The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Key Corporate Earnings Takeaways (January):

- S&P 500 EPS growth for Q4 is set to come in at -3.9%, the lowest rate in over 2 years, but an improvement from last week

- Despite headwinds, an early reading of corporate uncertainty seems to indicate that companies are actually the least anxious they’ve been in 5 years

- Potential misses include: US Bancorp, CSX Corp

- Peak weeks for Q4 season from January 30 – March 3

Earnings Season Kicks Off With Mixed Results, But Growth Estimates Improve

A handful of big banks kicked off the fourth quarter earnings season with mixed results on Friday. While JPMorgan and Bank of America beat top and bottom-line expectations on account of higher interest income that offset weakness in other areas, Wells Fargo and Citigroup both missed due to higher loan loss provisions, among other things. Several CEOs (JPM, BAC, C) made mention of the slowing economy, which would likely result in a mild recession in the second half of the year.

Even so, the S&P 500 blended EPS growth rate improved slightly to -3.9% from -4.1% in the week prior.¹ If the fourth quarter ends with a negative growth rate, it would be the first quarterly decline in over 2 years. Revenue growth is the complete opposite, expected to come in at +3.9% for the quarter.¹ Lagging sectors on the profit side still include Materials, Consumer Discretionary and Communication Services, while only four sectors are expected to post YoY growth (Energy, Industrials, Real Estate, Utilities).

CEOs Seem Unbothered, In Spite of Recent Recession Commentary

Despite warnings from the banks on an impending recession, the good news is that this conversation has been happening for a while and US corporations are likely prepared. Mentions of recession peaked during Q2 2022 calls and fell in the following quarter. Our proprietary data tells us that corporate anxiety is actually falling from where it was in the first half of 2022.

Through our tracking of “corporate body language”, or the non-verbal cues that publicly traded companies send to the market both intentionally and unintentionally, we are finding less companies are signaling that they are uncertain about future earnings. One tell a company can give regarding their financial health is the timing of their earnings release. Academic research shows when a corporation reports earnings later in the quarter than they have historically, it typically signals bad news to come on the conference call, and the reverse is true, an early earnings date suggests good news will be shared. The idea is that you’d prefer to delay bad news, but when you have good news you want to run out and share it.

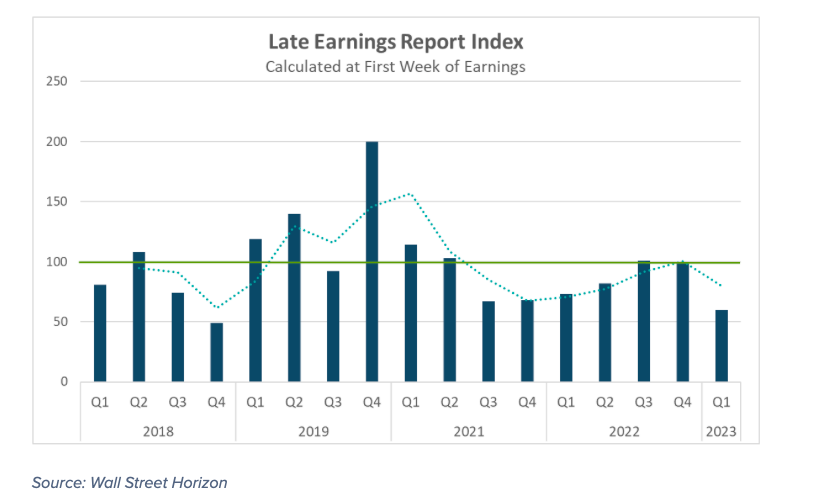

The LERI (Late Earnings Report Indicator) encapsulates this sentiment. It looks at the number of outlier earnings date confirmations and whether companies are confirming earnings dates that are later than they have historically reported, or earlier. A reading above 100 reflects that companies are confirming later earnings announcements and below this average indicates companies are confirming dates that are earlier. Thus far the LERI stands at 60 for the Q4 season, this is the lowest reading we’ve seen (on the day that JPM reports) in 5 years. However, as the season officially gets going, and more companies confirm earnings dates, we tend to see the LERI rise, but starting off at this low base is promising.

