We have been talking about the Retail Sector ETF (XRT) the its massive 11-month price consolidation for several months.

What we have been waiting for is a weekly close over 79.20, a price level we had not seen since February of 2022.

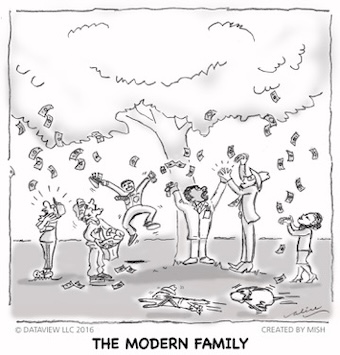

The stock market has been in risk-on mode, catching dollars as they fall from the trees. And bullish investors are hoping that this trend continues. Perhaps following Bitcoin higher (which is making it rain right now)!

Finally, XRT and retail stocks have closed above 79.20, attempting a technical breakout. But the risk is obvious.

Either the Retail sector (XRT) follows through and begins to trade higher towards 90 immediately, or we see yet another failure and a quick turn lower.

Remember, XRT remains an overall under-performer in an economy that needs the consumer.

And given high interest rates, a strong dollar and inflation on the rise again, we really cannot tell how long this run will last.

The Russell 2000 ETF (IWM) also did well this past week.

IWM held critical weekly support at 227, and now looks poised for a run to new highs. However, on the sobering side of the charts, this past week was only an inside week to the one prior.

We must watch the price range from 227-243 to reconcile.

The Biotechnology sector ETF (IBB) turned back around. While the monthly chart never failed a key support level, it got a bit scary on the weekly chart.

It is now trading back over the 200-week moving average (green line), which we are watching for follow through this week.

The Semiconductors sector ETF (SMH) has stayed in the game without rallying or falling much.

That’s just fine for the broader stock market as SMH has had its day in the sun. Now, for a broader market rally and a healthier outlook for the economy, we look to XRT IWM and… one more key ETF.

The Transportation sector ETF (IYT) continues to look like more upside is on the way. In fact, this past week was a new ALL-TIME high close for IYT.

Our next chart is Bitcoin, which rallied sharply higher and shook the proverbial money tree! Make sure you keep locking in some gains and keep a trailing stop.

As we head into Thanksgiving and Black Friday, keep watching the Retail sector (XRT) a Russell 2000 (IWM). Right now, hope springs eternal.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.