The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- As the first quarter reporting period wraps up, shareholder meetings take center stage on Wall Street

- Management personnel changes and new business plan announcements commonly occur at this key corporate event type

- Buffett, bitcoin, big tech, travel bookings, black gold, and banking are some of the major topics we highlight

Still with another key week of earnings underway, the focus will soon shift away from the dollars and cents to verbal cues provided at shareholder gatherings around the world. With most of these events now held in person, knowing when volatility is likely to strike is pivotal for traders. Back in Q1, we noted that March is prime time for corporate conferences before earnings season begins. Before summer break ensues, shareholder meetings take the spotlight right as the “sell in May and go away” crowd makes noise.

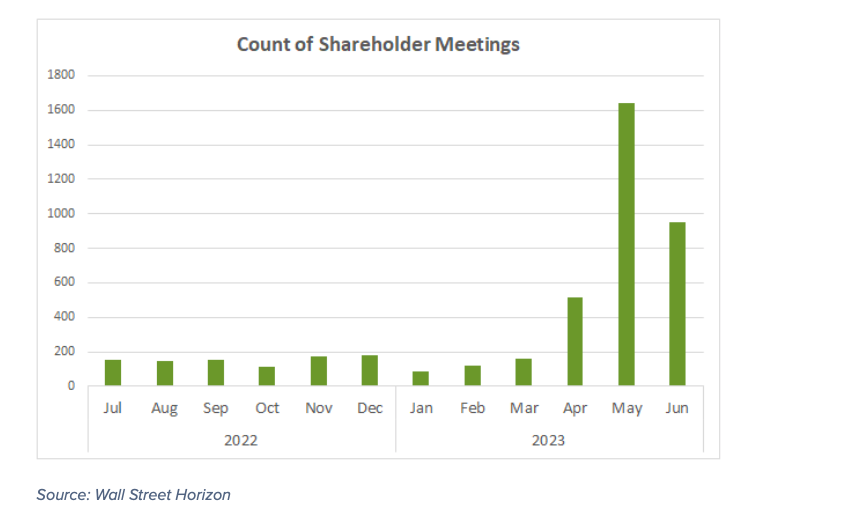

May: Peak Shareholder Meeting Month

This quarter, more than 2,500 shareholder meetings are on the docket. June features the tail end of the season with under 1,000 events. While there are a material number of April meetings, we think of the unofficial kickoff to the peak of the season to come on the first Saturday in May.

Berkshire Hathaway

But don’t pour your mint juleps just yet. Before the most exciting two minutes in sports happens in Kentucky, the most influential investor on the planet hosts the Berkshire Hathaway (BRKA) shareholder festival in Omaha. Value investors will pay close attention to what Warren Buffett and Charlie Munger have to say. With Berkshire’s cash position swelling once again, are new big buy plans going to be talked about? And what is the succession plan update?

A New Crypto Bull Market

On the opposite end of the spectrum, one asset class is many lengths ahead of other market horses in 2023. Bitcoin is once again flirting with the $30,000 mark after dipping under $16,000 last November. The once-popular (now maybe infamous) cryptocurrency has about doubled year-to-date. After a bludgeoning in 2022, Coinbase (COIN) shares are markedly higher over the last several months but have also retreated from the February peak. Key insights into retail token trading trends could be discussed at the meeting on June 16 if the same trend as last year holds.

The AI Boom

More broadly, artificial intelligence (AI) has been the talk of earnings season among tech firms. The metaverse has taken a back seat to transformational generative AI capabilities that are front and center for companies and individuals alike. While Apple’s shareholder meeting took place on March 10, May 24 is when Amazon (AMZN) has its event. Then comes Meta Platforms (META) on May 31 and Alphabet (GOOGL) on the afternoon of June 2. NVIDIA (NVDA) might also announce a shareholder event in early June if history is any guide.

Consumers Spending Is Strong in One Niche

Pivoting from big-cap tech, consumers continue to be on the move. International travel trends are robust while domestic flights are sure to be jam-packed once school gets out. Adults, meanwhile, are rolling the dice in Vegas. Both MGM Resorts (MGM) and Las Vegas Sands (LVS) shares are up from a year ago. MGM, one of the best S&P 500 stocks since May last year, holds its shareholder meeting on May 2 while LVS’s is on May 11.

The airlines might also give color on travel trends: American Airlines (AAL) hosts its event on May 10, then comes the embattled Southwest Airlines’ (LUV) date on May 17 before United’s May 24 gathering.

Services > Goods. Hard Times in Manufacturing.

While travel and services are hot, the manufacturing sector and goods spending are arguably in recession territory. If one area of the economy is going to pull the broad environment into contraction, it might be manufacturing.

General Electric (GE) has been a massive winner on the year, up nearly 50%. After spinning off its healthcare unit last year, everything has been coming up roses for the conglomerate. Will more corporate restructuring be mentioned on May 3 at its meeting? Mark it on your calendar to find out. Then comes UPS, which has not been so fortunate – the company delivered a lackluster earnings report. Its meeting is on May 4.

Other Industrials-sector names with shareholder gatherings are 3M (MMM) on May 9, Honeywell (HON) on May 19, and Trane Technologies (TT) on June 1. Caterpillar (CAT) may hold an event in early to mid-June, but that has not been announced yet.

Energy Market: Conspicuously Quiet

Another sector on edge right now is Energy. Oil prices have given back all of their gains after the surprise production cut news by OPEC-plus last month. Still, most firms are very free cash flow positive and are rewarding their investors with juicy dividends and big buybacks.

A slew of major names have meetings this month: Occidental (OXY) on May 5, ConocoPhillips (COP) on the 16th, EOG Resources (EOG) on the 24th, and Pioneer Natural (PXD) on May 25. Then come the major integrateds: ExxonMobil (XOM) and Chevron (CVX) both host shareholder events on May 31.

Jamie & Elon Pair Up

In the Financials sector, the lone wolf is Jamie Dimon at JPMorgan Chase (JPM). The S&P 500’s largest bank company holds its annual meeting on May 16 amid uncertainty regarding the CEO’s future. That is also when Tesla (TSLA) holds its annual event. So, America’s banker and the world’s second-richest man will have to share the spotlight.

The Bottom Line

Shareholder meetings often fly under the radar in terms of volatility catalysts money managers are watching. But just one management shakeup or activist investor move can send a stock soaring or plunging. Wall Street Horizon tracks all the key meetings so our clients can better manage risk.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.