The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Markets have turned volatile lately as several micro and macro fears brewed to the surface

- We highlight four companies that announced stock splits this year, each with weak recent stock price action

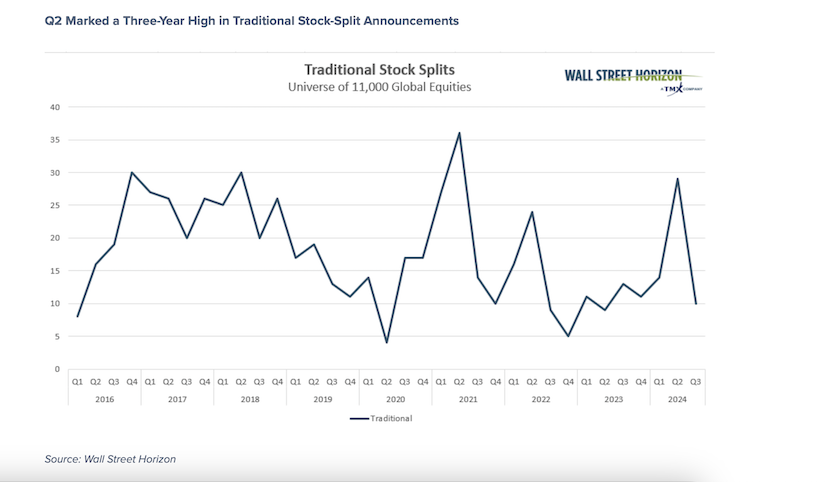

- While the positive effect on share price has waned, there has been an uptick in the number of companies announcing traditional splits

I Know What You Did Last Summer was a suspenseful horror hit in the late 90s. Millennials may remember the movie and its sequel starring Jennifer Love Hewitt and Freddie Prinze Jr. The story follows four teenagers involved in a hit-and-run accident and a killer seeking revenge for an apparent murder the teens committed. A year after the accident, the teens begin receiving ominous messages from the mysterious killer.

Today’s stock market has a bit of that same feel. Recall it was last summer when the S&P 500 was in the throes of a correction. Equities peaked in late July – during the heart of the Q2 earnings season – and would go on to bottom the following October. The pullback was nearly as textbook as it could get considering that US large caps dipped 10% over the course of three months before resuming a broader uptrend.

Troubling Headlines in Early August

Investors are now receiving ominous messages and reminders about volatility. Last week, the VIX® Index soared above 65 for a moment following a turbulent weekend of bearish news that included confirmation of a large sell of Apple (AAPL) stock by Berkshire Hathaway (BRKA),1 reports of a delay in NVIDIA’s (NVDA) new Blackwell chips,2 turmoil in the Japanese stock market and its yen carry trade unwind,3 and the potential for war in the Middle East.4 All of that followed a disappointing US jobs report after the Fed decided to put off its first rate cut, likely until September.5

While the reasons may be much different from this time in 2023, investors likely feel as if the bears are stalking them for past misgivings as we venture further into a historically weak period on the calendar. And we see selling pressure among a handful of once-hot individual stocks that announced splits earlier this year.

The Appeal of Stock Splits

The media often discuss stock splits in a positive light. After all, the reason a management team elects to divide its existing shares into multiple shares is commonly as a result of a previous run-up in the stock. A traditional split can increase trading liquidity, and it may have certain psychological benefits as investors may perceive a lower-priced stock as more accessible, even if the company’s fundamental value hasn’t changed. Stock splits can even be implemented to make shares more affordable for employees in certain stock-based compensation plans.

More Splitters

Traditional stock splits were back in vogue last quarter. Q2 2024 featured 29 split announcements – the highest in three years. It’s not surprising considering that markets were in rally mode, led by strength in US large caps. The third quarter is already tracking well with 10 split announcements as of August 7.

