The lazy days of summer have been anything but lazy.

The last 3 weeks, the Economic Modern Family has gone Outward Bound.

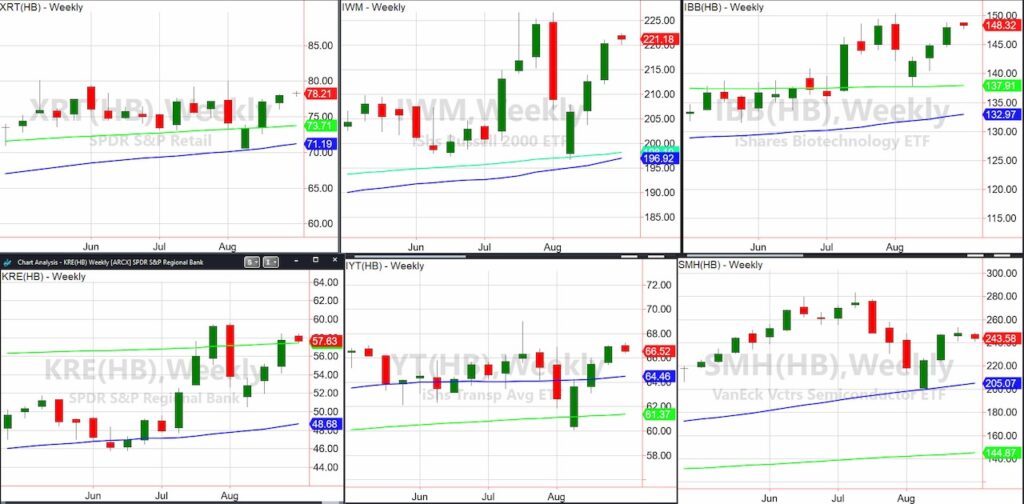

Now that we are in the last week of August, what do the weekly charts tell us?

Has anything really changed?

Yes, the Fed will lower.

Yes, inflation is down while geopolitics get hotter.

Yes, the dollar is on 2024 lows.

And yes, gold is on new all-time highs.

And the Family?

They rallied, but none cleared the July highs.

That means that:

Granny Retail XRT must clear the 80 level.

Granddad Russell 2000 IWM must clear 227.

Brother Biotechnology IBB (still in best shape) must clear 150.

Prodigal Son Regional Banks KRE must clear 60. But also, we see it on the 200-week moving average, so it must also hold 57.

Transportation IYT sure revived. Now, it is a long way to the 2024 highs, but at least we see it cleared the July highs already this month.

The market is watching Sister Semiconductors SMH as Nvidia reports on Wednesday.

SMH is far from the July highs at 280. What does that mean?

Maybe nothing, but if NVDA does not deliver, expect a quick move lower with the 50-WMA (blue) the key support level.

Finally, this is the daily chart of Bitcoin, our “tween” member of the Family.

There were huge cash inflows last week.

Now, we believe 62,000 is the key area to hold. And that the next move over 68K will bring Bitcoin to 90k next stop.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.