Good news – the world’s largest central bank hit the pause button on rate hikes last week. After embarking on a rate hiking cycle in March of 2022, it would appear the Fed is done for now after hiking from 0.25 to 5.25%. Yay! And what did the market do? Not much of a celebration, it trended downward.

Maybe after the recent rally, all the good news was priced in, or more likely, the re-flare up in U.S. regional bank woes, softening economic data and deteriorating earnings were the culprits. Any way you slice it, markets have soured a bit, even with a strong bounce following Friday’s labor report.

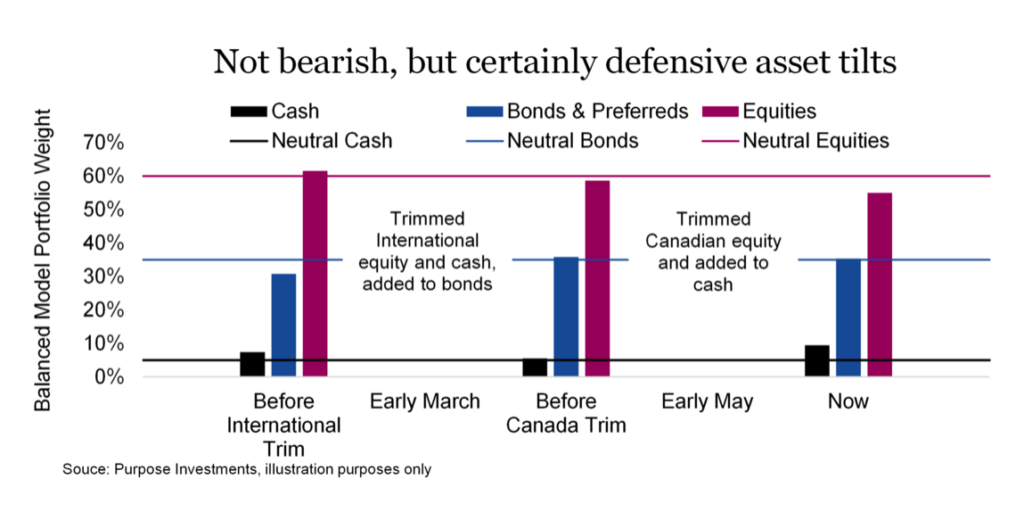

Last week we also moved our mild underweight in equities to a more moderate underweight. As our readers have likely picked up, we did not believe the recent strength in equities was sustainable given the softening fundamental underpinnings. And we believe a break lower is more likely than a sustained move higher in equity markets. This time we reduced Canadian equity exposure while increasing cash. Combined with our trimming of international equity in early March (Look through the zigs and zags), we have moved from a mild to moderate underweight in equities.

Probabilities & return expectations

The future path of markets is always uncertain. The good news is the very long-term trend creates value for your hard-earned savings, creating more savings through ‘the eighth wonder of the world’ – compounding. But there are times to lean into it (the market) and times to lean back a bit. How and when to lean, that’s the tricky part.

Today, you can earn 4-5% on your cash with no risk, often referred to as the risk-free rate. You can earn about the same in higher-quality bonds that carry duration. Don’t just focus on the comparable yields here; the duration of bonds plays an important role in a portfolio. Should a recession develop in the coming months or quarters, duration will provide a better ballast for your portfolio than simply sitting in cash. Hence, our lowered equity weight is spread across both bonds and cash, bonds just in case the next ‘R’ is approaching, and cash to be more opportunistic.

For equities which have a long-term average return of, say, 8-9%, the question is. With a risk-free rate of 4-5%, is the risk worth it? Now, ‘averages’ are what people with a little math skill use to mislead. Equities have an average return in the high single digits, but at times this can be well over 10 or 20% and other times well below 0 or -10%. On average, we are taller than our parents, but that doesn’t mean many aren’t shorter.

