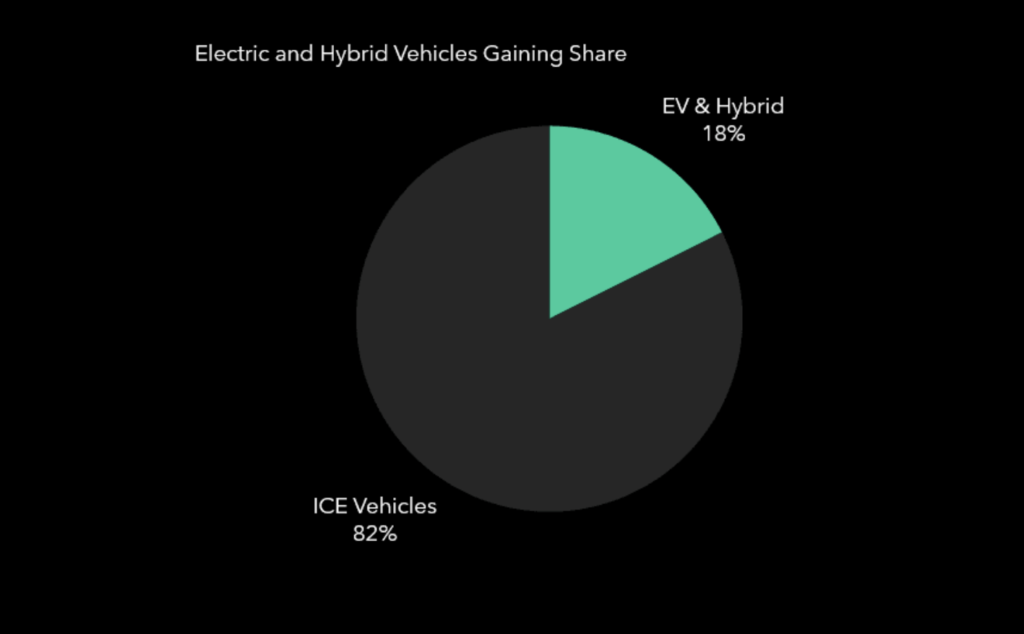

For starters, let’s review recent electric vehicle data:

- EV’s and Hybrids Taking Share: 17.6% of Ql sales hybrid or EVs.

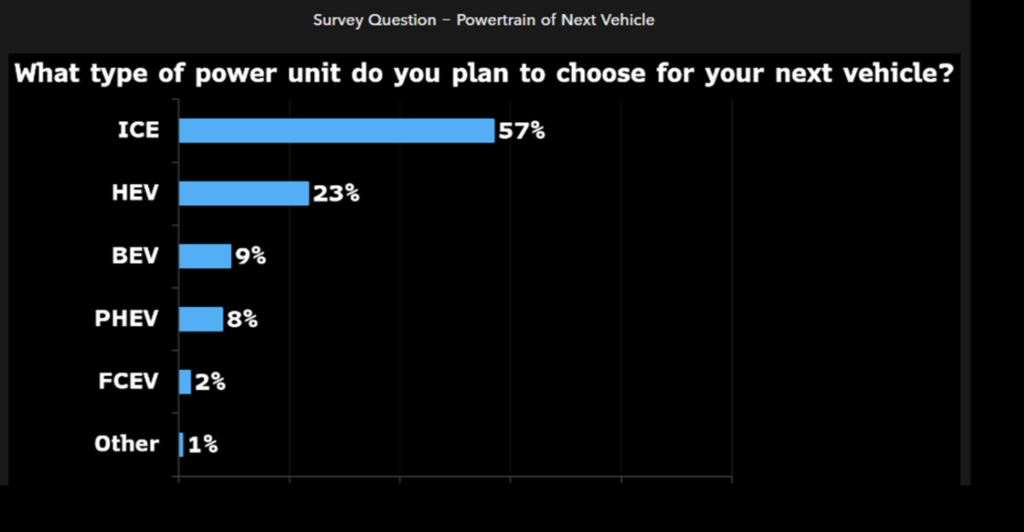

- Consumer Survey suggests Hybrids/EV Gaining Mindshare: 43% of consumers looking for hybrid or EV.

