Following up with the more fun notion of dogecoin as written about yesterday, today we look at blockchain.

If you’re like me, you need to increase your understanding of why blockchain technology is a game changer in our evolving digital world.

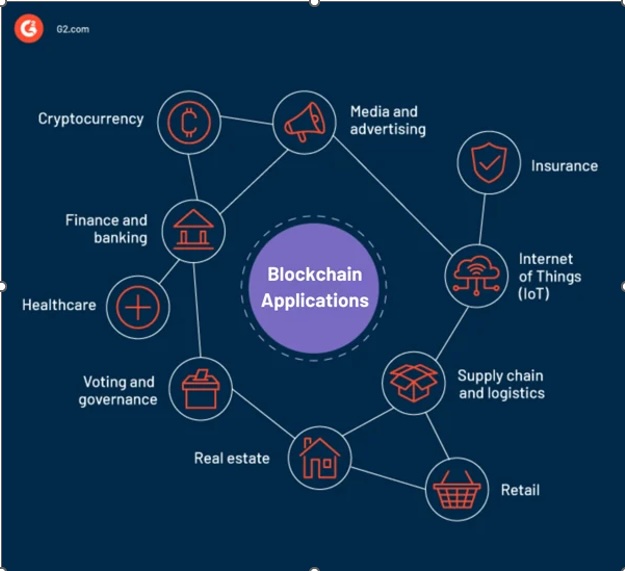

We all know that blockchain is most famously associated with cryptocurrencies, enabling secure and decentralized payments.

Here are a few more mainstream uses:

The main benefits of all the applications in these areas are greater efficiency, accuracy, transparency, and cost-savings.

However, it is not without its challenges.

- Scalability, as there are fixed block size limits.

- Energy consumption, as blocks consume substantial computational power.

- Speed, as in the processing speed is slower compared to traditional methods of transactions.

- Lack of universal standards, which can make navigating for developers more difficult.

Nonetheless, currently, we see most of the top mining companies not only underperforming the overall market, but also underperforming Bitcoin.

With a couple of exceptions.

When I checked a list of major mining companies, a few very recognizable names came up.

The first 2 names are Coinbase and Block (formerly known as Square).

The chart of Block shows a recent pop following the news or rumor of an ETF for Ethereum coming soon.

The Real Motion shows a bearish divergence as the price is above the 50-DMA but not the momentum.

Block is though, in a bullish phase and above the January 6-month calendar range high.

A move over 34.50 or a drop to around 27.50 look like the best parameters to watch for signs of buying.

With Coinbase COIN, there was an early in the day attempt to get the price to rise above the 50-DMA, but it did not hold.

COIN is starting to outperform SPY.

On Real Motion, COIN has yet to prove it can clear the moving averages and remains in a bearish divergence.

We have a position in COIN, full disclosure, and believe that the stock has huge potential to rise further in price.

As far as the other companies, only Microsoft has a strong technical chart,

IBM, PayPal, and FedEx are all on the list as well.

None of those companies have shown anything much in the way of performance.

Hence, like with all megatrends, timing on investments is everything.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.