Tuesday’s trading update was all about precious metals.

And come Wednesday, gold, the miners, and silver all rallied.

Is the bottom in on this last correction? Perhaps.

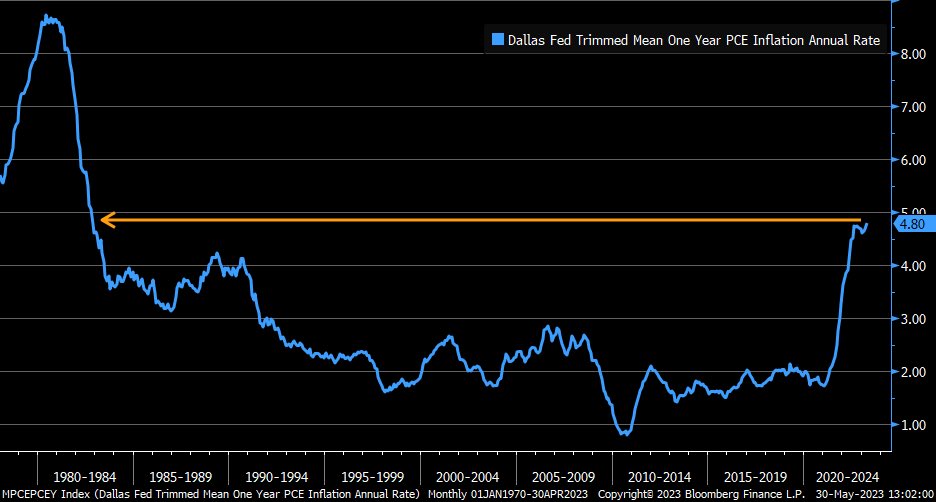

Two interesting areas to watch now are the one-year PCE rate-adjusted, as well as the retail sector which is now trading at critical lows.

In other words, stagflation is maturing before our very eyes. The PCE is at levels close to a breakout over the 1980-1984 levels. That is the Fed’s go to indicator.

However, Granny Retail is super close to the precipice of a major breakdown under the 80-month moving average or 6-8 year business cycle..

Fed’s playing pickle ball.

Last time we saw a breakdown under that moving average (if XRT fails it) was KRE Regional Banks in March. Can XRT hold here?

The Consumer Sector ETF (XRT) has some words for you and here they are:

First, the test of the 80-month MA (green and price 56.24) on the last day of the month of May is mad interesting.

Secondly, do not assume it will fail until it does. And even if it fails that MA-June has 30 days before we can determine what happens the second half of the year.

Thirdly, XRT could just as easily hold that level offering a very low risk/reward trade or more importantly, a relief for the rest of the Economic Modern Family and market.

Fourth, XRT is below the March 2023 lows but above the October 2022 lows at 55.32.

Finally, on the Daily chart, momentum is declining.

In fact, our Real Motion indicator shows that XRT’s momentum HAS NOT been below a key Bollinger Band until NOW. Not in March and not last October.

Mean reversion potential? Sure.

But also, fair warning that the consumer sector is yet another potential harbinger that the lower trading levels in SPY going back to March and/or October are not to be dismissed.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.