Amazon (AMZN) traded 6% higher on Friday morning, after an earnings report that beat Wall Street estimates.

The company reported earnings per share of $3.27 and total revenue of $51 billion, compared to analyst expectations of $1.26 and $50 billion. As well, they provided Q2 guidance of $51-54 billion in revenue, compared to expectations of $52 billion.

How did Amazon more than double Wall Street’s expectations for profits? This was largely driven not by ecommerce but rather by its cloud services division, Amazon Web Services, which accounted for 73% of operating income and grew at a rate of 57%.

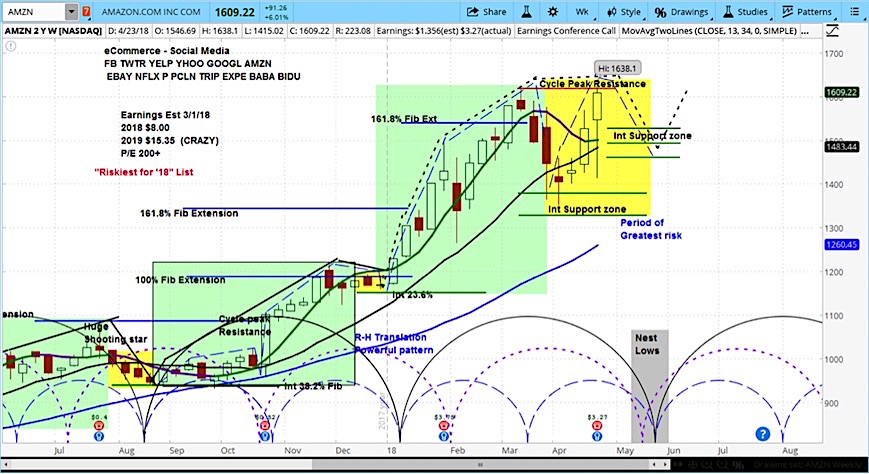

My analysis of AMZN (on the basis of its market cycles), is represented by the cycle brackets at the bottom of the chart below and shaded areas found on pricing chart.

My work shows Amazon’s stock to be in a “yellow” corrective phase, which represents some of the uncertainty inherent in earnings. And Amazon has

The bottom line is that into late May, we expect the declining phase of its current market cycle will help to push the price back into the $1500 area.

Amazon (AMZN) Stock Chart with Weekly Bars

For an introduction to cycle analysis, check out our Stock Market Cycles video, or watch the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.