The essence of ‘Thematic-focused investing’ is, at its core, a really good idea. There is no denying the world changes over time, and often there are long-term tectonic shifts.

In years past, we have all witnessed the rise of smart phones, the rise of cloud computing, health care spending due to advances in solutions, and aging populations. Identifying these trends isn’t that difficult; they become increasingly evident as society evolves and behaviours change demand patterns.

More recent themes include such things as eGaming, cyber security, AI or the rise of electric vehicles (EVs). Securing electronic data, in an increasingly electronic world, remains a top priority for people, companies and governments. Demand to secure data from unsavoury characters is something that will likely continue to grow faster than the overall economy for many years to come. And, demand for EVs, which continue to gain market share among total vehicles sold, is forecast to continue for many years, if not decades.

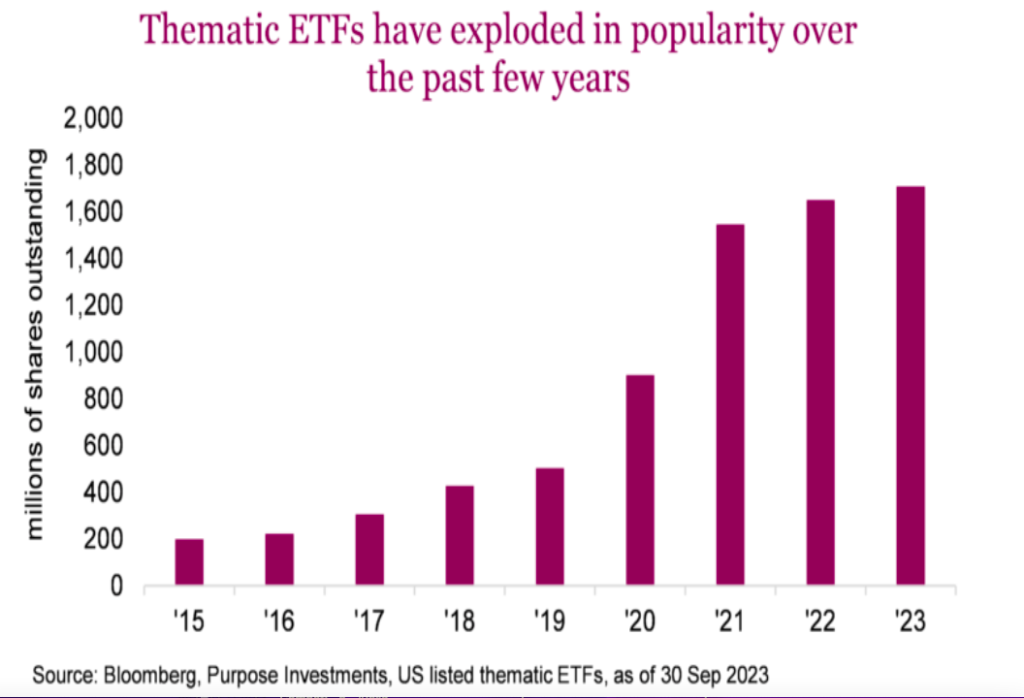

Naturally, an ETF or fund that attempts to capture one of these faster-growing or exciting themes can be a good idea. And investors agree – if you measure agreement by the inflows into thematic ETFs. The previous chart shows the number of shares outstanding in thematic ETFs, which has exploded over the past few years. We use shares outstanding instead of market value as this avoids the impact of changing market prices. Even in the past couple years, (which have been more of a risk-off environment for investor appetites), thematics have increased.

There is of course a ‘but’ … there are some hurdles investors face with investing in these high-growth, potential thematic ETFs.

1) Which one(s) to invest in?

