Over the past 18 months or so, large cap momentum stocks have slowed.

Most notable of the large cap momentum names are the FAANG stocks – Facebook, Apple, Amazon, Netflix, and Google.

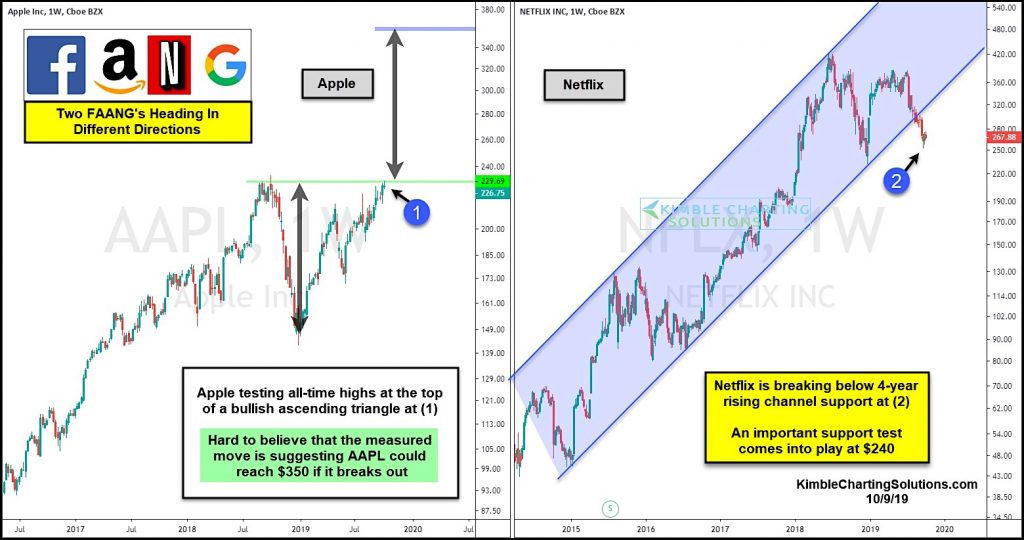

Today, we look at two of those names… heading in different directions: Apple (AAPL) and Netflix (NFLX).

Both stocks appear to be at important time/price points.

In the chart below, we can see that Apple’s stock (AAPL) is testing breakout resistance at (1). A breakout here could propel AAPL to $350 on a measured move basis.

Looking at Netflix (right side), we can see that the stock price is breaking down below 4-year rising trend channel support at (2). This development is structurally bearish for the stock. Important support resides at $240, which should be a battle ground for bulls and bears. Stay tuned!

Apple $AAPL versus Netflix $NFLX Performance Price Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.