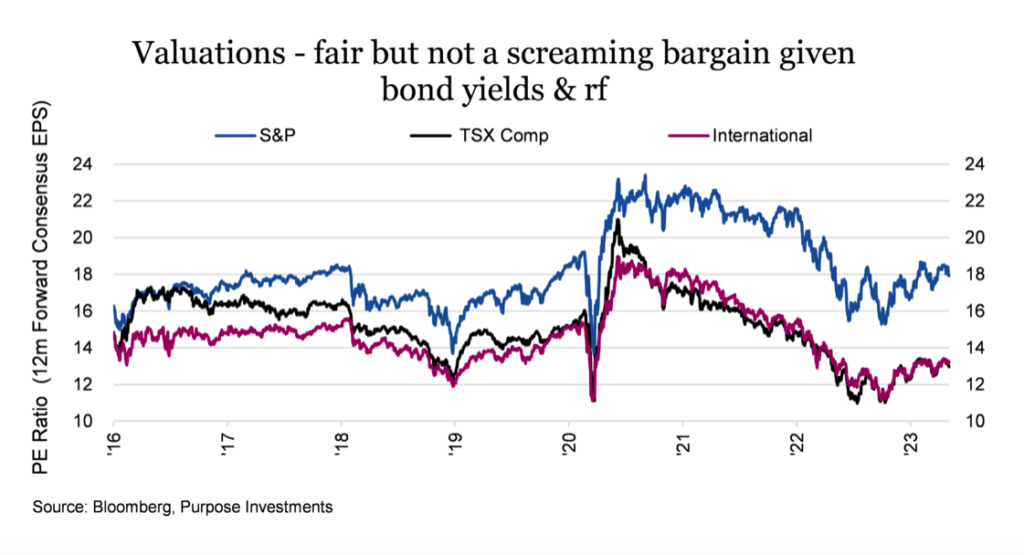

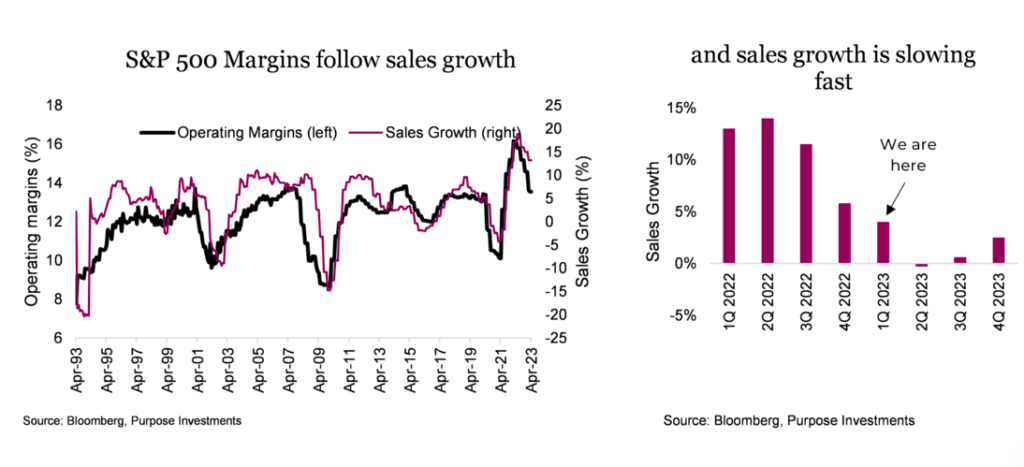

So, what is the probability that the next 12-month equity market returns will be above or below its average? With the risk-free rate so high, shouldn’t we demand a higher-than-average return from equities of, say, 10-12%? The U.S. market (S&P 500) may be hard-pressed to deliver simply because valuations are not cheap. At over 18x, multiple expansions may be hard to come by. So, solid earnings growth would have to deliver, but with the economy slowing and margins coming under pressure, the odds are not favorable.

International and Canadian equities certainly have a more compelling valuation starting point between 13-14x. That is a better safety buffer and is one of the reasons that even after our international trim, we are still a little overweight international equities. Canadian equities are just a minor underweight which leaves the U.S. a more material underweight.

The fact is our earnings growth models are not encouraging. Interest costs are starting to weigh on companies’ income statements. Wages certainly are rising, as are other input costs. And while sales growth has been strong over the past couple of years, lifted in part by inflation, costs appear to be rising faster of late. The last two quarters for the S&P 500 have seen sales growth combined with negative earnings growth … that is the literal definition of margin compression. In simple terms, earnings growth is challenged.

Final thoughts

Now, we are not overtly bearish on the equity markets. Earnings revisions have turned positive in the past few weeks, which is encouraging. And the labour report on Friday clearly points to an economy that is not on the brink of anything, not to mention the billions of cash sitting on the sidelines.

Nonetheless, given the risk/reward trade-offs, the yield on competing asset classes and with both the S&P 500 & TSX bumping up against the top end of their recent trading ranges, leaning a bit more to bonds/cash appears prudent.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.