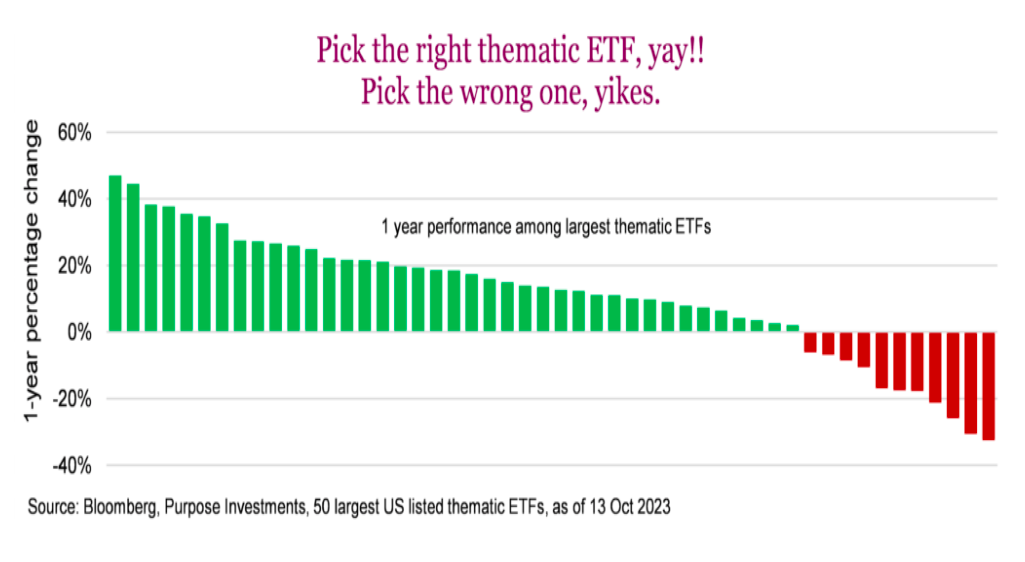

To put it plainly, thematic ETFs can offer outsized returns, but they can also offer outsized losses. The variability or disparity of performance is massive. If you are buying a Canadian bank and you pick the wrong one, unfortunate, but the disparity is low, so not too much of an issue. Pick the wrong theme, yikes. What if you chose the ‘marijuana theme’? Tough times of late. More optimistically, if you picked AI, you won.

The chart above is the 50 largest thematic ETFs listed in the U.S., showing the 1-year price change. Yes, you are reading the chart correctly, that is from +47% to -32%. Even those poor-performing themes are still enjoying a long-term growth trend in their industry. But investor appetite is a fickle thing – it can change a lot from one year to the next. Or a theme can experience a headwind of some sort or another, such as changing legislation.

Pick the right one, you win. Pick the wrong one, you lose. Even some of the poorest performing thematics over the past year are still focused on a theme that has great prospects. Some are down simply because they went up way too far the previous year. Picking who will win in the next year? Now that is challenging.

2) The lure of performance chasing

While performance chasing is evident in all kinds of investing, it is very evident in the thematic space. An artificial intelligence (AI) ETF is one of the big green bars on the left of the previous chart. It’s up about 40% over the past year, with all that gain reached by the end of May this year. In other words, flat over the past five months. At the end of May there were 9 million shares outstanding for this ETF, today there are 24 million. In simple terms, most of the money in that ETF came in after its gains.

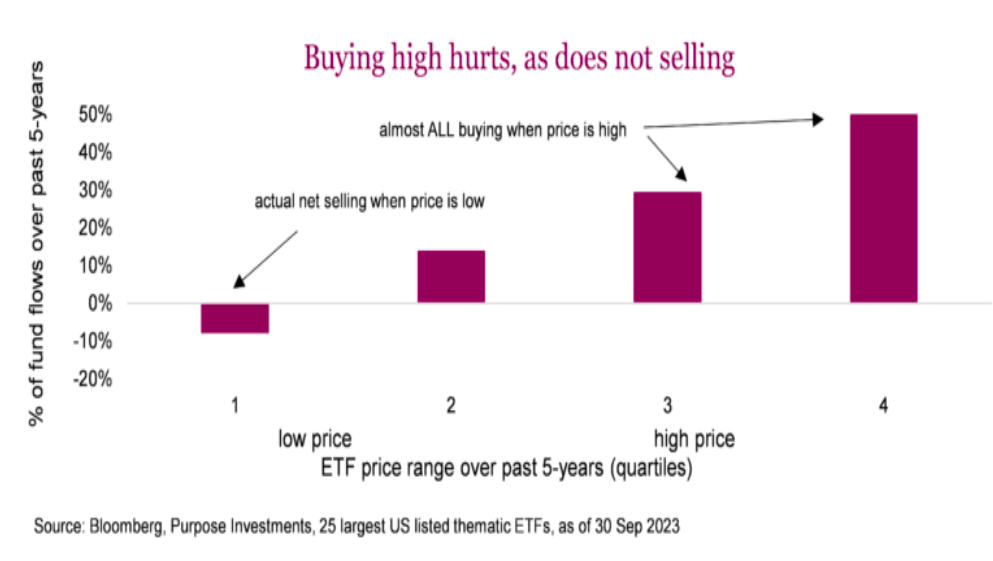

To further show this performance chasing, we broke down thematic ETFs price range into four equal buckets (quartiles). Quartile 1 was the lowest, 25% of prices over the past 5 years. Quartile 2 was the next 25%, still below average but not as cheap. Quartile 3 is above average and Quartile 4 is the most expensive. We then measured ETF flows during these four price ranges.

