This week, the spotlight was on Nvidia (stock ticker: NVDA), along with several of the companies we like delivering impressive financial results by striking a balance between profitability and growth.

Nvidia’s focus centered on their communicated outlook and the status of demand backlog. As anticipated, they exceeded revenue expectations yet again, surpassing estimates by $2B for the 3rd consecutive quarter. The only hint of weakness was the revenue beat was a slightly lower percentage compared to the previous two quarters. This positive news extends beyond Nvidia, signaling a broader shift in technology spending.

After a period of cautious optimization due to recessionary concerns, CFOs seem to be opening their wallets to capitalize on emerging opportunities.

Data Point #1

Power of Subscription and Cohort Analysis via Wix Earnings

Why does this data matter?

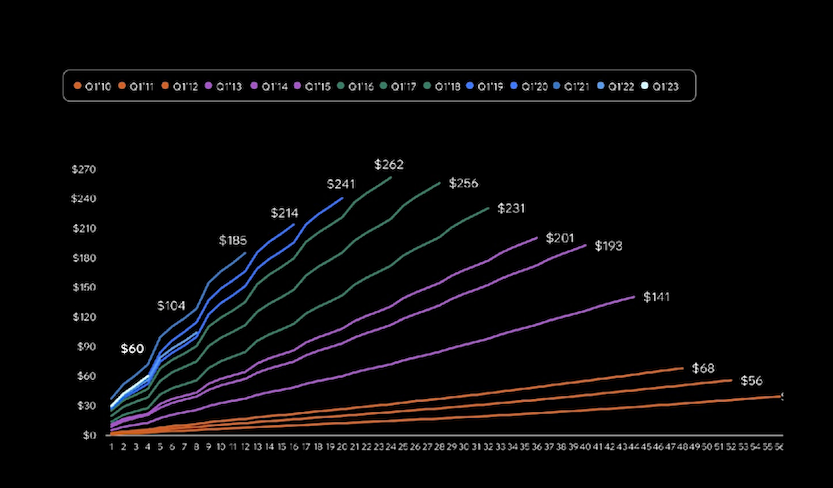

Wix’s earnings report this week showcased robust performance, reinforcing its position as a holding in Avory’s portfolio (my investment company). Wix continues to benefit from two main things:

Secular Demand for Online Presence: The need for businesses to establish and maintain an online presence remains a powerful and enduring trend.

Rise of Low-Code/No-Code Solutions: Wix’s intuitive platform caters to the growing demand for user-friendly website creation tools, empowering individuals and businesses with limited technical expertise.

The chart illustrates the compounding effect of customer cohorts over time. Each line represents the revenue generated by customers acquired during a specific quarter, with the bottom orange line representing Q1 2010 acquisitions and their current spending levels. Two key observations emerge from the chart: 1) Wix’s product enhancements have led to higher initial revenue from customers, with consistent growth in spending over time; 2) The most recent quarter marked the second strongest start in company history. This underscores the efficacy of Wix’s subscription model, which exhibits clear customer behavior trends over time. Similar success stories can be seen in recent earnings reports from companies like Fiverr and Block, both of which are investments we anticipate to eventually mirror Wix’s recent valuation rise.

Data Point #2

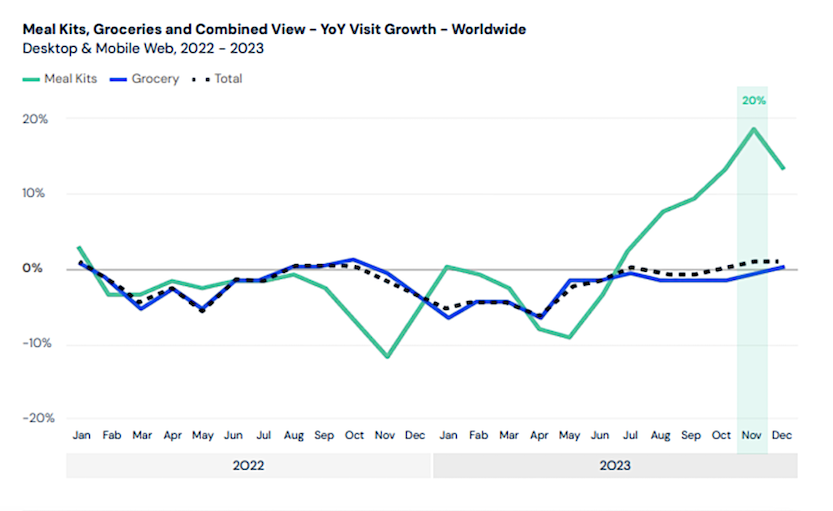

Meals Kits are Back… Data Shows Massive Inflection

Why does this data matter?

This is just the data, but it is very supportive of meal kit demand vs traditional grocery. Here we are tracking visits to meal kit sites vs traditional grocery. These have generally moved in lockstep over time, however, the growth rates separated rapidly at the end of 2023. While this shift in consumer behavior may be a recent occurrence and not necessarily indicative of a long-term structural change, it’s pretty noteworthy. We’ll continue monitoring this trend closely for any further insights and bring it back up one way or another.

Data Point #3

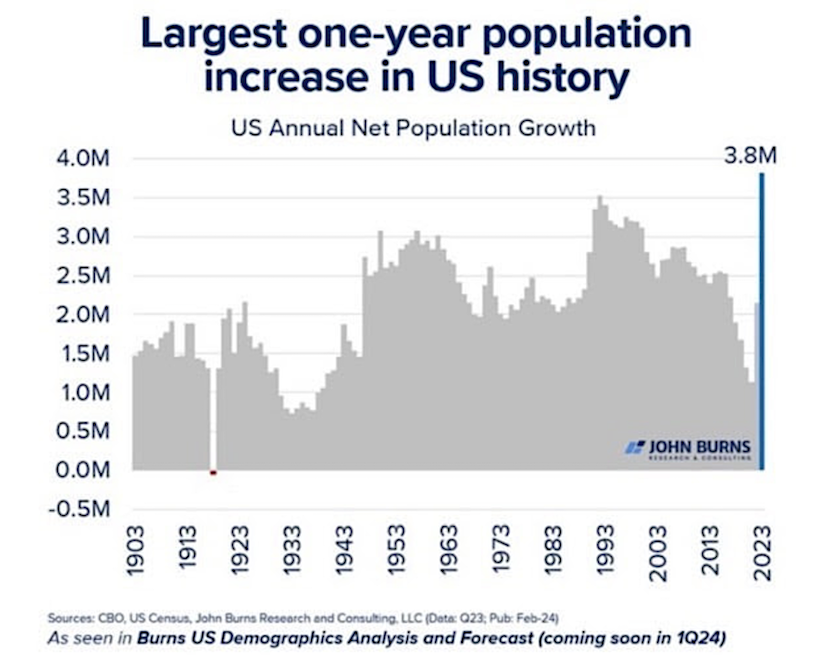

Population Growth Tends to = Economic Growth

Why does this data matter?

Periodically, we revisit the framework for economic growth, which simply boils down to this equation: more people + more productive people + debt = growth. This equation has historically held true, as evidenced by the economic expansions of the 1980s and 1990s. Recent data indicates one of the most robust periods of population growth in quite some time. While there are intricacies to why population growth surged post-pandemic, the key takeaway for us is that this demographic shift will be a tailwind to economic activity in the years ahead. I do not think enough people know this!

Twitter: @_SeanDavid

The author and/or his firm have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.