The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Amid drama in the media and movie industries, this year’s box office revenue tracks below 2023’s pace

- Netflix continues to dominate while other players reshuffle their teams and strategies

- Life beyond markets and trading screens – we highlight the major movie releases this summer

It’s the unofficial kickoff to summer this weekend. Millions of Americans are expected to hit the road and fly the skies to enjoy warmer weather and get a break from the grind. We’ve seen just how popular many forms of in-person entertainment have been in the past year, so there’s reason for optimism on the consumption front.

Recall that about a year ago, the “Taylor Swift Effect” drove improved economic growth in certain regions (no joke, the Philadelphia Federal Reserve said as much), and strong ratings and ticket sales have been seen for other artists and in live sports.1 It doesn’t hurt that, as of this writing, a pair of New York professional sports teams are making playoff runs too.

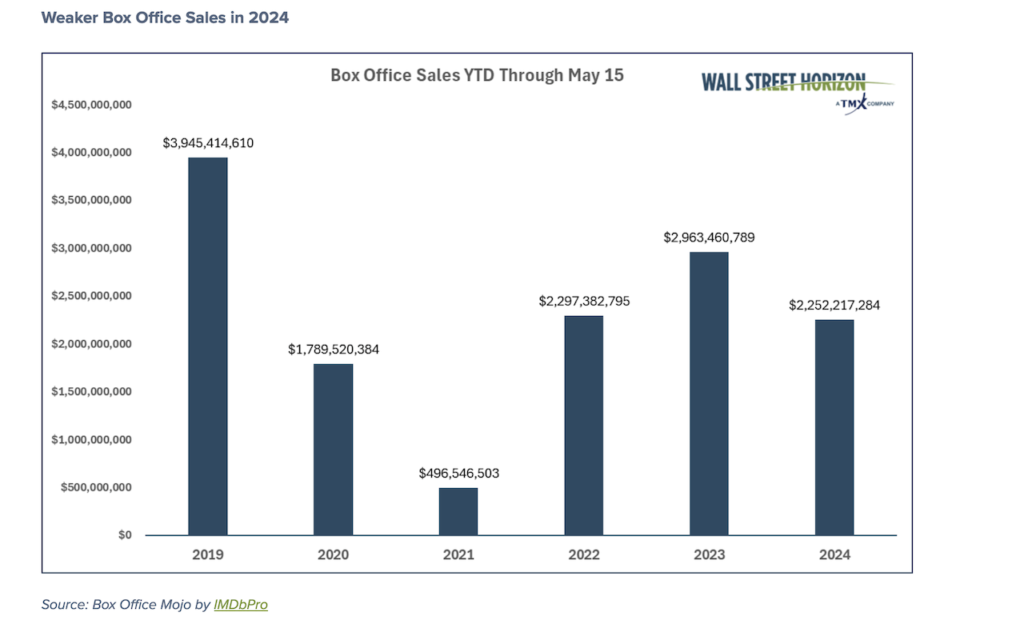

But not all entertainment venues have been welcoming boisterous crowds. So far in 2024, domestic gross box office sales are down 24% from year-ago levels through May 15, according to IMDbPro.2 It comes as Hollywood struggles to put out popular blockbusters and as continued drama in the media-enterprise space casts a dark cloud over out-of-the-house entertainment.

Weaker Box Office Sales in 2024

Bundle-Unbundle-Rebundle

Investors and casual observers alike have surely read and heard about the ongoing drama at Disney (DIS). All the while, families across the country have been forced to consider the steeply rising costs of subscription streaming services. Maybe just as frustrating for consumers, it seems the Movies and Entertainment industry is now pivoting from an à la carte sales model back to bundling, which has features of the old-school cable package.

Corporate Activity

There has been no break in the action this year with so many moving pieces and a reshuffling of the media playing field. It was just a handful of months ago when Lionsgate Studio spun off from Starz. The new entity, Lionsgate Studios Corp (LFG.A), focuses on film and TV. Then in May, shares of Paramount Global (PARA) fell on a report that Sony was “rethinking” its $26 billion bid for the company.3 The latest whisper is that Paramount and Amazon (AMZN) may partner up.4

Netflix Pounces on New Opportunities

Netflix, meanwhile, continues to venture further into sports, inking a 3-year deal with the NFL to stream a set of games each season.5 It also plans to launch an in-house advertising technology platform to further diversify its revenue sources.6 The Communication Services stalwart may not be grouped with the Magnificent Seven heavyweights, but shares are up more than 25% in 2024.7 Boasting a highly profitable ad-supported tier, with a total subscriber base of 40 million customers, up five million from a year ago, consumers just keep chillin’.8

2021 Social Media Favorites Come Roaring Back

And how can we not offer a nod to meme-stock mania Part III? Shares of GameStop (GME) and AMC (AMC) have gone bananas in recent weeks, all prompted by a single picture posted to X by @TheRoaringKitty earlier this month.9 Of course, the social-trading frenzy has little to do with fundamentals in the movie market, but the saga is worthy of sitting back with a bowl of popcorn and seeing what unfolds.

