I ended last week on Maggie Lake’s podcast.

During the discussion, we covered a lot of topics, and I encourage you to go have a listen as we offer actionable information on the stock market and associated risks.

One of the topics we covered is the notion of stock market risk parameters, and how we use ratios to ascertain risk-on or risk-off.

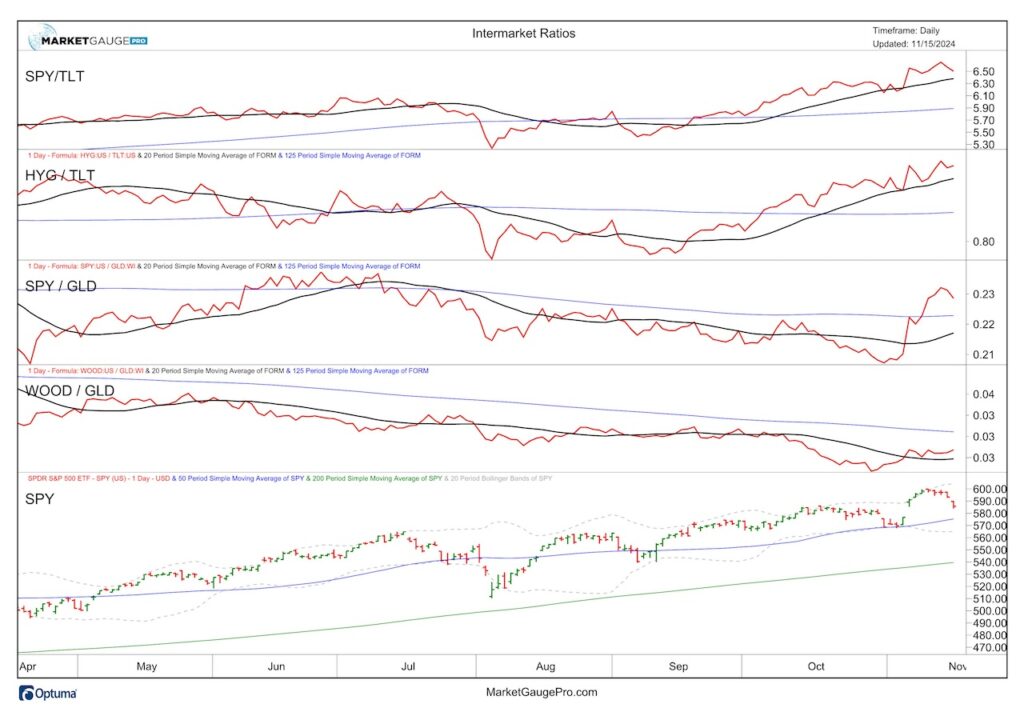

Below is a chart from our BigView stock market product.

These are the four stock market risk ratio indicators I look at the most:

- S&P 500 ETF (SPY) vs Long-Dated Treasury Bonds (TLT) – the relationship between the safest debt instrument (U.S. bonds) versus the benchmark stock index, the S&P 500. Stocks historically offer higher returns than bonds, but they are inherently riskier. When the ratio is trending up as it is now, it identifies an increased appetite for risk in the market. Risk on.

- High Yield Bonds ETF (HYG) vs TLT – the relationship between risky high yield corporate debt (HYG) versus the safety of U.S. Bonds (TLT). When HYG outperforms TLT, as it is now, that shows an increased appetite for risk in fixed-income markets. Risk on

- SPY vs Gold ETF (GLD) – the relationship between the S&P 500 (SPY) and Gold (GLD). Currently, SPY outperforms GLD. That generally identifies an increasing appetite for risk and is viewed as favorable to stocks. Risk on

- Lumber ETF (WOOD) vs GLD – The relationship between gold (GLD) and lumber (WOOD). When this ratio is trending up it indicates that the relative performance of lumber is improving versus gold. Economy Improving

With all stock market risk factors in gear, it is hard to get too bearish unless those ratios change.

Another big point of our conversation was on Bitcoin. Essentially, we discussed money management based on current levels in Bitcoin and many of the other currencies.

Viewers often ask me about gold and silver.

Maggie and I discussed the bounce (which began today) and more importantly, how silver behaves relative to gold.

This is yet another key ratio to assess stock market risk (and overall risk) and inflation factors.

While both metals are beneath their 50 daily moving averages, momentum turned up today.

However, looking at gold, it underperforms SPY.

Looking at silver, it remains an underperformer to gold at this point (also risk on for equities).

The goal of the podcast with Maggie given the time she generously allows for, is to leave you with actionable indicators that assess the risk dispassionately.

This is especially crucial during this highly emotional time for investors.

Stock Market ETFs Trading Analysis and Summary:

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY): 575 is price support, 600 resistance.

Russell 2000 (IWM): 227 is price support, 244 is the area to clear.

Dow Jones (DIA): 430 is price support.

Nasdaq 100 (QQQ): 500 is important price pivot.

Regional banks (KRE): 65 is important price pivot.

Semiconductors (SMH): 235 is the 200-day moving average (price support), while 250 is resistance.

Transportation (IYT): Looks good if IYT holds over 71.

Biotechnology (IBB): 132 is price support, 138 is now resistance.

Retail (XRT) : 78.50 is important price support.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.