Q2 Marked a Three-Year High in Traditional Stock-Split Announcements

Digging Into the Anomaly

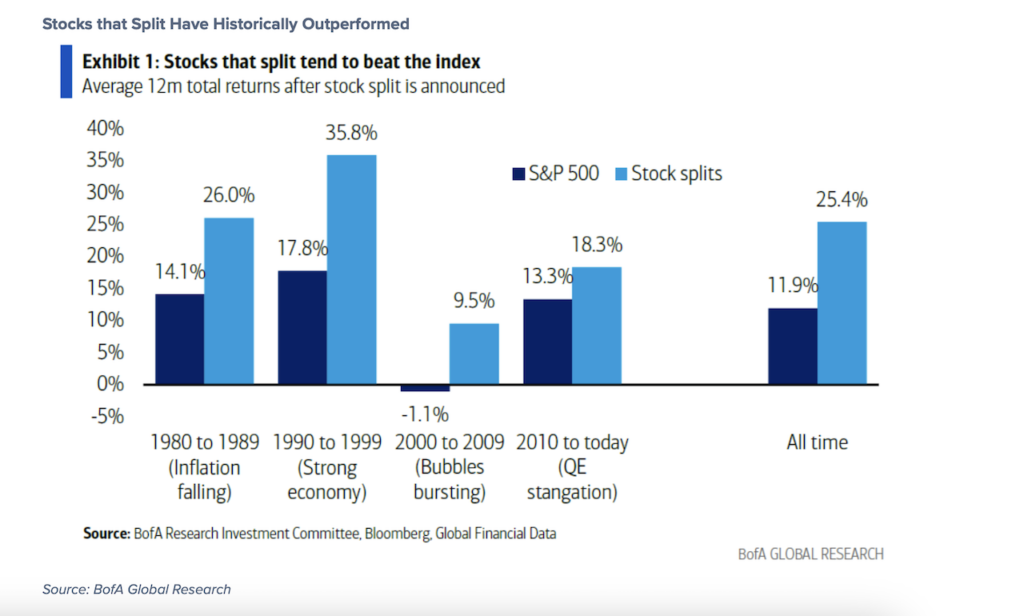

Research shows that stocks that split tend to beat their primary index, but the alpha trend has waned over the years as the anomaly has become more widely understood. BofA Global Research reports that since 2010, stocks that have split have posted a 12-month forward return five percentage points above the index. While that’s strong, it’s far short of the 10-percentage-point-plus positive gap seen in previous decades.

Stocks that Split Have Historically Outperformed

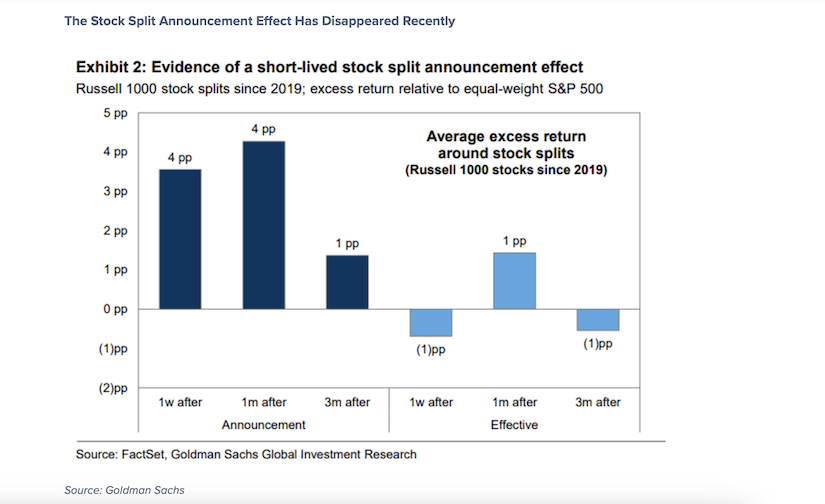

More recent figures from Goldman Sachs, using FactSet data, reveal that in the past five years, the stock-split halo has been even less powerful. Average excess returns among splitters are essentially flat in the following week, month, and 3-month periods.

