For today, I am including a clip that covers currency pairs and several commodities.

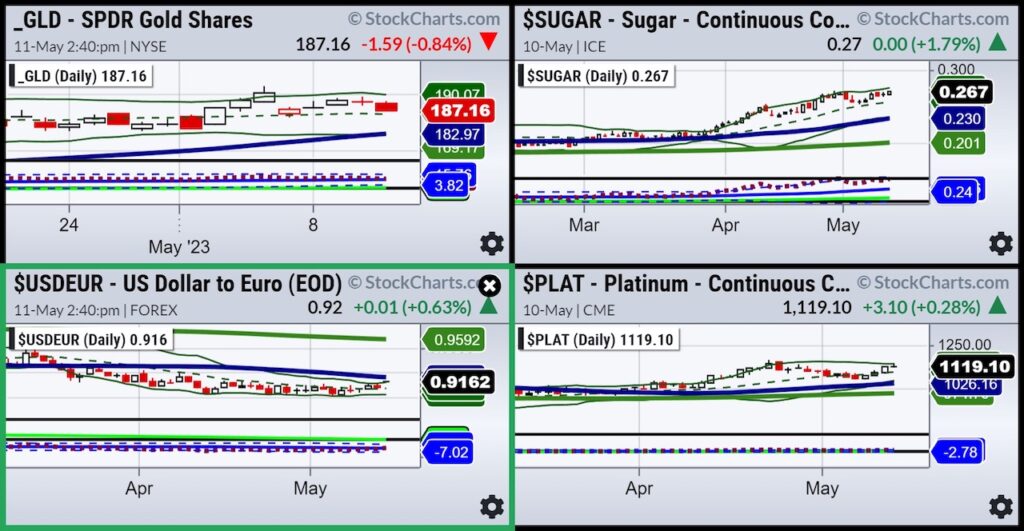

The four-chart screen is a daily screenshot of Gold (GLD), Sugar (continuous contract), the US dollar to the Euro (USDEUR) and Platinum continuous contract (PLAT).

The Gold ETF (GLD) is falling from its recent highs.

Sugar has run into some resistance with momentum currently in mean reversion to the downside.

The Dollar to the Euro shows the dollar strengthening while its momentum has a bullish divergence.

Platinum, mirroring gold, also looks like some resistance is at hand.

Have a listen to the clip as I go through the chart (futures) and give actionable information:

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 23-month MA 420

Russell 2000 (IWM) 170 support – 180 resistance

Dow (DIA) Now below the 23-month MA

Nasdaq (QQQ) 329 the 23-month MA

Regional banks (KRE) 42 now pivotal resistance-holding last Thurs low

Semiconductors (SMH) 23-month MA at 124

Transportation (IYT) 202-240 biggest range to watch

Biotechnology (IBB) 121-135 range to watch from monthly charts

Retail (XRT) 56-75 trading range to break one way or another

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.