In just 4 years, the trend (and investment theme) of low interest rates has been turned on its head.

During this time, home and auto loan rates have gone from consumer friendly to unfriendly.

Quite frankly, whether you look at the 10-year or 30-year treasury bond yield, both are rising. Today we look at the latter.

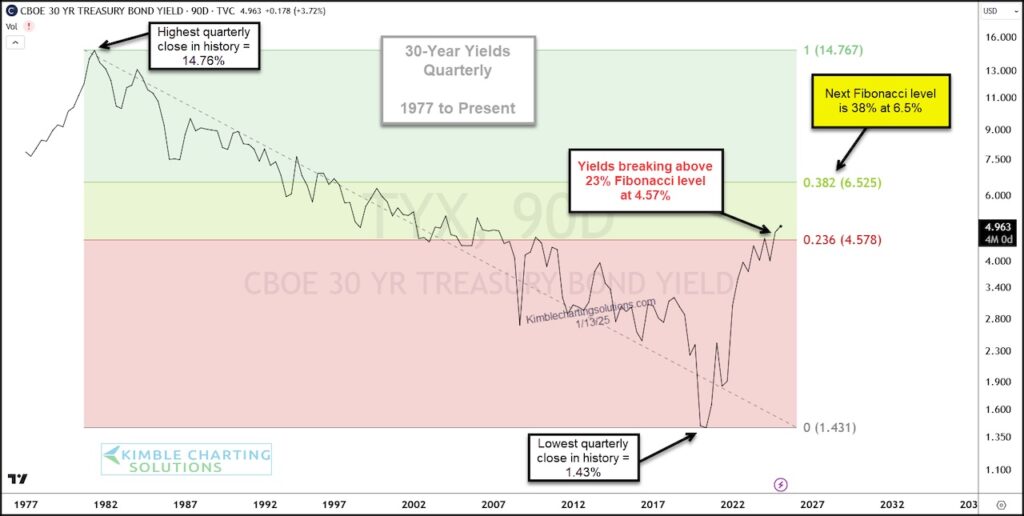

Below is a long-term “quarterly” chart of the 30-year Treasury Bond Yield. Using applied Fibonacci, we can see that the 30-year yield spent nearly two years testing the 23% Fibonacci level.

This quarter yields are attempting to breakout above the 23% level. The next upside Fib level comes into play at 6.5%. That’s not what consumers, businesses or economists want to hear.

In my humble opinion, this is a very important chart to be mindful of. Let’s see how yields close this quarter. Stay tuned!

30-Year Treasury Bond Yield “quarterly” Chart

Twitter: @KimbleCharting

The author may have a position in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.