The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- The S&P 500 Index and global stocks appear poised to post strong 1H24 gains

- Interest rates have steadied, and the US dollar has been calm ahead of the next round of corporate earnings

- Key interim data will be released before the US holiday that could offer further clues on the state of the consumer

And just like that, the end of next week marks the finish of the first half. What a wild ride it has been on the macro front. 2023 ended with a string of better-than-expected inflation reports, much to the delight of Chair Powell and the Federal Reserve. The tables turned, however, when the calendar flipped to 2024.

At one point early in Q1, nearly seven quarter-point rate cuts were priced into the Fed Funds futures market, a time when the US 10-year Treasury note yield was trading near 4%. However, three consecutive troubling CPI reports sent the bond bulls scurrying as the year pressed on.

The interest rates market seems to have found its footing after the last pair of CPI prints.

Big Bull Trends in Big Tech

In the stock market, despite many calls for a broadening out of the rally, the mega-cap AI theme reasserted its dominance following small caps’ surge over the back half of Q4 2023. Shares of NVIDIA (NVDA) rose big, then split 10-for-1, and jumped once again. Other semiconductor stocks took part in the boom. Taiwan Semiconductor (TSM), ASML (ASML), and 2023 IPO Arm Holdings (ARM) provided a global bull market in the chip space.

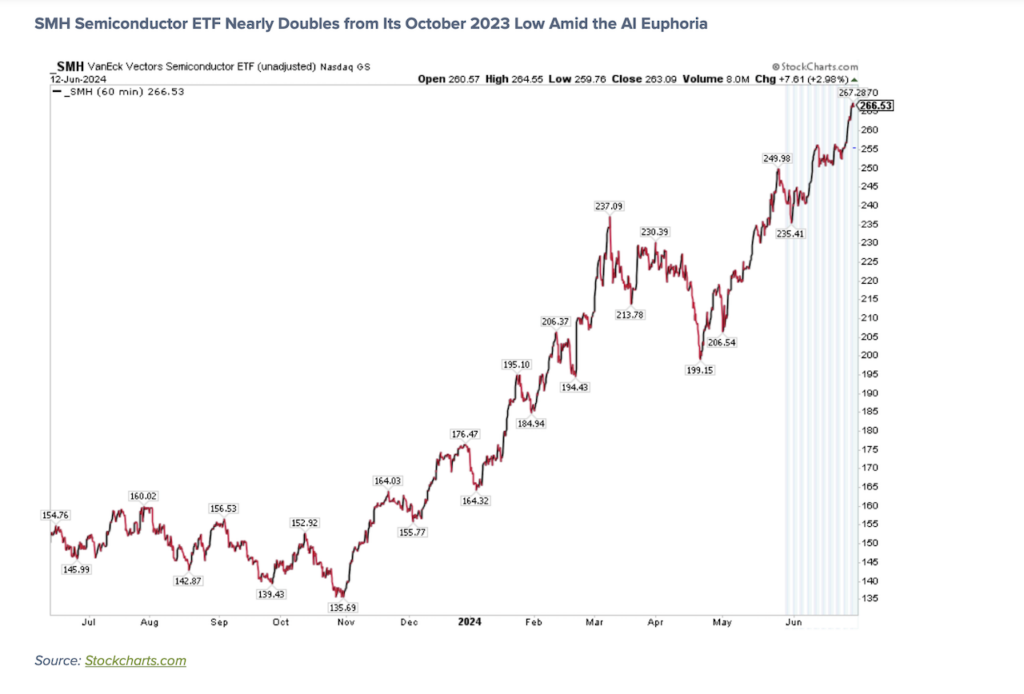

Then, after yet another NVIDIA blowout quarterly earnings report, the sometimes-overlooked AI picks-and-shovels company, Broadcom (AVGO), followed its rival’s suit, issuing a gangbuster Q1 profit report and announcing a 10:1 split. In all, the VanEck Semiconductor ETF (SMH) rallied nearly 100% from its October 2023 nadir through late June.

