavors. Tesla has reignitied a global push toward the eletric automobile as its CEO, Musk, has simultaneously catalyzed a new era in the American space industry. We see how high the hopes for this company have soared as revenues have risen. Here CML Pro shows us the market cap as blue bars and revenue as the orange line:

Revenues for the trailing twelve months hit $4 billion and even with the overall market sell-off, Tesla’s market cap is over $20 billion.

The Stakes For Winning

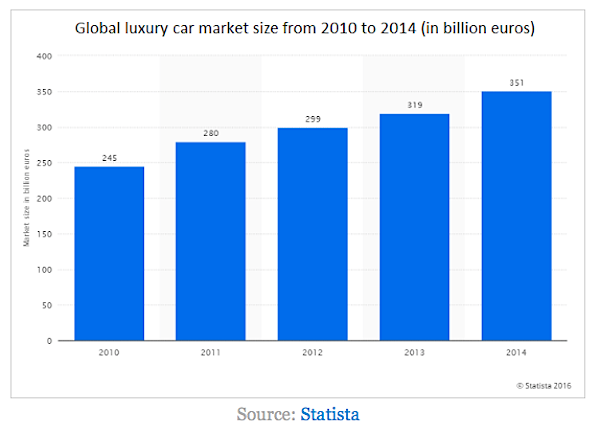

The purse for victory is huge. The automotive industry is one of the world’s largest markets, with luxury cars alone accounting for $360 billion per year in sales and growing fast:

The electric vehicle market is projected to hit greater than $270 billion by 2019.

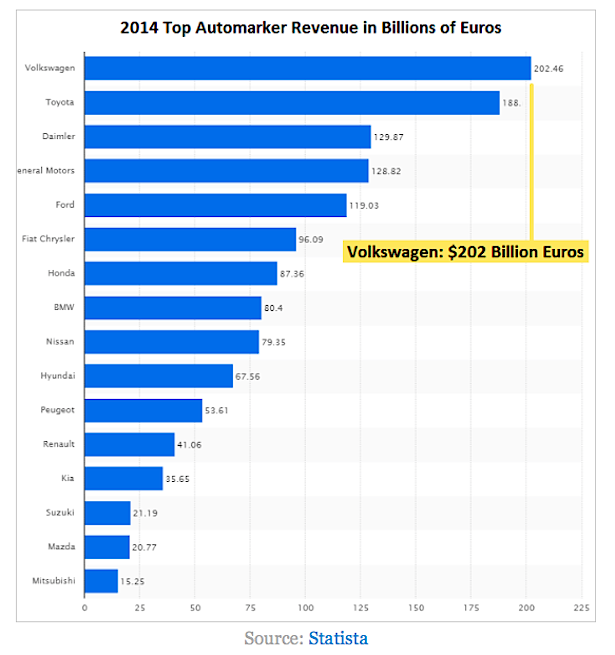

Given the countless array of car makers across the globe, we must size how much of the world market and individual car company can capture. Let’s do just that.

The world’s largest vehicle producer is Volkswagen, with global sales of over 200 billion euros per year, followed closely by Toyota:

Put in perspective, Volkswagon has roughly the same total revenue as Apple’s $240 billion USD.

For Apple, a successful launch of an Apple Car could realistically double revenue, and with time, operating margins and substantial new profits would be sure to follow. For Tesla, with Revenue of $4 billion yearly, the potential is staggering.

The Stakes For Losing

Apple has a cloud of wary investors with concern focused largely on the worry that Apple is too dependent on the 60% of revenues coming from the iPhone. Many on Wall Street are betting that Apple won’t be able to transition to another equally large success. A failed launch would irrevocably tarnish the Apple brand and confirm the bears view that Apple’s scope is limited. So the Apple car broadens and diversifies their revenue and products.

