American Eagle Outfitters NYSE: AEO announced a number of new actions as the company manages through the COVID-19 / coronavirus crisis.

American Eagle (AEO) suspended their buyback, deferred the Q1 dividend and issued a $400M convertible note.

The company said they have enough cash to get through fiscal 2020. AEO was down 17% on the day.

Given this background, let’s see what the charts tell us.

American Eagle Outfitters (AEO) Weekly Chart

At askSlim.com we use technical analysis to evaluate price charts of stocks, futures, and ETF’s. We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing:

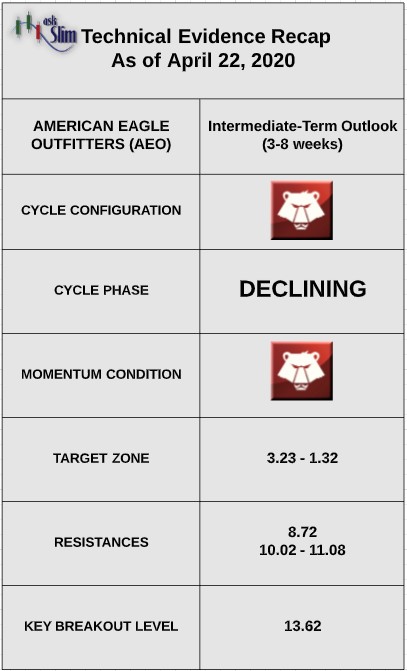

The weekly cycle analysis suggests that AEO is in a declining phase. The next projected intermediate-term low is due in the end of June. Weekly momentum is negative.

On the upside, there are intermediate-term resistances at 8.72 followed by another zone of resistance from 10.02 – 11.08.

On the downside, there is a Fibonacci extension zone from 3.23 – 1.32. For the bulls to regain control of the intermediate-term, we would need to see a weekly close above 13.62 to repair some of the damage.

At this point, the odds of this occurring are quite low.

askSlim Sum of the Evidence:

AEO is in a declining phase in a very negative cycle pattern. Given these conditions, we would expect any rally to fail in the intermediate-term resistances beginning at 8.72. There is a likelihood the stock trades below 4 by July.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.