Once upon a time, agriculture commodities were so weak that they were in a seemingly never-ending down-trend and gapped much lower on news of the coronavirus in the United States early this year.

Agriculture commodities have been slow to recover, taking several months to bottom and retest that bottom before rallying.

BUT now that the rally has started, Corn, Wheat, Soybeans, Sugar, and other food/agriculture commodities are strengthening.

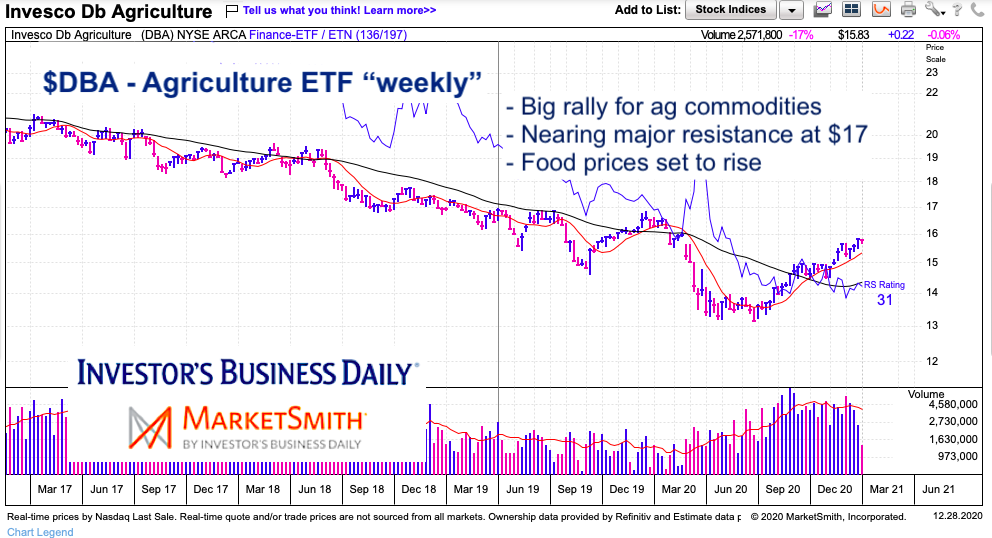

The Invesco DB Agriculture ETF (DBA) has carved out a nice rounded bottom and perhaps ended thoughts of a never-ending bear market.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

$DBA Agriculture Commodities ETF “weekly” Chart

The 40 week moving average is finally curling higher, joining the 10 week moving average. $17 is an important area of price resistance. Be on the lookout for a pullback that forms a potential inverse head and shoulders pattern (bullish). Food prices look set to rise in late 2021 and beyond.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.