Following up on our August post about treasury bonds, the market has made a minor new low as expected. Now the pattern becomes more risky for bears, while bulls might have begun watching for an entry.

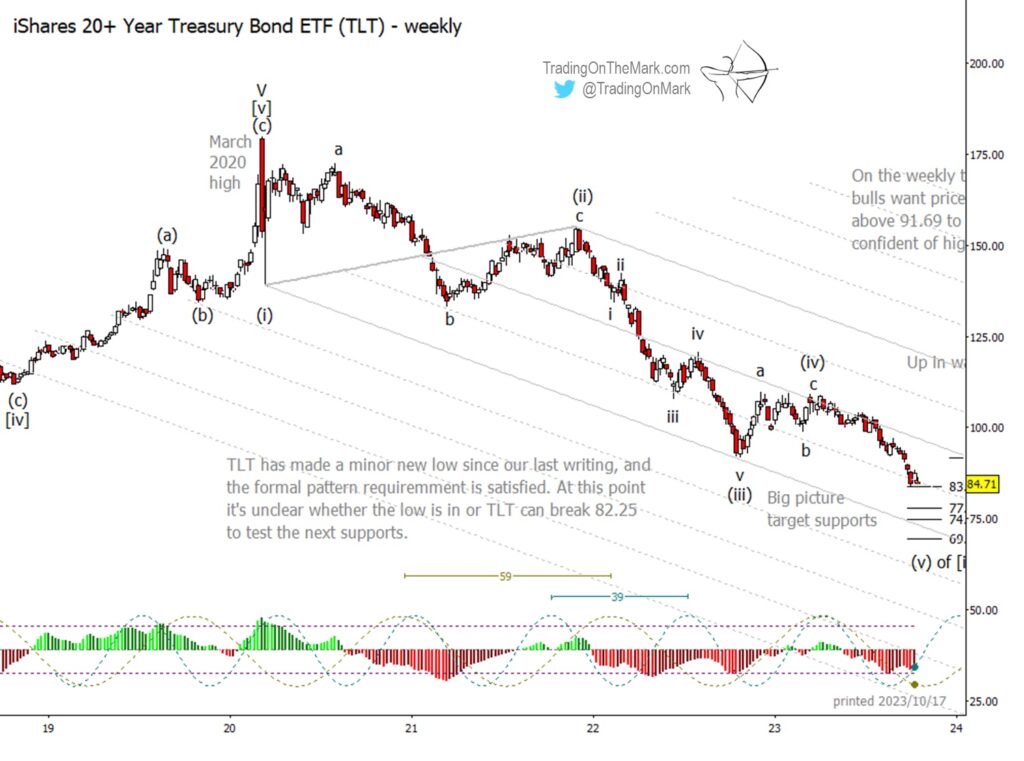

Looking again at the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT), we see that price is testing the Fibonacci-derived support zone at 83.95 to 82.25. It’s quite possible the pattern could extend lower, and there are additional big-picture supports at 77.84, 74.95 and the area from 69.60 to 69.18. However the formal requirements have been met for completion of the downward impulse that began in 2020.

On a slow trading time frame, bulls would like to see a weekly close above 91.69 in order to be reasonably confident the market can climb away from the low.

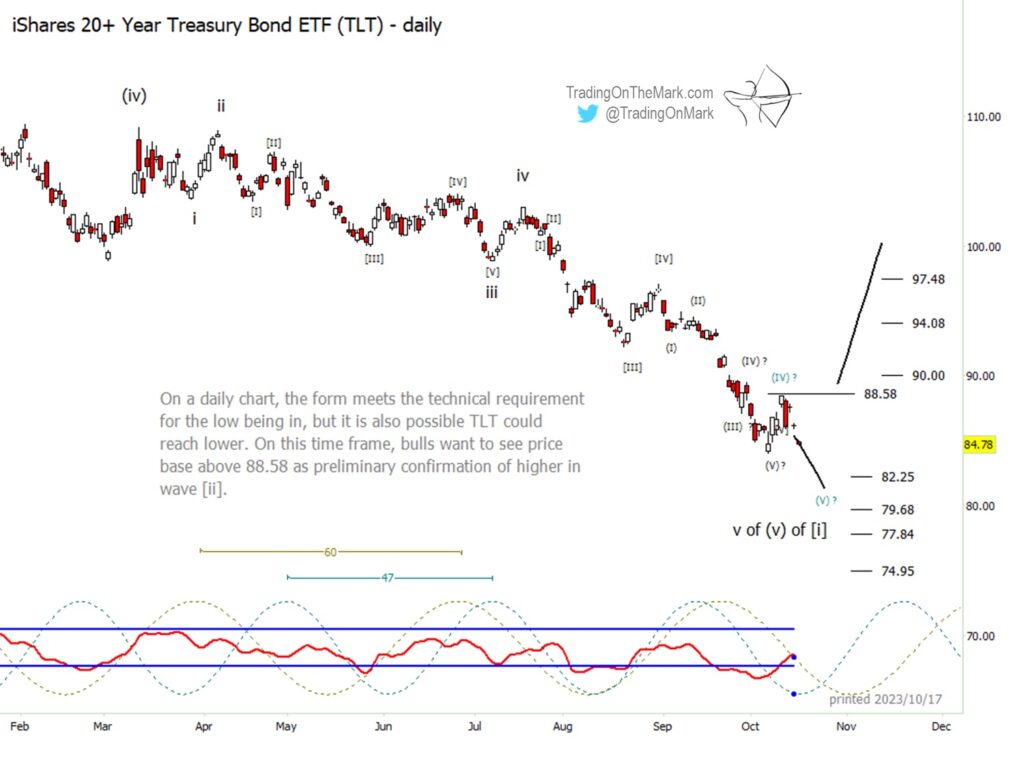

Zooming in with a daily chart, we believe the pattern down from wave (iv) has consisted of an impulse that just keeps extending. Is the final wave [V] of ‘v’ of (v) of [i] complete yet? The wave count can be interpreted either way.

If price continues extending downward, then the most relevant supports on a daily time frame mostly match the ones shown on the weekly chart above. There is additional minor support at 79.68.

For traders working on a daily time frame or faster, a break and daily close above the Fibonacci-derived price level at 88.58 would lend initial confirmation to the bullish case. Cycles suggest that could happen somewhere between late October and mid-November.Trading On The Mark uses technical analysis to identify the trends and turns in highly traded markets for commodities, energy, currency, bonds and indices. Visit our website for more charts, and follow Trading On The Mark for updates and special offers.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.