Apple reported fourth quarter earnings and most investors seem to paying close attention to a year over year decline in China sales and a lower average sales price per iPhone sold. I think those are important, but the story should really be focusing on the Apple services business.

This is a business which includes revenue from Internet Services (Music), AppleCare, Apple Pay, licensing and other services (app sales). Apple services reported $6.3B in quarterly revenue, or $25B on an annualized basis. In addition, it is growing 24% year on year, and 6% sequentially.

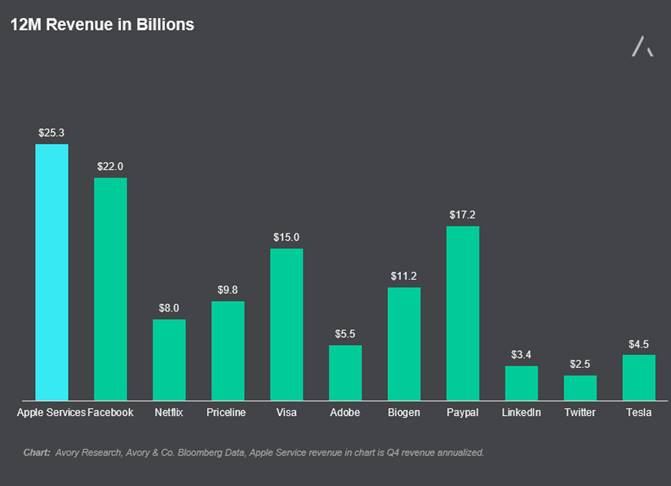

These are massive numbers which would normally get a great deal of attention for other companies, but not so much for Apple. To put the size of the Apple services business in context, here is a chart showing 12 month revenue for some major tech related companies.

Here are some eye popping takeaways:

- Apple services business generates 3 times more revenue than Netflix, while growing at the same rate.

- Apple services generate revenue equal to the 12 month revenue of Tesla, Twitter, LinkedIn, Adobe, Priceline all combined. These have a combined market cap of $127 billion.

- Apple services generates revenue equal to the 12 month revenue of Visa and Priceline, while growing faster. These two have a combined market cap of $267 billion.

- Apple services has a revenue run rate higher than Facebook’s 12 month revenue figure.

With over 1 billion active installed devices, I believe Apple is just at the very beginning of monetizing this through services. I think of it in a similar capacity as Facebook. Installed devices is Apple’s version of users, and they both have over a billion.

You can catch more of my market insights on my site, The Market Meter. Thanks for reading.

Twitter: @_SeanDavid

The author has a long position in AAPL at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.