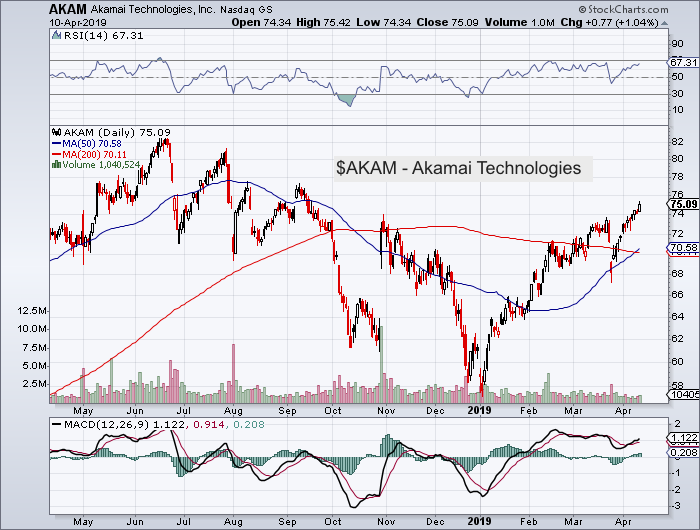

Akamai (NASDAQ: AKAM) has been on a tear of late, rallying to new 6 month highs.

Today KeyBanc talked it up some more on “increased near-term conviction” (whatever that means).

Some may also be connecting the roll-out of Disney’s (NYSE: DIS) streaming service with more traffic for Akamai and CDNs in general. However, the reality is that video streaming, at least until it becomes ubiquitously 4k, will only gradually and marginally add to AKAM revenues.

But, for whatever reasons, investors are obsessed with Akamai’s media revenues (even if every quarter it becomes a lesser and lesser portion of total revenues) and any positive perception around “media” moves the stock.

Considering that Akamai’s stock (ticker: AKAM) is by multiples my largest long (prudently protected by puts of course) I am not silly enough to argue with the reasons why the stock is going up.

But anyone who buys into AKAM for OTT video streaming alone, is probably missing the real story:

AKAM’s long term success is increasingly tied to 1) resolving the quality and complexities of content distribution; and 2) the ever-growing security issues of cloud computing. If media revenues also end up spiking at some point, that’s just icing on the cake.

Twitter: @FZucchi

The author has a position in Akamai (AKAM) at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.