As bond yields and interest rates rise, bond prices fall. Pretty simple.

And this has been happening for a while now, forcing one of the most popular bond ETFs into a brutal bear market.

Back in July, I wrote an article that asked, “Will Treasury Bonds Ever Be A Buy Again?“

Yes, it’s been that bad. And although we are getting long in the tooth for a formidable bounce, the landscape has changed. The long-term trend is now higher. Today, we provide an update below.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

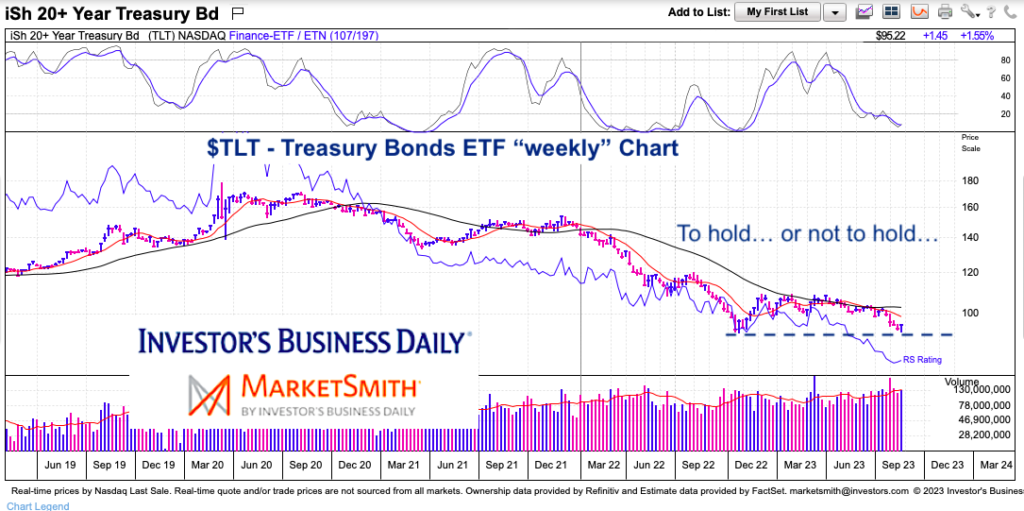

$TLT 20+ Year Treasury Bonds ETF “weekly” Chart

On the longer-term “weekly” chart we can see that we are getting oversold again. Will it take one more leg lower (and breach of support) before we get a multi week/month rally? Or will support hold and product a nice rally?

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.