2024 is an election year, just about everywhere. Already behind us are India, the UK, France, and Mexico (to name a few), and the big U.S. showdown is coming up in a few months.

Not surprisingly, this creates the most often-asked question: “How should we position a portfolio ahead of the election?” The challenge, of course, is you never really know who is going to win, and even if you had a good idea, how the market reacts or what policy is actually implemented are two other big variables. It is like a bunch of coin flips.

Just look at the Mexican market drop and lack of any recovery after electing the party often viewed as less business friendly. While in India, when Modi lost his clear majority, markets dropped for a day, then recovered and have continued to move higher over subsequent months. France’s CAC 40 has not enjoyed their election process. But the UK market seems to like the labour party winning results. The only constant is some level of volatility, but even that seems pretty random.

We would also be cautious about listening too much.

Even if confident about the result, can you take their intended policy statements made during the campaign period as rock solid? How many times have we seen promises for “no new taxes” amount to nothing? Campaign talk has the objective of winning votes and doesn’t always translate into real policy.

And then how the market reacts is a big variable. When President Trump won in 2016, markets dropped hugely in overseas trading. Markets never like surprises. But they had largely recovered by the open in NY and finished up on the day. Global markets went on to rise for the next year. The S&P 500 in 2017 only had 4 days that it dropped more than 1%, and it never fell more than 2%. It was one of the smoothest upward-trending rides in market history.

One could easily let confirmation bias kick in and attribute the great market to the new president. Not so fast. The market started trending higher before the election, likely thanks to synchronized global growth for the first time since before the financial crisis. After 2008, we had this kind of rotation of problems globally. The U.S. and Japan were doing fine, but Europe was suffering. Then, when Europe started to improve economically, Japan stumbled. When Japan was getting back going, the U.S. slowed. But in early 2016, they all started humming along nicely.

It’s the economy, silly. It does matter more than who sits in which seat. In fact, looking at past elections and which side won in the U.S. leads to really no clear winner regarding market performance. A great analysis by the U.S. Bank Asset Management Group found a very weak connection between election outcomes and the market. But a stronger connection between economic growth and inflation trajectory and the market. If you look at market performance with improving or deteriorating economic activity, well that paints a much more clear picture compared to who wins the election.

Or, for some other evidence, under President Joe Biden, the S&P 500 energy sector is up 196% while the Wilderhill clean energy index is down 75%. This is probably not what one would have expected.

We are not saying to ignore the elections; they have the chance of adding a lot of volatility to markets and injecting a good amount of uncertainty or surprises. And remember, markets usually don’t like surprises. Outside perhaps adding a bit toward volatility management, it is probably best not to meddle with your portfolio construction based on elections.

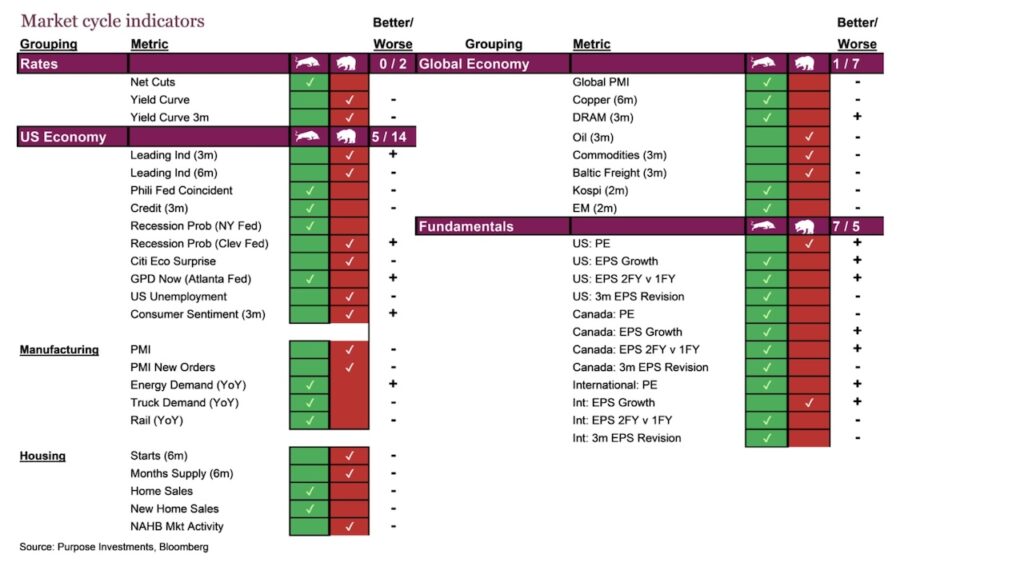

Market cycle

Market cycle indicators have remained decently on the bullish side, albeit with some softening during the past month, mainly in the U.S. economic data. Fundamentals remain encouraging. If we see a dramatic drop in more signals, that would contribute to potentially changing our mindset, but for now, this could simply be the start of a corrective phase.

From an asset allocation tilt perspective, we remain mildly or moderately defensive. We hold a bit more cash, a lot more bonds, and less equity. The bond allocation is more conservative with less credit exposure. Diversifiers are also focused on volatility management strategies. Our higher cash balance is considered dry powder, so if this does grow into a more interesting correction, we may be enticed to do some buying.

Final thoughts

If this does develop into a full-on correction, it might actually be a healthy development. The market was extended and overly concentrated. Some recalibrating could help with the longevity of the cycle. While we would expect economic recession talk to grow louder, so far, the data is only moderating. Given all the data, this looks more like we hit a pothole (albeit a big one) than a sinkhole.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.