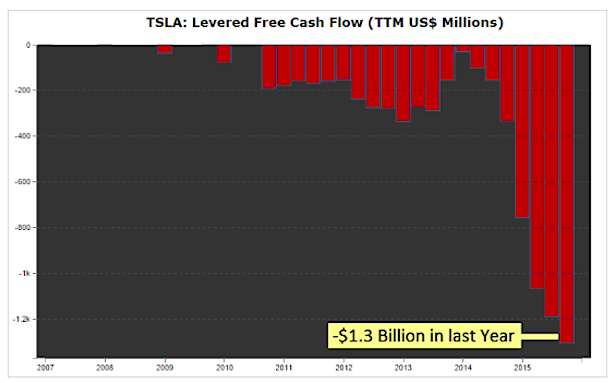

For Tesla, the stakes are higher still. Tesla is burning cash to stay afloat, propped up by hopes of their potential to release a mass-market automobile in the Model 3. Looking at the levered free cash flow from CML Pro, we see how pressing their situation is:

In the last three years the young electric car company has sky-rocketed from a $3 billion market cap to over $20 billion, and the coming battle will determine whether they double and triple yet again, or if, instead, they fade to become just a modest acquisition for an established car company.

The Decisive Battle

Hitting the technical inflection point is a critical part of having a huge success, and failing to do so is to fall into the “chasm” where many new technologies die. Aptera, Fisker, Coda, and Better Place all failed in their attempts to bring electric cars across this gap.

Through our extensive research, we believe we have found the break-through technology that will make the company that first develops it the decided winner in the electric vehicle war.

Top universities around the world have been researching this technology and we discovered a world renowned institution that has made a major advance. If this technology continues on track, the owner will dominate the electric car industry.

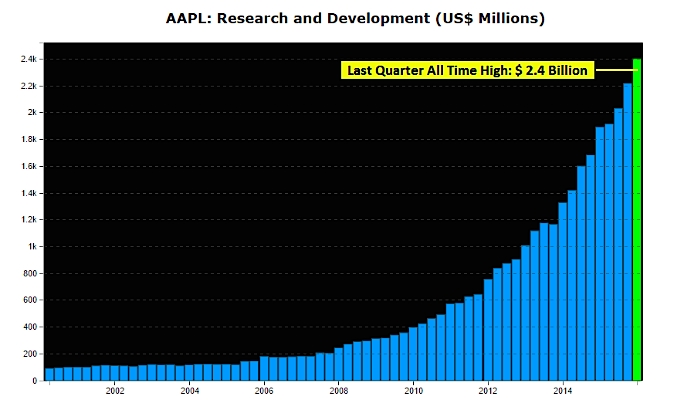

Looking at Apple’s R&D spending, we see clearly the massive investment Apple is making in its future:

Apple is now spending $2.4 billion per quarter on R&D. Could a sizable chunk of these funds be directed toward an Apple car?

Finish Line

Tesla has a massive headstart in the electric vehicle market, but no company is better positioned to make a huge technological investment, backed by a brilliant marketing campaign, and championed by a beloved brand, than Apple.

If Apple succeeds in releasing its Apple car, they are likely to not only reap enormous financial rewards,but also to massively swell the size of the electric vehicle market and, in so doing, create a permanent shift to a new era of automotive history.

Further, let us not forget that Alphabet / Google (GOOGL) is still considered by many to be the real innovator in driverless technology and General Motors (GM) is releasing its electric Chevy Bolt this year.

Why This Matters

If any of the information in this article feels like a surprise, in many ways it is. The Apple car and battle with Tesla will be defining and revolutionary for the industry.

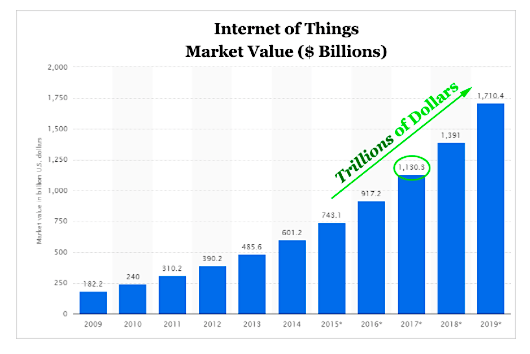

Thematic investing is the key, in fact, here are just two of the trends that will radically affect the future that we are ahead of:

Thanks for reading.

Further reading from Ophir: “Is Netflix Stock Attractive After Deep Selloff?“

Read more from Ophir on CMLviz.com.

Twitter: @OphirGottlieb

Author has a position in AAPL. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.