Gold retreated following the U.S. election as money parked in the precious metal in case of trouble or a contested election, moved back out. But that sale didn’t last long and gold is steadily recovering.

In this article, we share our views on gold and miners as unique portfolio diversifiers.

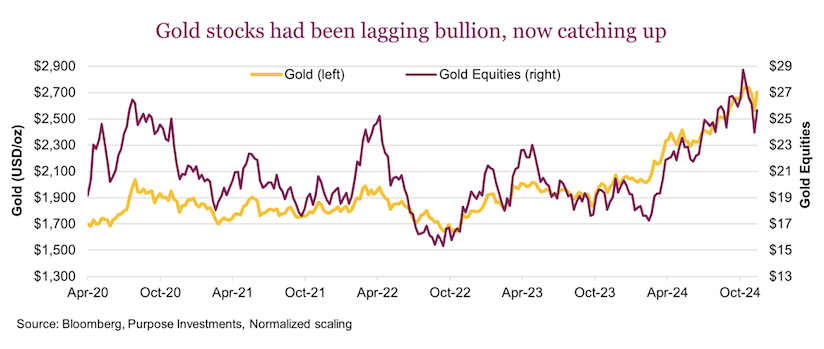

Gold has done well this year, as have gold stocks. Gold bullion is up about 30% at $2,700/oz, and gold miners are also up about 30% based on global gold miner ETF.

However, following the election there was a rather steep drop in gold prices, both bullion and stocks. Gold dropped from around $2,800 to below $2,600/oz before partially recovering. Neither the drop nor recovery should come as a surprise if you look at positioning.

Heading into the election – one that most thought would be close and could very easily become a contested election – folks added to gold, just in case things got weird or unsettling. Well, that didn’t happen and it appears there will be a smooth transition of power in the U.S. So right after the election, some of that fast money that parked in gold ‘just in case’, left. You can see this in the non-commercial futures position trends and in the money flows for gold ETFs.

