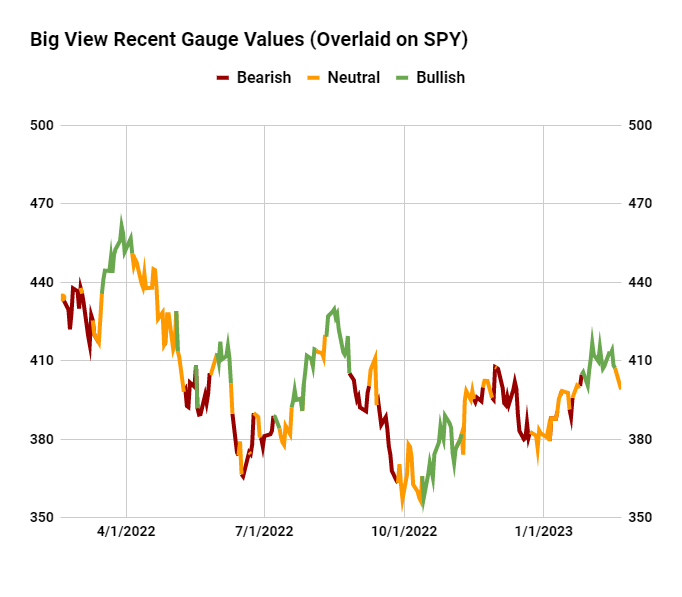

This chart is from our product called Big View.

Coming into the FOMC, the sentiment for risk is neutral. A week ago sentiment was 100% bullish. A month ago, it was neutral leaning towards bearish.

Amazingly, the sentiment and the persistent trading range in the S&P 500 are aligned.

The S&P 500 failed the 23-month moving average or 2-year business cycle, which if clears, signals a softer landing. Yet, it held the pivotal 3900 ahead of the Fed, signaling a no landing.

And by tomorrow, we will watch if SPY breaks below 3900, more of an indication of a hard landing.

So a neutral sentiment while we wait is appropriate and speaks volumes about the smarter retail investor.

With so much speculation on “landings” for the economy, let’s examine the definitions and implications.

What is a “no landing?”

A “no landing” means that the economy still grows even though the Federal Reserve tries to lower inflation by continuing to rase interest rates.

Soft Landing

A soft landing or what many believe is the best scenario-would be if the Fed raises rates just enough to cool while the economy remains robust.

Hard Landing

A hard landing infers that the only way the Fed can control inflation is by raising the rates enough, that the result is the economy goes into a big recession.

It seems to us, that the word “stagflation” is more appropriate.

Stagflation

Stagflation is a period when slow economic growth and joblessness coincide with rising inflation.

The argument against this scenario is that joblessness, even with all the job cuts by large companies, has yet to take hold in the jobs numbers. At least for now.

Also, GDP comes out this week. The expectations are for an annual rate expansion of 0.6% this quarter. That is up from previous calls for a 0.2% increase.

Clearly the FED minutes shed no new light. Consensus is for watching the upside risks to inflation, keep raising if need be-and of course, be mindful of going too far to cause recession.

Looking at the weekly chart of “Granny” Retail Sector $XRT, it will be easier to gauge next steps.

For starters, this is 70% of the GDP. Consumers count. Secondly, XRT never cleared the 2-year cycle high or 23-month moving average. Thirdly, it is in a bullish phase on the daily and weekly charts.

Next, the Real Motion momentum indicator shows declining momentum and a bearish phase on the weekly charts. The daily charts show a retracement to momentum support.

XRT is indeed marginally outperforming the SPY on the weekly timeframe and underperforming on the daily timeframe.

Hence, a neutral bias, and a bit more patience needed to see if the consumer’s confidence remains high or not.

From deflation to inflation to stagflation and beyond, our approach to 2023 is to consider each of those potential outcomes, weighing market expectations against the price.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 390 support with 405 closest resistance

Russell 2000 (IWM MA support around 184. 190 has to clear again

Dow Industrials (DIA) 326 support 335 resistance

Nasdaq 100 (QQQ) 284 big support 300 resistance

Regional banks (KRE) 65.00 resistance 61 support

Semiconductors (SMH) 228 big support and 240 resistance

Transportation (IYT) Broke the 50-DMA so must confirm the warning phase-228 pivotal

Biotechnology (IBB) Under 130 now (pivotal)

Retail (XRT) 66-68 huge area to hold if the market still has legs

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.