Potential Misses – Big Names that Typically Report this Week, but Have Pushed their Releases

U.S. Bancorp (USB)

Company Confirmed Report Date: Wednesday, January 25, BMO

Projected Report Date (based on historical data): Wednesday, January 18

DateBreaks Factor: -3*

U.S Bancorp initially set a Q4 earnings date of January 18, 2023 on October 15, only to change it to January 25 on December 1. Academic research shows when a company revises an earnings date later, it’s typically indicative that bad news will be shared on the coming earnings call. This is often an even stronger signal when the company confirms and then consequently changes a date, than when they confirm a date that is just historically out of range.

USB tends to report on a Wednesday, but has reported in a range from Jan 15 – January 21 over the last 8 years, making this year’s confirmed date the latest in our history.

It’s important to note that USB also confirmed their earnings date later than usual, typically a sign that once they do confirm a date that it will also be later than usual.

CSX Corp. (CSX)

Company Confirmed Report Date: Wednesday, January 25, BMO

Projected Report Date (based on historical data): Thursday, January 19

DateBreaks Factor: -3*

CSX doesn’t have a strong day of the week trend, but for the last eight years they have reported Q4 earnings sometime between Jan 13 – Jan 21, with this year’s report date being the latest in our history. Based on historical reporting, we had set a report date of January 19, six days earlier. While this would normally signal bad news ahead for the company, it’s also important to note CSX just onboarded a new CFO, Sean R. Pelkey, last year, and this will be the first Q4 report with him at the helm. Oftentimes shifts in reporting dates are due to changes in management.

On Deck for this Week

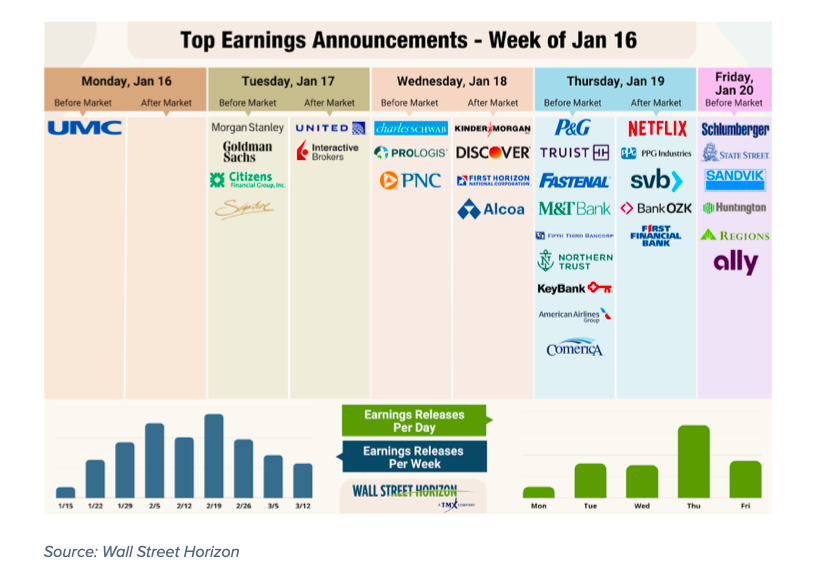

The season continues on slowly with reports from Financials (capital markets, commercial banks, brokerages), airlines, Energy, and Netflix.

Earnings Wave

This season peak weeks will fall between January 30 – March 3, with each week expected to see over 1,000 reports. Currently February 23 is predicted to be the most active day with 715 companies anticipated to report. Thus far only 38% of companies have confirmed their earnings date (out of our universe of 9,500+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data. Keep in mind the Q4 reporting season is always a bit more prolonged, typically stretching over 4 or 5 peak weeks rather than the usual 3 peak weeks seen in Q1 – Q3.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.