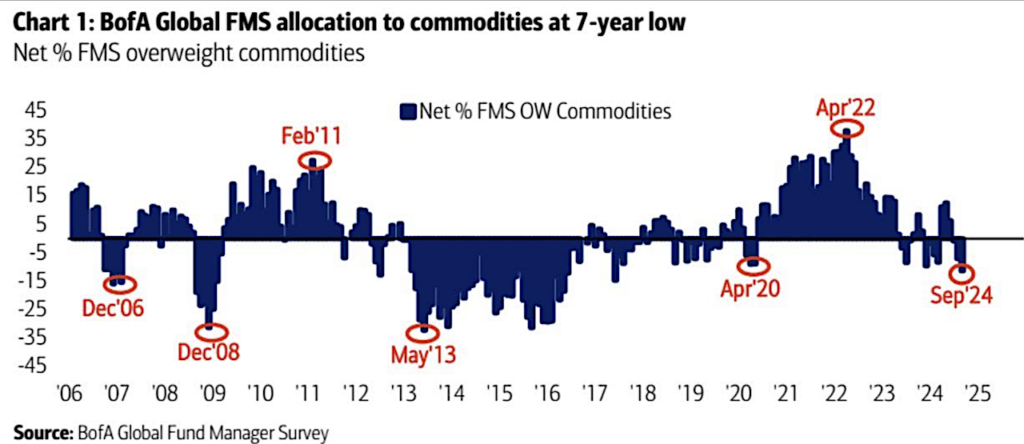

Look at the headline of this chart and you can see that global FMS allocation to commodities is at a 7-year low.

This is fascinating, particularly the day before the FOMC meeting and after an increase in M2 over the last several weeks.

We also had a positive reading in the Empire manufacturing numbers.

And we saw a stronger than expected headline for retail sales.

We expect the Fed to cut by .25% but talk dovish going forward.

Perhaps gold will take a rest.

But that hardly means anything in terms of a potential stagflation environment, as gold might pause while silver takes over.

Nonetheless, for turnaround Tuesday, I would like to turn your attention to DBC, the DB Commodity Index Tracking Fund.

When analysts try to prove that inflation is dead, they often show this chart.

Now I show it to illustrate that commodities could be ready for a huge comeback.

DBC tracks an index of 14 commodities. It uses futures contracts to maintain exposure and selects them based on the shape of the futures curve to minimize contango.

The ETF represents 14 commodities drawn from the Energy, Precious Metals, Industrial Metals and Agriculture sectors via futures contracts.

After a new 60+ day low on September 10th, the next day the price traded within that range. And then on September 12, DBC gapped higher leaving a reversal bottom intact.

The mean reversion for DBC looking at our Real Motion occurred on September 10th.

Now, and the most fascinating part of this chart, is that we are seeing a BULLISH divergence in momentum as the red dotted lines sit on the moving averages.

While DBC underperform SPY, we will look for that to change.

Meanwhile, Geoff and I launched our first weekly video podcast-link below-please have a listen. We can use a name for it so any suggestions are greatly appreciated.

Furthermore, we will want to see DBC clear the 50 daily moving average and change phases to recuperation.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.