Ok, we are going to keep this market update a bit shorter, simply because the rise in market volatility had us writing lots of content outside our regular weekly installment.

If you missed it, click HERE, as we did our best to explain the mechanical unwinding of the yen carry trade and how it was reverberating differently across parts of the market.

Beneath the ‘carry trade’ talk, there has been an uptick in folks talking about recession once again. That will be our brief topic this week.

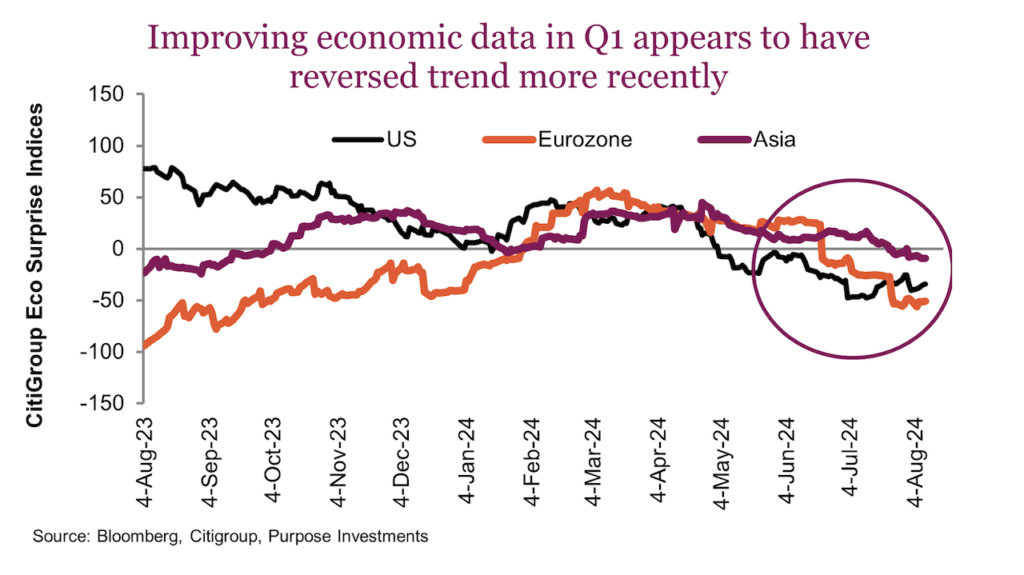

There is no denying the economic data has turned a bit softer. This isn’t new news either; in fact after a really strong Q1 and part of Q2, the data began rolling over. First in the U.S. and now more recently globally. The chart below is the Citigroup Economic Surprise index, measuring the data compared to consensus, adjusted for the importance of the data release. Sorry, Canada is not on here, but the chart is similar, strong for much of 2024 and then turning negative, fueled by our weak labour report on August 9.

The economic data has a lot of noise and since there are so many data releases, you can always find something good and something bad, if you look hard enough. The key is what is more important for the market today. And that answer is simple: US consumer or labour (labor as they say).

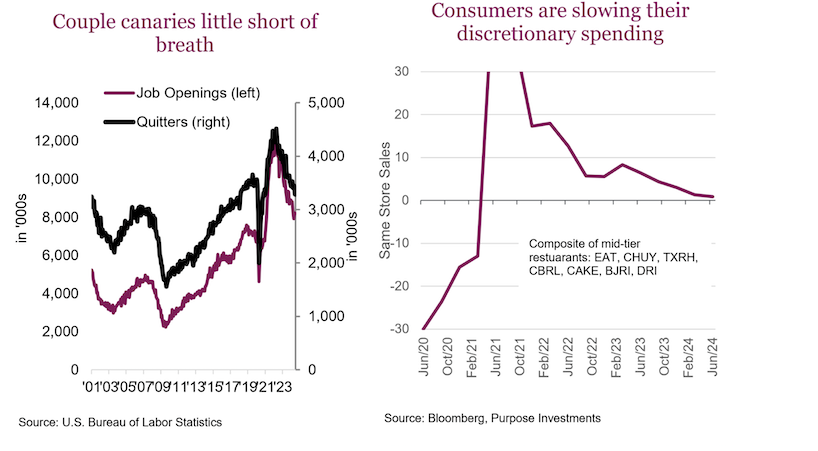

The U.S. consumer has been downshifting their spending patterns, which is often a sign of stress or retrenchment. We started highlighting rising credit card late payments and sit down restaurant same-store-sales many months ago (chart below on left). And the anecdotal pieces kept coming.

This was supposed to be a record travel summer for airlines as capacity remains constrained (seems a major plane maker is running behind) and prices are high. Well, the seats were not selling and many guided lower and started discounting. Walmart highlighted increased spending among wealthier patrons. When the wealthy are back at Walmart, that is not a good sign. The list goes on.

Softening consumers are not a huge deal, they have been very resilient for many quarters while inflation has been eroding wealth. One positive of the more fragile U.S. consumer, has been their job market. When jobs are plentiful and easy to find, people are more confident and spend more freely. But that appears to be starting to change. Lots of people still finding jobs but it is not as easy as it was a few months or quarters ago. Job openings are dropping, and people are quitting as well. If you are worried about finding a new job, it tends to result in people quitting less often.

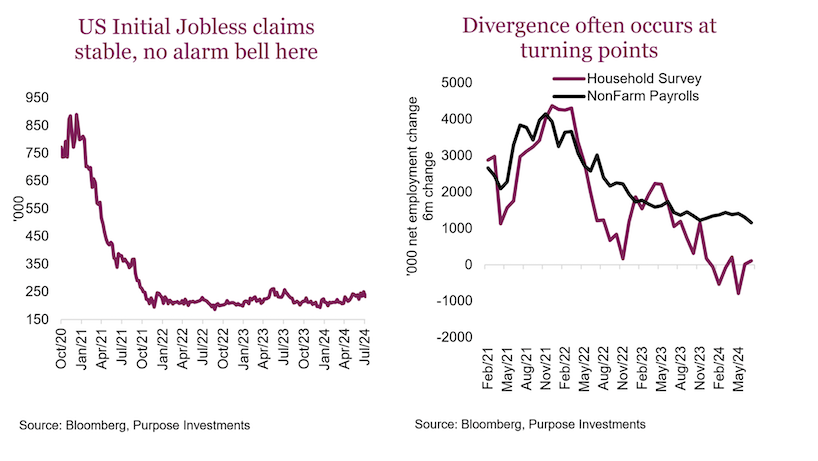

As a result, hard labour reports are now much more important than a few months ago. The official nonfarm payrolls will be more closely scrutinized; the only risk here is if the jobs have started to disappear, we may already be in a recession. Labor is a lagged indicator usually. The downtick in jobs in July was concerning, as is the divergence between the household and nonfarm surveys. There is often divergence at a turning point.

But for something a bit timelier, people are starting to focus on initial jobless claims. So in the last couple weeks, the nonfarm report was weak, but the initial jobless claims were stable. See, it is easy to find data that can support or refute any view.

Final thoughts

The economy is slowing. But it is probably way too early to talk recession or even get too excited. Financial conditions have actually been easing for the past number of quarters, deficit spending still really strong, and parts of the economy are doing well. Probably a few oscillations, some better, some worse, for the economic data before recession risk become material. The only real certainty: economic talk will be on the rise.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.