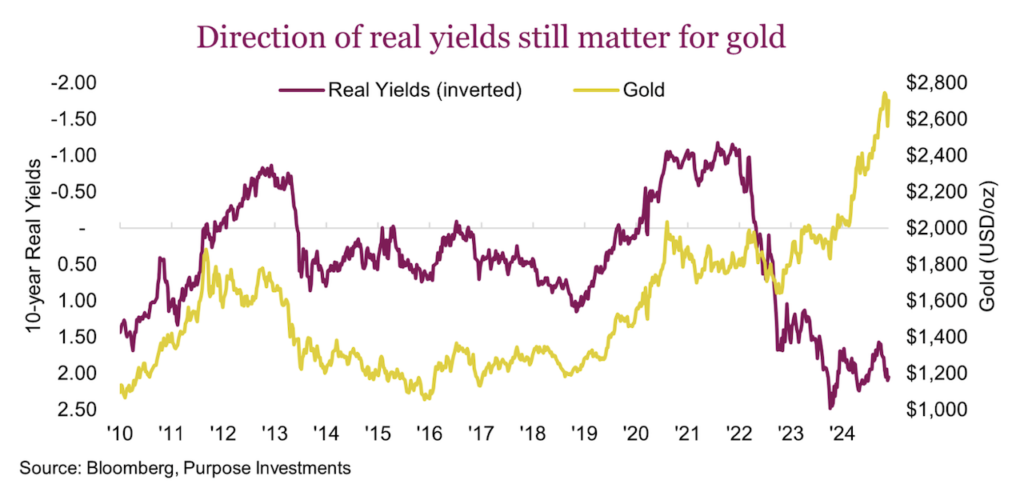

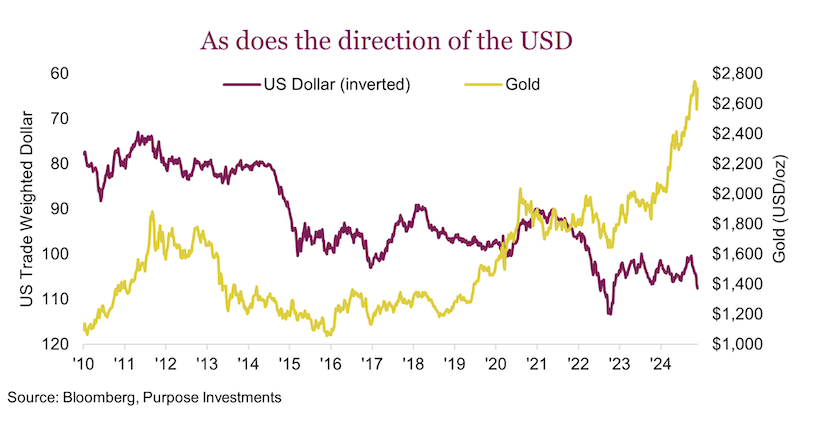

Magnifying this weakness in the yellow metal was a spike higher in the U.S. dollar and a move higher in real yields. One could argue that gold broke the relationships with these two factors over the past couple of years. Gold moved a lot higher while real yields rose and the dollar was rather flat. Looking at the following charts, these two factors don’t seem to support a gold price way up here. However, it is not the level that matters for these factors, it is their directional move. So when the U.S. dollar strengthens and real yields rise, gold likely falls. Keep in mind, there are many other factors as well.

We remain fond of gold exposure for a couple key reasons: crisis alpha & USD hedge. Gold and gold miners have a strong history of providing a stabilization factor for portfolios during times of market trouble. One could say this is what bonds provide, but if the market trouble is caused by debt or inflation concerns, bonds often fall short. For us, having some gold diversification under these potential scenarios simply makes sense. We discussed this ‘crisis alpha’ view back in March with some pretty compelling charts. (Crisis alpha refers to the ability to generate positive returns during periods of market stress or crisis). Gold also provides a hedge in case the U.S. dollar declines. It hasn’t happened yet, but it’s still a risk.

This does raise the question though, without a crisis and with a strong U.S. dollar, why is gold up at $2,700/oz? Central bank buying has helped, with more and more investors wanting to diversify their holdings. And then there is inflation. Gold, as a true real asset, does provide a hedge against inflation risk which is one of the factors that has driven the price up over the past few years. We do believe inflation may re-accelerate somewhat in 2025. Maybe even in Canada too, given that while we are still fighting lingering inflation, the government has decided to give most citizens $250 and a tax holiday on such strategic consumer goods as children’s toys and booze.

Gold is a part of a diversified defensive stack within a portfolio, in our view. This often leads to the question of miners vs bullion. Miners provide greater leverage but during risk-off events they can be weighed down by being more equity related. Miners may be a little more attractive at current prices, but not materially so. Back in February/March there was a very wide discount which has largely closed. Of course, if investors ever get excited about gold miners, they can be pushed up much more than bullion.

Finally, let’s talk valuations. You can’t really value the price of gold. A strategist once said – gold’s valuation formula is 1/T, where T is trust in the system. So do you think T (trust) will rise in the coming years or fall? Most likely think less T; that helps provide support for some gold exposure.

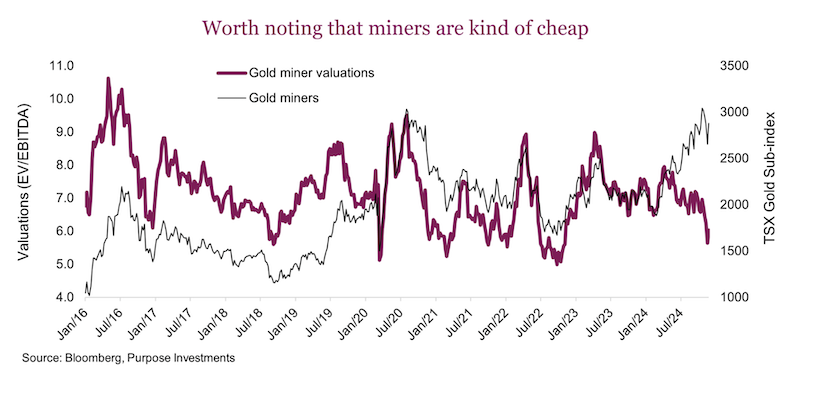

At the company level of course there are valuations and we have historically not been fans of valuation approaches to this space. Mainly because gold is influenced by more macro factors, causing valuations to fluctuate as a result. That being said, in the chart below it is interesting to note that peaks in gold mining companies often coincided with rather high valuations. That is not the situation today as profitability has increased faster than the share price appreciation, resulting in falling valuations.

Final thoughts

Gold exposure certainly isn’t for everyone as many investors carry some scars from this space. However, gold does provide a unique kind of defense for a portfolio that may be needed if inflation picks back up, or the bond market loses faith in government or the U.S. dollar moves into a downward trend after going up for more than a decade.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.