Guess what? The vast majority of inflows from investors occurred during the more expensive price ranges. In fact, during the cheapest quartile, there were outflows. Buy high, sell low has never been a viable long-term strategy.

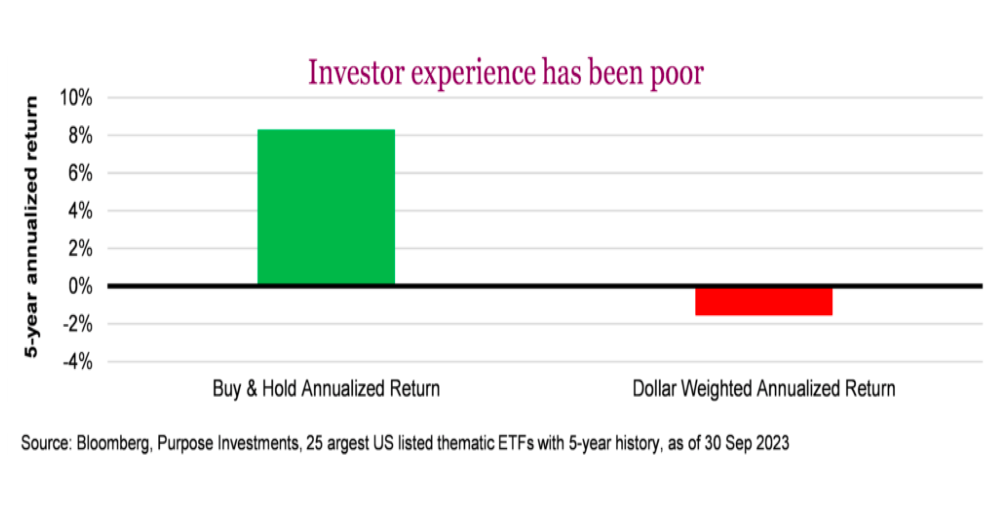

With the same universe of thematic ETFs, we measured the actual return experienced by investors using money- weighted returns, comparing this dollar-weighted return to if an investor had simply held the ETF all along. More evidence that the average investor has had a tough go with thematic ETFs.

3) No sell discipline

Contributing to the previous evidence of poor timing is an apparent lack of sell discipline. Even thematic ETFs that have seen their share price fall 40, 50 or even 80% over the past few years, have seen very few sells. One of the largest thematic ETFs in the U.S. is down 75% since early 2021 and still has about the same number of shares outstanding. Congrats for being a stable investor and sticking with your conviction. Unfortunately, those investments are now worth a lot less.

The challenge is if you believe in the long-term theme, why would you sell? Yes, 50% of cars sold in 2035 may very well be EVs so just stick with the EV thematic ETF and ride out the peaks and troughs. But what if the composition of the ETF doesn’t capture the theme as the companies involved change over time? Most auto manufacturers now sell EVs; clearly not pure plays like in years past when it was just one or two new companies making EVs. One of the biggest EV ETFs was up 62% in 2020, up 28% in 2021 and down 34% in 2022. Yet the theme continues its path.

Unfortunately, you can’t use valuations as a sell signal. Many times the underlying thematic companies are very expensive to begin with, can become even more expensive and if they fall 50%, may still be expensive.

A lack of sell discipline and stubborn attachment to thematic ideas has caused many investors to take the full ride, up and down. Sometimes more down than up.

Final thoughts

Thematic ETFs can offer a growth boost for portfolios. Plus, given the composition of the TSX and its lack of growth (lots of dividends, not as much growth), many Canadian investor portfolios are light on the growth factor. And there are many options available, covering many different themes from many different ETF providers that could actually experience a positive tailwind for many years. But the data clearly points out that picking a theme or two, or five, and jumping onboard may not be the best path. The intention of this report is not to dissuade you from thematic investing – far from it. Rather, we highlight the importance of proper discipline and diligence to avoid performance chasing. Keeping the risks outlined above in mind and having a disciplined strategy in place should be considered when going down the path of thematic investing.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.