The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- Macro factors have weighed on corporate dealmaking, but we spot some potential bellwether transactions across sectors

- From wrestling rings to steakhouse tables, consolidation trends offer some shareholder excitement and savory value creation

- As interest rates stabilize, equity volatility eases, and earnings inflect higher, the second half could feature more M&A

Capital markets have been cruddy lately. Higher interest rates and stubbornly elevated volatility in the fixed-income market have done little to instill confidence among corporate executives looking to make strategic financial moves. M&A activity has been soft, but there are a handful of intriguing deals that our team has spotted. Bigger picture, traders and macro strategists are on the lookout for clues of a rebound in dealmaking in the latter half of 2023.

More Capital Market Clarity

And that might very well happen. Consider that the Fed is expected to hike rates perhaps just once more and corporate profits have verified much better than expectations lately. That backdrop is favorable for CEOs and CFOs to sharpen their financial engineering tools to get back out on the M&A hunt. Another sanguine signal? Equity volatility is down big. Last week, the VIX settled at its lowest level since February 2020. Keep in mind that it’s both the cost of equity and the cost of debt financing that matter when making key capital allocation decisions. Softer stock price swings and even some loftier valuations today versus Q4 last year might make equity deals a bit more common.

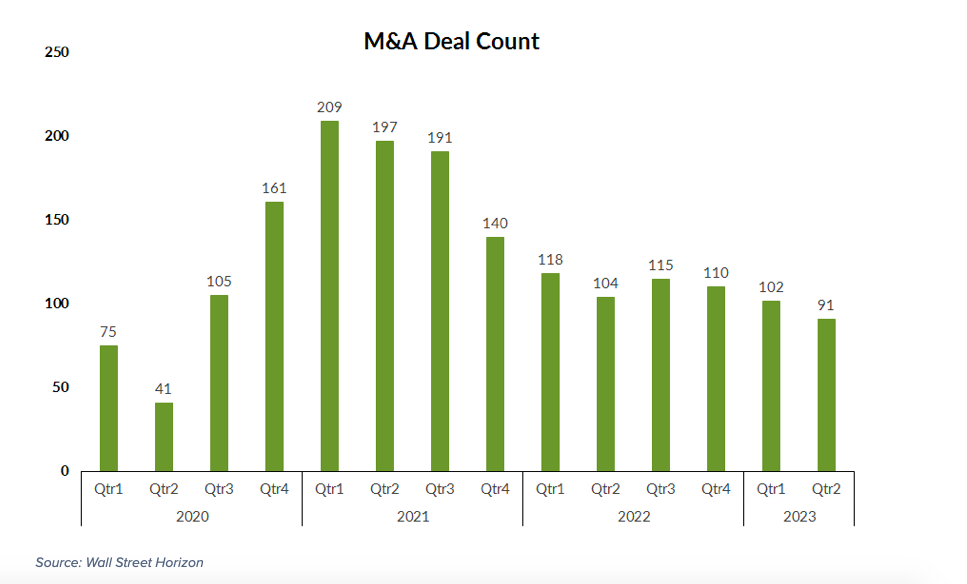

Less M&A, But Monitoring a Q2 Pickup as June Progresses

Q2 M&A Review

Let’s dig into a few transactions that could portend a second-half pickup in corporate moves.

Corporate Cage Match

The Q2 M&A curtain opened with a smackdown. Vince McMahon’s World Wrestling Entertainment (WWE) announced a partnership with Endeavor Group Holdings (EDR). The new, publicly listed company joining two iconic global sports and entertainment brands, UFC and WWE, will be a $21 billion tag team. Endeavor will hold a 51% controlling interest in the new enterprise while WWE shareholders will own 49%. The stipulations of the partnership include all existing WWE equity being rolled up into the new entity that will be the parent of UFC and WWE, which will eventually boast the “TKO” ticker, according to WWE. This is actually an important move. Here’s why: content spending is uncertain right now and so many players in the space. With a very mixed earnings situation among media companies, we could see more industry consolidation beyond the ring.

A Prime Acquisition

Turning from wrestling main events to a dinnertime main dish, steak aficionados might have been concerned about a deal inked on May 3. Darden Restaurants (DRI) announced its plans to acquire Ruth’s Hospitality Group (RUTH), owner of Ruth’s Chris. While technically a merger, DRI will commence a tender offer to acquire all outstanding shares of RUTH for $21.50 per share in an all-cash transaction. The total equity value of the transaction is $715 million, per Darden. As DRI steaks its claim, restaurant stocks face mounting pressure. Consumer spending on services is robust at the moment, but as inflation in so-called “food away from home” outpaces grocery inflation for the first time in years, the industry might have to produce new recipes for growth.

Golden Opportunities and Fueling the Future

Lastly, there has been activity in the resource space, too. The Energy and Materials sectors enjoyed rising commodity prices during the first half of last year, but 2023 has been a different story so far. With the broad commodity index sinking to 52-week lows in May, and oil straddling the $70 market after trading north of $120 per barrel 12 months ago, there are deals to be had.

Back on May 14, Newmont Corp (NEM), the biggest global gold miner, agreed to acquire Newcrest Mining (NCM.AU) in a stock deal that features a special dividend to be paid by Newcrest. The acquisition represented a more than 30% premium to the acquiree’s value before the transaction. The Materials merger is expected to be highly accretive for Newmont shareholders with significant synergies on the cost side of the ledger. Newmont could use a boost as the stock is 50% off its 2022 peak and not far from 52-week lows even with spot gold hovering near $2,000 per ounce.

Also on the 14th of last month, ONEOK (OKE) and Magellan Midstream Partners (MMP) announced a definitive merger agreement in which OKE would acquire all MMP shares in a cash-and-stock deal valued at nearly $19 billion. The resulting combined-company total enterprise value is $60 billion. This one sent shockwaves across the Energy sector. With stable oil prices and natural gas that have dipped from nearly $10 last summer back down to $2 per MMBtu, oil & gas M&A could pick up as larger would-be acquirers seek to fuel their profitability for the next economic upcycle.

That potential trend was underscored later in the month. Integrated oil giant Chevron (CVX) is buying up all shares of PDC Energy (PDCE) in an all-stock acquisition. While the shale space is perhaps no longer aptly described as “booming,” the more mature market remains active. Chevron expects annual free cash flow of $1 billion from the oily purchase.

The Bottom Line

Wall Street dealmaking peaked in early 2021. Speculative fervor reached its climax more than two years ago, but stricter lending standards and less liquidity today foster a far different financing environment. Still, we are watching for a possible M&A increase as the year wears on considering some improving macro conditions.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.