The disconnect between the stock market and the devastating economic numbers continues on.

Look no further than last Friday, when the S&P 500 Index and broader stock market rallied after the Labor Department reported 20.5 million Americans lost their jobs last month and the April unemployment data soared to the highest level since the numbers began being collected following World War II.

It is important to remember that the stock market is not a reflection of the current economy but is a forward-looking mechanism.

Investors are looking ahead to a recovery in the second half of the year with the opening back up of the economy and the encouraging news of various treatments for COVID-19.

Additionally, investors remain confident that the Federal Government and Federal Reserve have their back with continued stimulus.

However, on Friday, Minneapolis Federal Reserve Bank President Neel Kashkari said that he is expecting a more gradual recovery due to the massive job losses. The monetary and fiscal stimulus will help with near- term disruptions but cannot cure the virus or return investors to their previous spending habits.

But there is plenty of room for optimism. The mortality rates for the virus are decreasing. If we can reopen the economy smartly and safely then, based on estimates from the Congressional Budget Office, we can expect to see a transition to growth in the third and fourth quarters of this year.

Congress is working on a number of programs that focus on private sector growth and are working on a plan to give tax incentives to manufacturing companies who bring their plants home from China and other nations – back to places where they had previously been prosperous, mainly in the middle of the country.

We will be safer and less dependent on other nations for pharmaceuticals and supplies and this manufacturing-based economy will provide jobs. We are going to be better off in an environment of low interest rates, cheap energy, and a disengaging of some of our supply chains from other nations.

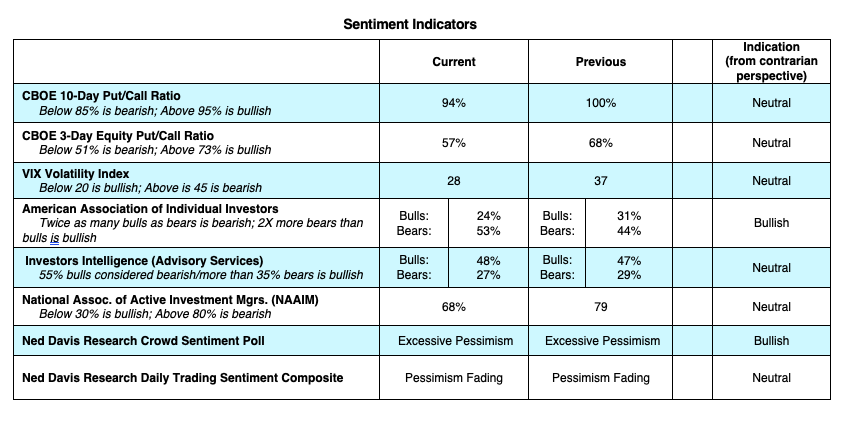

The stock market technicals are mixed. The latest survey from the American Association of Individual Investors (AAII) shows more than twice as many bears as bulls, which from a contrarian stance is bullish, and is consistent with the $4.7 trillion sitting in money market funds. Yet the Investors Intelligence (II) numbers show 48% bulls and 29% bears, a neutral reading.

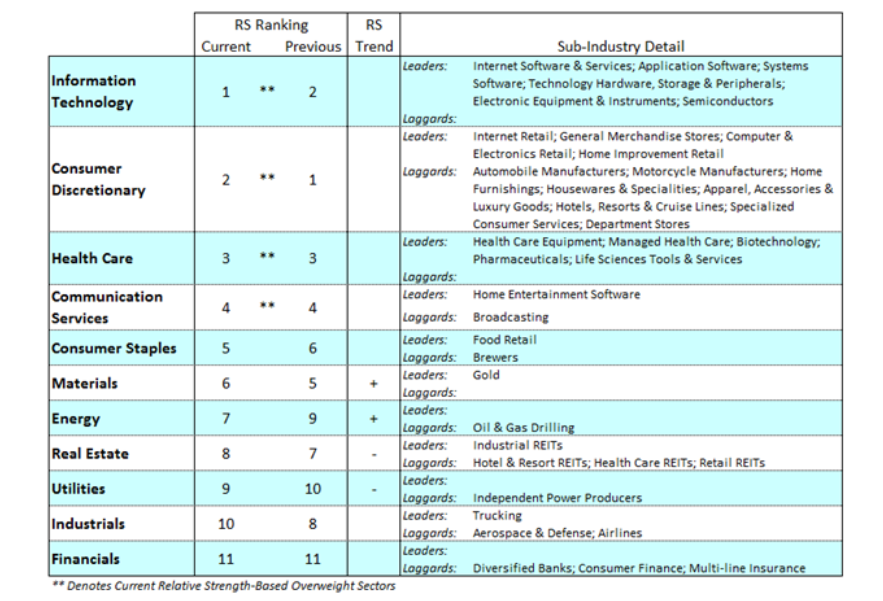

The broad market has yet to match the gains in the S&P 500 Index or the NASDAQ. Both indices are heavily concentrated in the technology sector and a few healthcare stocks. Historically, a higher level of concentration of one or two sectors within a stock market rally eventually limits the upside. Currently less than 30% of S&P stocks are trading above their 200-day moving average. We need to see more than 60% trading above their 200-day moving average to suggest the broad market is in gear for a sustainable rally.

The Bottom Line: The sentiment indicators point to more upside in the short run but the breadth indicators suggest the upside is limited until the market can broaden out. The strongest sectors of the market continue to be technology, healthcare, consumer discretionary, and communication services.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.