Alcoa Corporation (NYSE: AA) traded 8% higher on Wednesday morning, after reports that competitor Norsk Hydro would stop production of the world’s largest alumina refinery.

The Norwegian metals producer Norsk Hydro announced that it would temporarily close its Alunorte plant, due to an environmental dispute with Brazilian regulators.

This plant refines alumina, which is a key input in the production of aluminium. The plant, which had been running at 50% of capacity, will now reduce its operations to 0% until the dispute is resolved.

While Norsk Hydro fell 14% on the news, the shares of competitor Alcoa were up.

Meanwhile, the price of aluminium rose 4%, as this will effectively increase the cost of production. As well, the Deutsche Bank Base Metals Index (DBB) was up 1% on the news, and analysts expect it could continue to move higher.

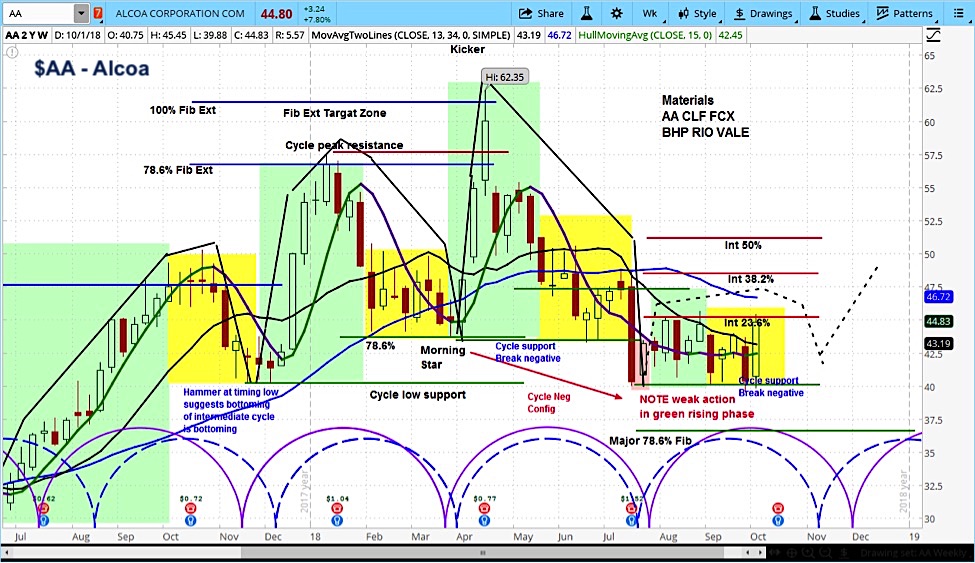

In analyzing the market cycles for both AA and DBB, both have cycles that will end at some point in November. We see near term resistance for both, as well as some downside risk once the declining phases of their cycles kick in. Yet once the next cycles begin, we see a higher chance of sustained gains.

Alcoa Corporation (AA) Stock Chart with Weekly Bars

Invesco DB Base Metals ETF (DBB) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.