Advanced Micro Devices (AMD) traded 5% higher on Thursday morning, after FBN initiated coverage on the stock with a $40 price target.

FBN Securities analyst Shebly Seyrafi initiated coverage on chipmaker AMD with a rating of outperform and a price target of $40. This is a 24% premium from the previous day’s close, however it is notable that the stock had just closed 7% higher on that day.

Seyrafi noted AMD’s current product cycle is strong and pointed out that the company sells custom semiconductors to Microsoft and Sony, both of whom are planning to launch new gaming consoles as soon as 2020.

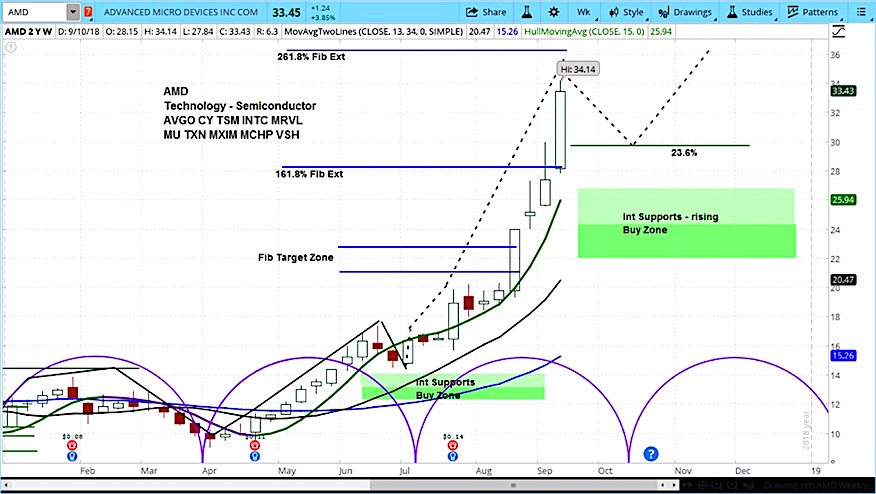

In reviewing the market cycles for AMD, we can see that the stock continues to trade in the rising phase of its current cycle. However, it has nearly reached the 261% Fibonacci extension on the weekly chart below.

Furthermore, the stock is rated “extreme overbought” on the askSlim Option Bias Indicator (OBI), which uses a proprietary methodology.

As such, we are looking for a reversal to $30 or lower in the near term.

Advanced Micro Devices (AMD) Stock Chart with Weekly Bars

Advanced Micro Devices (AMD) Option Bias Indicator (OBI) with Weekly Bars

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.