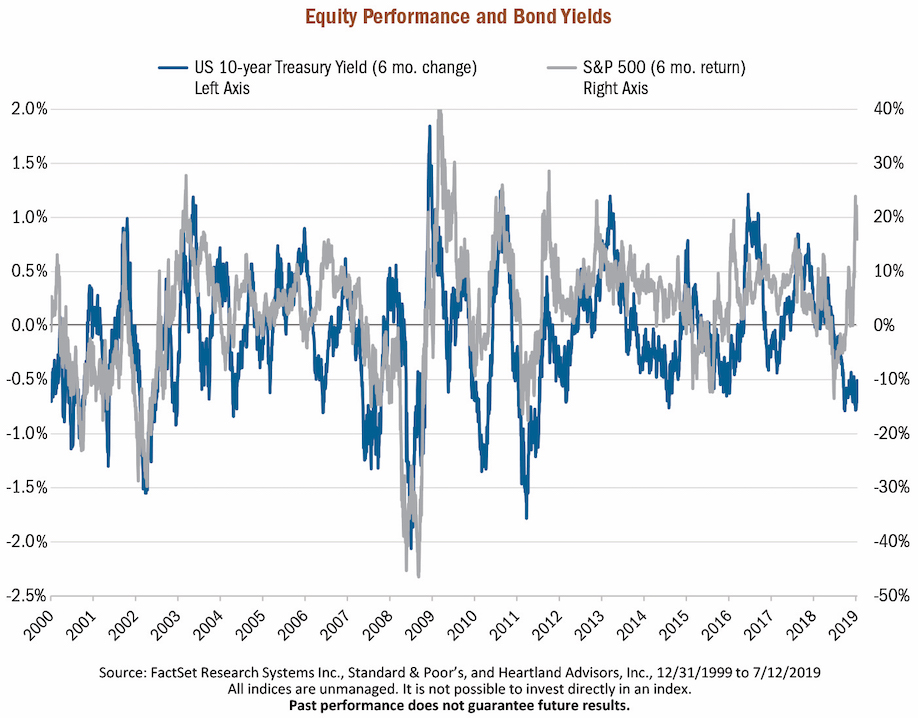

Equities versus Bond Yields (6 month change) Performance Chart

There’s nothing quite like the promise of a rate cut to get the animal spirits of Wall Street stirring.

Since early June, the stock market has been marching higher thanks to growing conviction that the Federal Reserve will lower interest rates to keep the economy expanding.

In fact, the only sustained pause for the S&P 500 Index (INDEXSP: .INX) came after an unexpectedly strong jobs report cast doubt on timing of the first cut.

The thinking goes that since cheap money has fueled growth and a rise in equities for years, why shouldn’t it work going forward? While this view has become conventional wisdom, at least one asset class in the market doesn’t seem to be on board.

A look at the gap between yield changes on the 10-year Treasury and performance of the S&P 500 points to two very different views on what’s next for the economy—with lower yield generally forecasting a slower economy. The discrepancy has reached levels not seen since pre-financial crisis in early 2007.

While we don’t foresee a repeat of those days, the disconnect should serve as a reminder how quickly today’s momentum can turn and why fundamental analysis could take on greater importance going forward.

This article is by Colin McWey, CFA, Portfolio Manager.

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful. Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in the articles or appearances are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

Definitions:Treasury Yield: is the effective rate of interest paid on a debt obligation issued by the U.S. Treasury for a specified term. S&P 500 Index: is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.