The Stock Split Announcement Effect Has Disappeared Recently

A Changing Market

Why aren’t we seeing the outperformance of yesteryear? Well, information is more easily available today and the advent of fractional-share trading along with markets that are perhaps more efficient at least partially negates the halo effect of a stock split. There are also fewer splits as higher share prices are now accepted, and many large companies are not as concerned about needing to appeal to retail investors due to large institutional shareholder bases.

Stock-Split Stars Hit the Skids

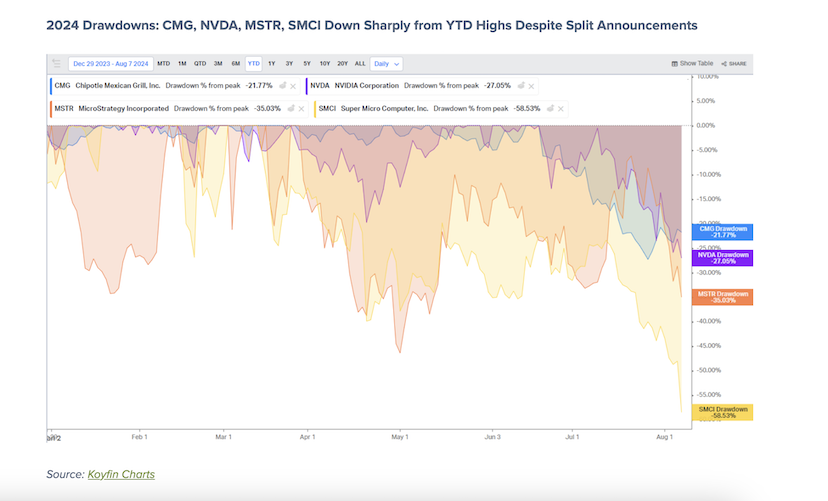

Turning to recent market action, let’s follow four of this year’s highest-profile stock splitters. Chipotle (CMG), NVDA, MicroStrategy (MSTR), and Super Micro Computer (SMCI) each announced splits, the first being CMG back on March 19. NVDA followed with a 10:1 on May 22, then came MSTR’s 10:1 on July 11, and SMCI joined the party on August 8.

Through last Wednesday, all of those stocks were mired in steep drawdowns. Notice in the graph below that the best performer was CMG – down 22% from its mid-June peak. NVDA was the poster child for the AI-fueled bull market from late 2022 through the first half of 2024, but the mega-cap is now well into bear-market territory. MSTR, often included in the same conversation as crypto, tested its March peak last month, but has since plunged more than 30%. SMCI, another AI play, reacted harshly after its quarterly earnings report and stock-split announcement on August 6.

2024 Drawdowns: CMG, NVDA, MSTR, SMCI Down Sharply from YTD Highs Despite Split Announcements

The Bottom Line

There’s a feeling of déjà vu in markets today. The S&P 500 fell about 10% from late July through early Q4 last year, and that followed downside price action over a similar stretch in 2022. This year, the bears have asserted themselves after the bulls controlled the first half. Shares of companies that recently announced stock splits are well off their highs, generally not benefiting from the historical trend of outperformance.

Sources:

1 Warren Buffett’s Berkshire Hathaway Slashes Apple Stake, The Wall Street Journal, Karen Langley, August 3, 2024, https://www.wsj.com

2 Nvidia Investors Grapple With Delay to Next Generation AI Chip, The Wall Street Journal, Tom Dotan, August 5, 2024, https://www.wsj.com

3 Why the Yen Carry Trade Unwind Has Further to Go, The Wall Street Journal, Chelsey Dulaney, August 5, 2024, https://www.wsj.com

4 Mideast Braces for More Violence Amid Warnings of Iranian Attack, The Wall Street Journal, Laurence Norman, Benjamin Katz, Feliz Soloman, August 5, 2024, https://www.wsj.com

5 Market Selloff Upends Fed Rate-Cut Calculus, The Wall Street Journal, Nick Timiraos, August 5, 2024, https://www.wsj.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.