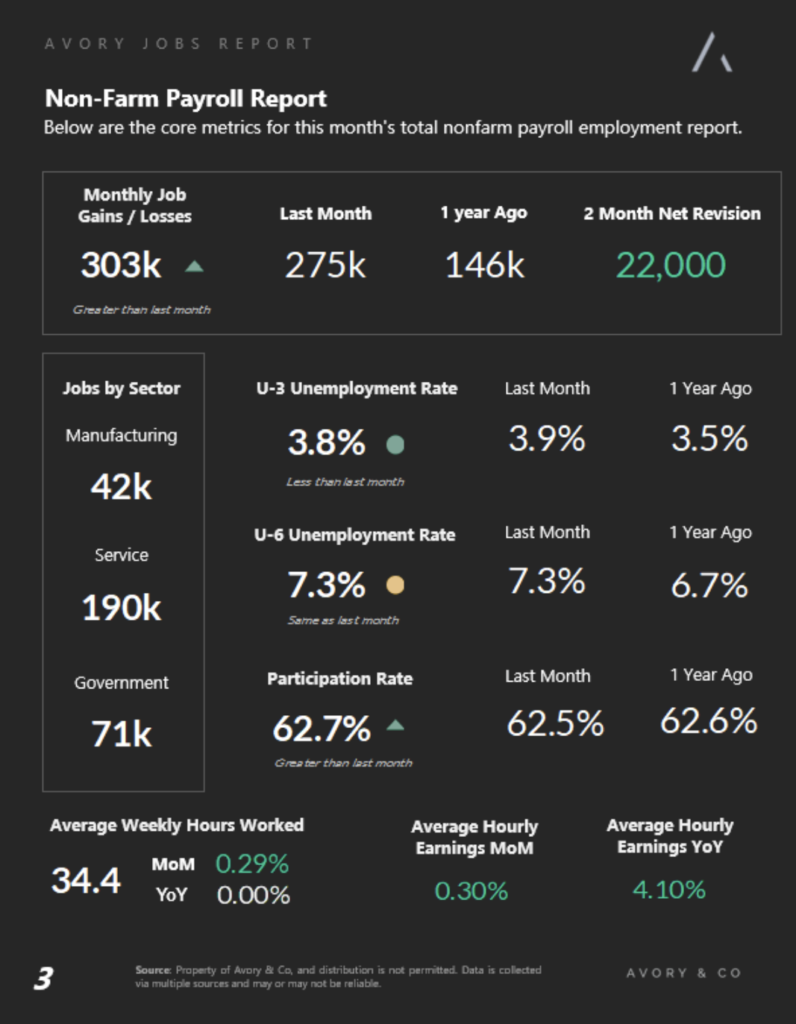

- Jobs Data Shows Resilience: 303K jobs added, wages 4.1%

The first data point: Q1 Vehicle Sales Showed Traction for Hybrids and Electric Vehicles

Why does this matter?

Q1 vehicle sales data released this week offers some encouraging signs for supporters of non-Internal Combustion Engine (ICE) vehicles. Notably, there’s significant variation in sales. Hybrids continue to show resilience, serving as a transitional solution towards fully electric vehicles. In Q1, electric and hybrid vehicles comprised 17.6% of total vehicle sales, with hybrids representing over half of this figure. The overarching question remains whether hybrids will maintain their lead or if Electric Vehicles (EVs) will gradually gain more market share. The next data point will shed more light on this.

The second data point: 43% of Surveyed Consumers Plan to Buy Non ICE Vehicle

Why does this data point matter?

Now, the question arises: Will Internal Combustion Engine (ICE) vehicles maintain their demand moving forward? A recent survey suggests a continued shift towards non-ICE vehicles. The survey, which inquires about the preferences of current car owners for their next vehicle, reveals that 43% intend to purchase an electric vehicle or a hybrid variant. However, echoing the previous data point, hybrids continue to emerge as a prevailing choice.

The third data point: Job Growth Remains Firm with Wages Moderating

Why does this data point matter?

Strong jobs data came out this morning, indicating the addition of 303,000 jobs last month, further affirming the economy’s solid foundation. However, when considering its implications for inflation, there are nuances to think about forsure. While jobs growth was robust, it was predominantly driven by the healthcare and education sectors. Additionally, the participation rate increased, while wage growth decelerated, suggesting some slack in the labor market.

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.