In his characteristically unassuming manner, Carl Icahn

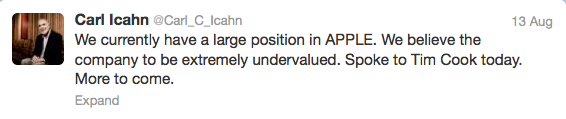

In his characteristically unassuming manner, Carl Icahn or some faceless desk lackey authored a his eleventh tweet (the entire tweet) Tuesday to an audience of untold millions about his new $1 billion stake in Apple (Symbol: AAPL). Given the dispassionate and benign nature of his prolific tweet volume historically 10 previous tweets – seven about Dell, one about July 4th, and tw0 about “CEO agitation” – one could be forgiven for passing over Icahn’s post-facto disclosure of a 10-figure investment and the wholly forgettable statement accompanying it about the AAPL‘s “extremely” discounted value as unremarkable.

Shockingly however, AAPL added +4.75% following Icahn’s tweet; and tacked on +1.82% yesterday.

Perhaps this shouldn’t be so surprising, after all: Icahn states in his Twitter profile he makes money “studying natural stupidity”.

What better than to create a zero-net cost social experiment via an instantaneous, global communications medium and “study” its herd-driven effects on his PnL?

Not unlike Blackberry (BBRY) a few days ago, though: this announcement came at a technically opportune time.

Here’s AAPL on 08/12, poised to activate a clean Double Bottom above $465-$470 (click image to zoom):

And two trading sessions later, the Apple breakout (click image to zoom):

And lost in all the shuffle later? The Apple breakout that occurred following the opening gap-and-fill on August 13th, preceding the tweet later in the session (click image to zoom):

Twitter: @andrewunknown and @seeitmarket

No position in any of the mentioned securities at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.