The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- The LERI shows corporate uncertainty increasing to its highest level since the pandemic, in line with what bank CEOs have been sharing on Q3 calls

- This week 460 companies are expected to report for Q3, 55 from the S&P 500

- Potential Surprises this week: Discover Financial Services (DFS)

- Peak weeks for Q3 season run from October 23 – November 10

Big Banks Seem Resilient, but Worries Still Pervade

Third quarter earnings season is off and running, and a few big banks set the tone when they reported on Friday. JPMorgan Chase (JPM), Citigroup (C) and Wells Fargo (WFC) all beat top and bottom-line estimates, but despite robust results some of the commentary was cautionary.¹

Higher interest rates continued to be a tailwind for banks in the third quarter, with increased net interest income making loans more profitable and helping boost the bottom-line. In addition, the consumer has been surprisingly resilient despite these higher rates. There are signs that is starting to change, however.

While higher net interest income has propped up banks this year, that is now being offset by the increased amount banks are having to pay for deposits as customers opt for higher-yielding instruments. Rising yields also cause the bonds owned by banks to fall in price. And although the consumer has kept up, there are signs that higher borrowing costs are starting to impact demand for mortgage and business loans as well as customers’ ability to repay credit card loans as seen by increasing delinquency rates and decreased overall savings.

These headwinds, along with geopolitical concerns made for some worrisome comments from bank CEOs. Possibly no more publicized than remarks from JPM CEO Jamie Dimon who commented “The war in Ukraine compounded by last week’s attacks on Israel may have far-reaching impacts on energy and food markets, global trade, and geopolitical relationships.” He went on to say, “This may be the most dangerous time the world has seen in decades. While we hope for the best, we prepare the firm for a broad range of outcomes.”²

Additional warnings came from Citigroup’s CEO, Jane Fraser who remarked that “All of these macro dynamics have clearly impacted client sentiment,” as well as CEO sentiment saying she is “struck by how consistently CEOs are less optimistic about 2024 than a few months ago.” More on that in a minute as our proprietary Late Earnings Report Index (LERI) is suggesting the same.

With only 6% of the S&P 500 reporting at this point, and 84% beating EPS expectations, the overall blended EPS growth rate improved to 0.4% from -0.3% the week prior.³ This would be the highest growth rate in a year. Leading sectors this quarter include Communication Services and Consumer Discretionary while Energy and Materials are expected to be laggards.

It’s Official – US CEOs the Most Uncertain They’ve Been Since the COVID-19 Pandemic

Similar to some of the commentary we heard on Friday (October 13), the official pre-peak reading of the Late Earnings Report Index (LERI) released on that day also showed that CEOs continue to be hesitant ahead of the third quarter earnings season.

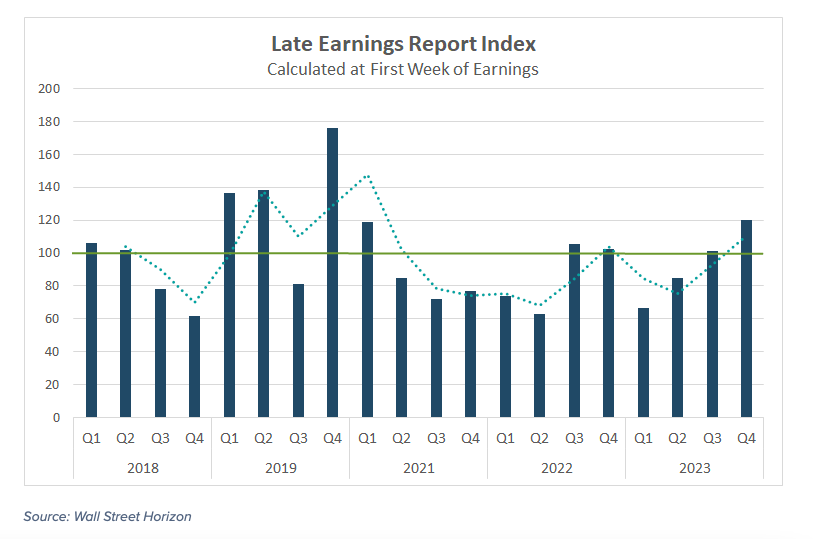

The Late Earnings Report Index tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The current pre-peak season LERI reading stands at 120, the highest reading since the COVID-19 pandemic. As of October 13, there were 65 late outliers and 49 early outliers. Typically, the number of late outliers trends upwards as earnings season continues, indicating that the LERI is poised to get even worse from here as corporations are increasingly more worried heading into the second half of the year.

