The Big Picture:

It was a busy week with earnings across retailers, fintech, and marketplaces. Overall, results were strong, with record profits and revenue from several portfolio companies.

One call out is Fiverr which we were excited with the results, along with their announcement of Ai Agents on their platform. Going from Gig Economy to Giga Economy. We speak with management next week, so more on that later.

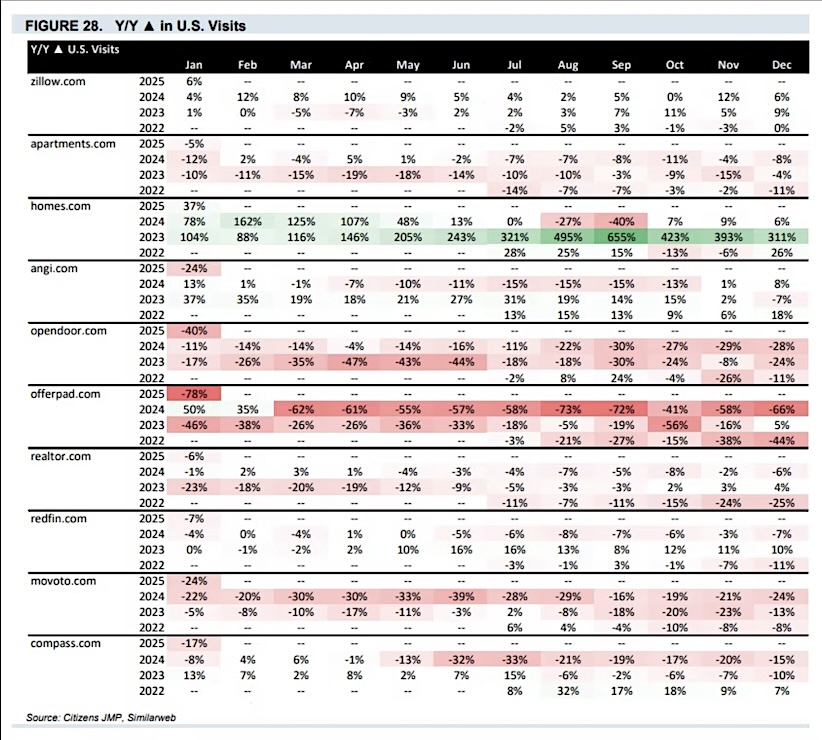

In terms of data this week, we are kicking off with some real estate web traffic. Zillow, despite being the largest in its space, is gaining strong traction. Elsewhere, Block’s margins surged from 0% to 34%, and humanoid robotics is advancing rapidly. Let’s dive into the data.

The Data:

- Zillow web traffic – Leading and still growing.

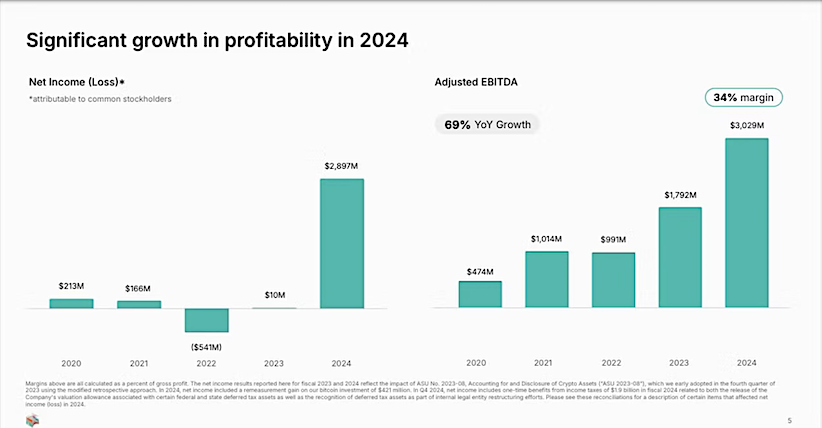

- Block’s margin explosion – From breakeven to 34% in a 5 years.

- Humanoid robots scale up – The rise of human-sized machines

Data Point #1: Zillow: Strong Growth Despite Market Leader

Zillow remains the dominant online real estate platform, but it’s notable that it continues to see solid Y/Y growth in traffic. January U.S. visits were up 6% Y/Y, one of the strongest showings among real estate platforms. It is growing again despite being the ONLY real estate platform seeing growth in every month last year.

- Competitive edge – Smaller platforms like Redfin, Opendoor, and Offerpad continue to decline.

- Zillow’s brand power – The company remains the go-to source for homebuyers and renters.

- Potential revenue expansion – Higher traffic could fuel Zillow’s advertising and mortgage businesses.

Data Point #2: Block: Margin Expansion Story in 2024 – Growth in 2025?

Block (Square) went from nearly 0% profit margins in 2019-2020 to 34% in 2024, driven by cost efficiencies and scaled monetization across Cash App and Square. This type of margin expansion is rare. If Block sustains this profitability and furthers its growth (see our latest X post) it changes the long-term earnings power narrative. Investors will likely re-rate the stock higher if margins hold.

- 9% Y/Y EBITDA growth – Massive acceleration in profits.

- Cash App is scaling fast– User engagement is translating into real margin leverage.

- Proto – We are excited about their bitcoin mining optionality here as revenue are likely to hit in second half of 2024.

DATA Point #3: Meta Announced Humanoid Robots: Scaling Beyond the Prototype Phase

Meta announces humanoid robot ambitions. Pretty big news. Humanoid robots are evolving rapidly, with models now reaching human size (6ft tall). Leading designs like Tesla Optimus, Figure-02, and Phoenix are pushing towards commercial applications. Robotics is transitioning from concept to real-world adoption. We even just heard Meta suggest that they are building for this.

If you have listened to our “Where’s the World Headed” presentation then you know this is happening due to cost of robotics, and cost of compute coming down, all while human labor continues to march higher. The value of humanoid robots comes down to automation, efficiency, and capability expansion. Meaning this market can be hugggee!

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.