SMH Semiconductor ETF Nearly Doubles from Its October 2023 Low Amid the AI Euphoria

Earnings Growth Looks Firm

Bigger picture, corporate earnings growth outperformed during the first half. More than $250 of S&P 500 EPS is now the forecast over the next 12 months, with about $244 of current-year per-share operating profits and $277 of out-year EPS, according to FactSet.1 Traders have just three weeks to prep for the beginning of the Q2 earnings season when the big banks kick things off on Friday, July 12.

Where’s the Volatility?

While it has been an action-packed first half, what’s been conspicuously absent from the financial front page has been volatility. The VIX Index had just a lone spike above 20 during a short window in April when equities pared early-year gains.2 At least we got some excitement and wild price action in the meme stocks for a fleeting moment.

Low volatility in equities seemed to carry over into the currency markets as the US Dollar Index ranged from 102 to about 106 despite macro uncertainty around growth and inflation across many developed economies.3

Interim Data Ahead: Auto Sales and Production Figures for June

Be on the lookout for clues on the macro from individual companies in the coming days. Before the Independence Day holiday in the states, monthly sales and production results from the world’s biggest automakers hit the tape.

The first major set of interim data comes from Toyota Motor (TM), Honda Motor (HMC), Subaru Corp (7270.JP), and Mazda Motor (7261.JP). While there are no widely followed consensus expectations for the numbers, there’s optimism in the industry considering that US auto sales have been inching up, according to WARD’s Automotive.4

The second half begins with more monthly sales reports from the likes of Tata Motors (500570.IN), Li Auto (LI), and Hero MotoCorp (500182.IN) from the Chinese and Indian markets. For China’s EV companies, specifically, tensions appear to only be rising as both the US and European politicians threaten and impose new tariffs.5 It comes as the US election season heats up. If there’s one thing both Democrats and Republicans agree on, it’s a tough stance on China trade relations. We’ll find out what the rhetoric is at the first presidential debate Thursday next week.

Hopes for Solid Monthly Results from US Auto Companies

But it’s hard to stand in front of the freight train that is the American consumer. Ahead of the holiday, interim updates from the likes of General Motors (GM) and Tesla (TSLA) cross the wires and Ford (F) posts its June numbers on July 5, according to Wall Street Horizon’s data.

With the start of summer today, the shine has been on GM since late May. The stock revved to a 52-week high last week as the Detroit automaker announced a reduced outlook for 2024 EV production at an industry conference. CFO Paul Jacobsen provided color on stronger-than-expected vehicle pricing this year, helping to lift GM shares.6 Before the presentation, the company announced a new $6 billion share repurchase authorization and hiked its quarterly dividend.7

AI Spotlight: NVIDIA Shareholder Meeting

Before all that, the spotlight will be on what else but NVIDIA on June 26. That’s when the $3 trillion market cap chip designer hosts its annual shareholder meeting. While there are no imminent signs of big news to come from the event, the AI capex arms race is bigger than ever after a slew of developers’ events in the past month (from Alphabet, Microsoft, and Apple, among others). And with Elon Musk’s pay package punditry finally out of the way, NVIDIA’s shareholder gathering might be the final major Magnificent Seven event to make headlines.

The Bottom Line

As the first half wraps up, investors have plenty to be happy about. Both US and foreign stocks are solidly positive amid AI euphoria. Other industries, such as automakers, can point to encouraging data points too. Earnings season is already within sight, but investors and portfolio managers will have plenty of interim reports to parse through before then.

Sources:

1 Earnings Insight, FactSet John Butters, June 7, 2024, https://advantage.factset.com

2 Volatility Index, StockCharts, June 14, 2024, https://schrts.co

3 US Dollar, Stock Charts, June 17, 2024, https://schrts.co

4 Car Sales Very Strong, Apollo Academy, Torsten Sløk, June 10, 2024, https://www.apolloacademy.comy-strong/

5 Europe to Hit China With EV Tariffs That Its Own Automakers Oppose, The Wall Street Journal, William Boston, Kim Mackrael, June 12, 2024, https://www.wsj.com

6 GM lowers EV production targets amid slow demand, says EVs will show ‘variable profit’, Detroit Free Press, Jamie L. LaReau, June 11, 2024, https://www.freep.com

7 GM Board Approves New $6 Billion Stock Buyback, The Wall Street Journal, Mike Colias, Dean Seal, June 11, 2024, https://www.wsj.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.