Earnings on Deck – Week of Oct 16, 2023

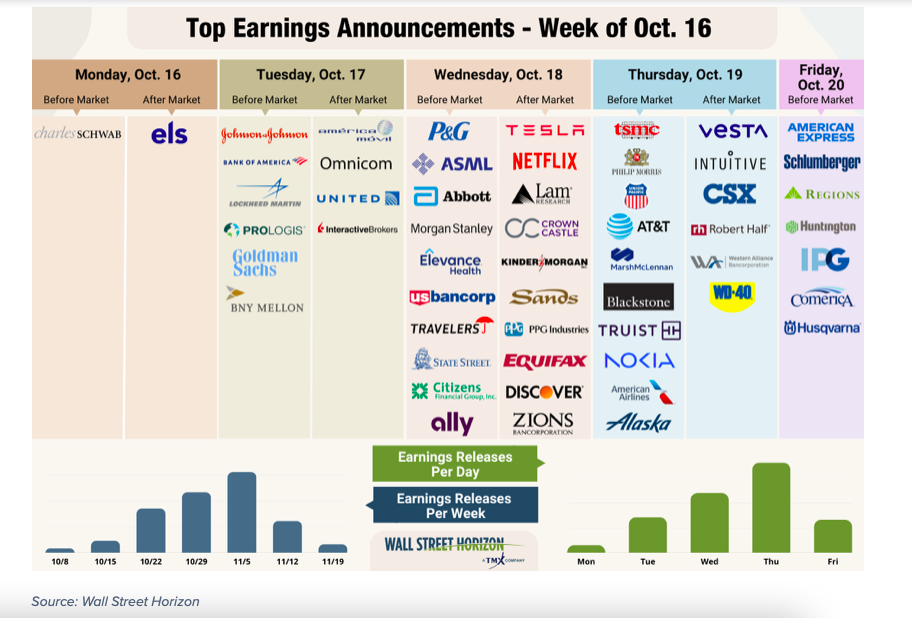

This week we continue to look out for results from big banks such as Bank of America, Goldman Sachs and Morgan Stanley on Tuesday and Wednesday, as well as cult favorites Tesla and Netflix which are out Wednesday after-the-bell. Peak earnings season doesn’t begin until next week, but there are still 460 companies reporting results this week, 55 from the S&P 500. This is in addition to several other important investor conferences and events happening this week where public companies will be sharing their views on current macroeconomic and industry headwinds.

Potential Surprises This Week

Discover Financial Services (DFS)

Company Confirmed Report Date: Wednesday, October 18, BMO

Projected Report Date (based on historical data): Monday, October 23, BMO

DateBreaks Factor: 2*

Discover Financial Services is set to report Q3 2023 results on Wednesday, October 18. This is five days earlier than expected, and also the first time the regional bank has reported Q3 results in the 42nd week of the year (WoY), typically favoring the 43rd or 44th WoY.

Academic research shows when a corporation reports earnings earlier than they have historically, it typically signals good news to come on the conference call. Just as the other banks have reported thus far, DFS is also expected to benefit from increased net interest income which is the main contributor to their top-line. In addition, the Payment Services division is likely to have seen a boost due to increased debit transaction volumes and expenditures.

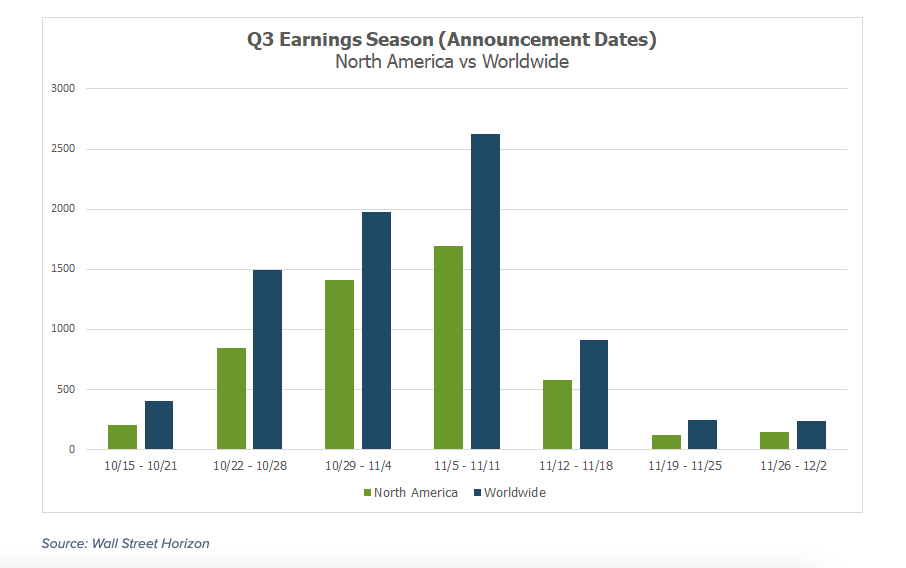

Q3 Earnings Wave

This season peak weeks will fall between October 23 – November 10, with each week expected to see nearly 2,000 reports or more. Currently November 9 is predicted to be the most active day with 1,151 companies anticipated to report. Thus far 53% of companies have confirmed their earnings date (out of our universe of 9,500+ global names), with 2% reporting. The remaining dates are estimated based on historical reporting data.

Sources:

1 Using analyst data from FactSet

2 https://www.jpmorganchase.com

3 https://advantage.factset.com

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.