Feature Films

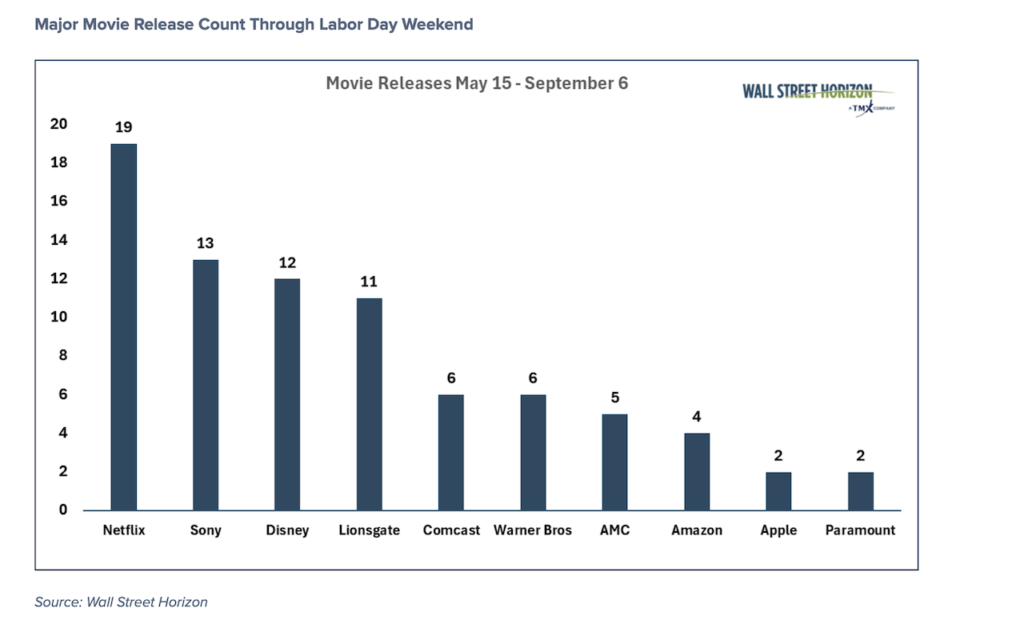

But let’s aim the spotlight at the movie scene as the summer months inch closer. Our data show that, as has become the norm, Netflix dominates the movie-release count from mid-May through the Labor Day weekend. Nineteen major motion pictures are slated to be released. Sony Pictures Studios is runner-up with 13 movies set to hit the domestic box office. Disney and Lionsgate also have several high-profile films in the cue.

Major Movie Release Count Through Labor Day Weekend

Conferences & Shareholder Meetings on Tap

On the event watch, following the JP Morgan 52nd Annual TMT Global Technology Media and Communications Conference this week, be on the lookout for potential volatility in the media space on May 30 when the Bernstein 40th Annual Strategic Decisions Conference (SDC) begins. Warner Bros Discovery (WBD), Paramount Global, AMC, and Netflix each hold annual shareholder meetings during the first full week of June. All eyes will then be on Apple (AAPL) when it holds its Worldwide Developers Conference (WWDC) on June 10.

Grab Your Popcorn – What to Watch This Summer

As for the box office, much depends on how the summer lineup performs. Here are the key motion pictures that analysts will watch closely and movie-goers can look forward to:

May 24: The Garfield Movie, Furiosa: A Mad Max Saga, Atlas

June 7: The Crow

June 14: Inside Out 2, Bad Boys 4

June 21: The Bikeriders

June 28: A Quiet Place: Day One, Horizon: An American Saga (Chapter 1)

July 3: Despicable Me 4

July 5: MaXXXine

July 12: Longlegs

July 19: Twisters

July 26: Deadpool & Wolverine

August 9: Borderlands

August 16: Horizon: An American Saga (Chapter 2), Alien: Romulus

August 30: Kraven the Hunter

September 6: Beetlejuice Beetlejuice

The Bottom Line

There’s been more drama and action scenes in movie stocks than on the big screen so far in 2024. The media space continues to go through shakeups both in the boardroom and with broad strategies. All the while, consumers may be growing increasingly frustrated with TV options, but data suggest that fewer folks are flocking to theaters for entertainment. All eyes will now be on Hollywood’s summer lineup.

Sources:

1 Summary of Economic Activity, Federal Reserve Bank of Philadelphia, June 2023, https://www.philadelphiafed.org

2 Box Office Mojo by IMDbPro, May 22, 2024, https://www.boxofficemojo.com/

3 Paramount shares fall after CNBC reports Sony rethinking its bid, Reuters, May 14, 2024, https://www.reuters.com

4 Paramount Holds Talks With Amazon About Expanded Partnership, Bloomberg, Thomas Buckley, Lucas Shaw, May 15, 2024, https://www.bloomberg.com

5 Netflix Nears Deal for NFL Games, Extending Push Into Sports, Bloomberg, Lucas Shaw, Randall Williams, May 15, 2024, https://www.bloomberg.com

6 Netflix To Launch In-House Advertising Tech Platform, Next TV, Jon Lafayette, May 15, 2024, https://www.nexttv.com

7 NFLX, Stockcharts, May 17, 2024, http://stockcharts.com

8 Netflix hits 40 million users for ad-supported plan, Reuters, May 16, 2024, https://www.reuters.com

9 TheRoaringKitty, X, May 12, 2024, https://x.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.