The surge in gold prices in 2024 has seen gold breakout to new all-time highs and gold mining stocks out-perform.

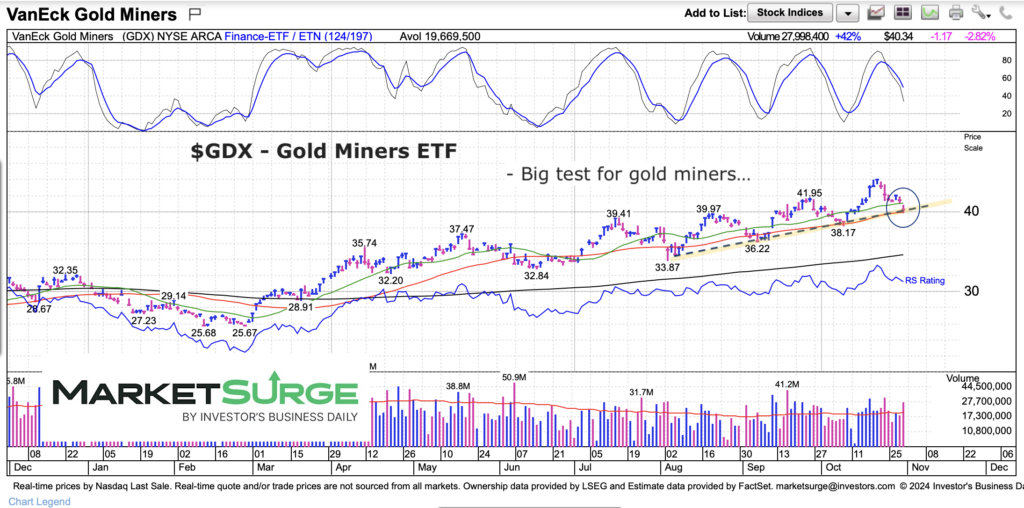

More precisely, the Gold Miners ETF (GDX) has steadily risen making high after high.

The price of gold per ounce recently hit $2800 and indicators are overbought. This has brought a stallout in gold prices and a pullback in GDX, the gold miners etf.

But right now GDX is testing important price support. And additional selling could bring a deeper selloff.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$GDX Gold Miners ETF “weekly” Chart

As you can see, GDX is testing its near-term trend line. Follow through selling to the downside would signal a deeper selloff for GDX and gold miners stocks. Silver lining: A deeper selloff would likely be a buying opportunity considering that gold has broken out to new highs and appears to be in another long-term leg higher.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.